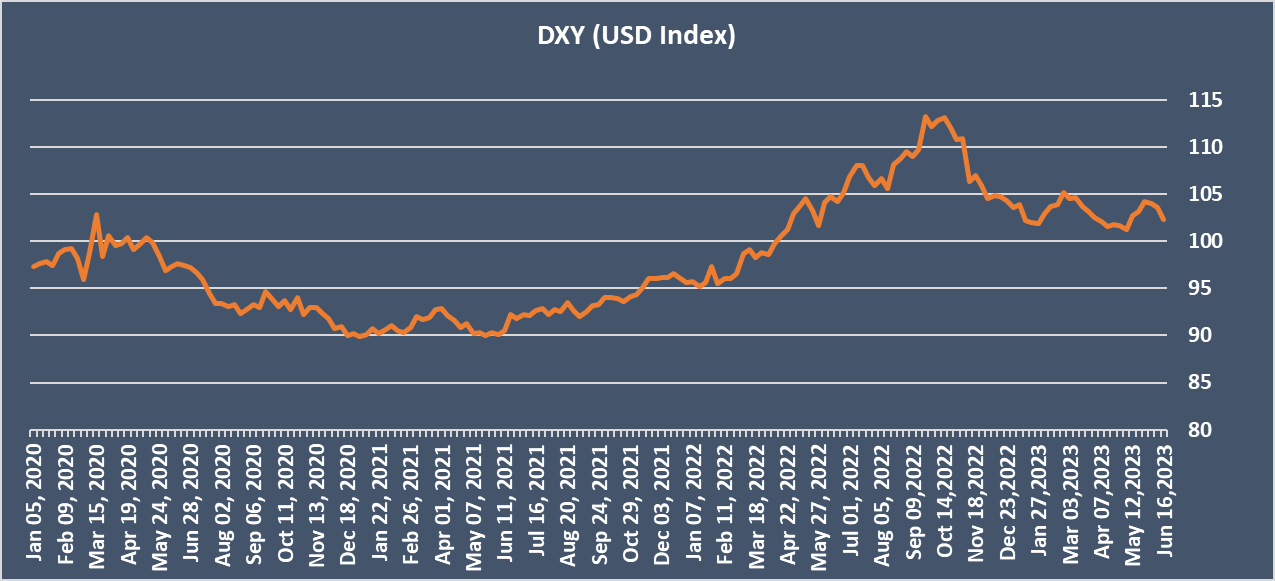

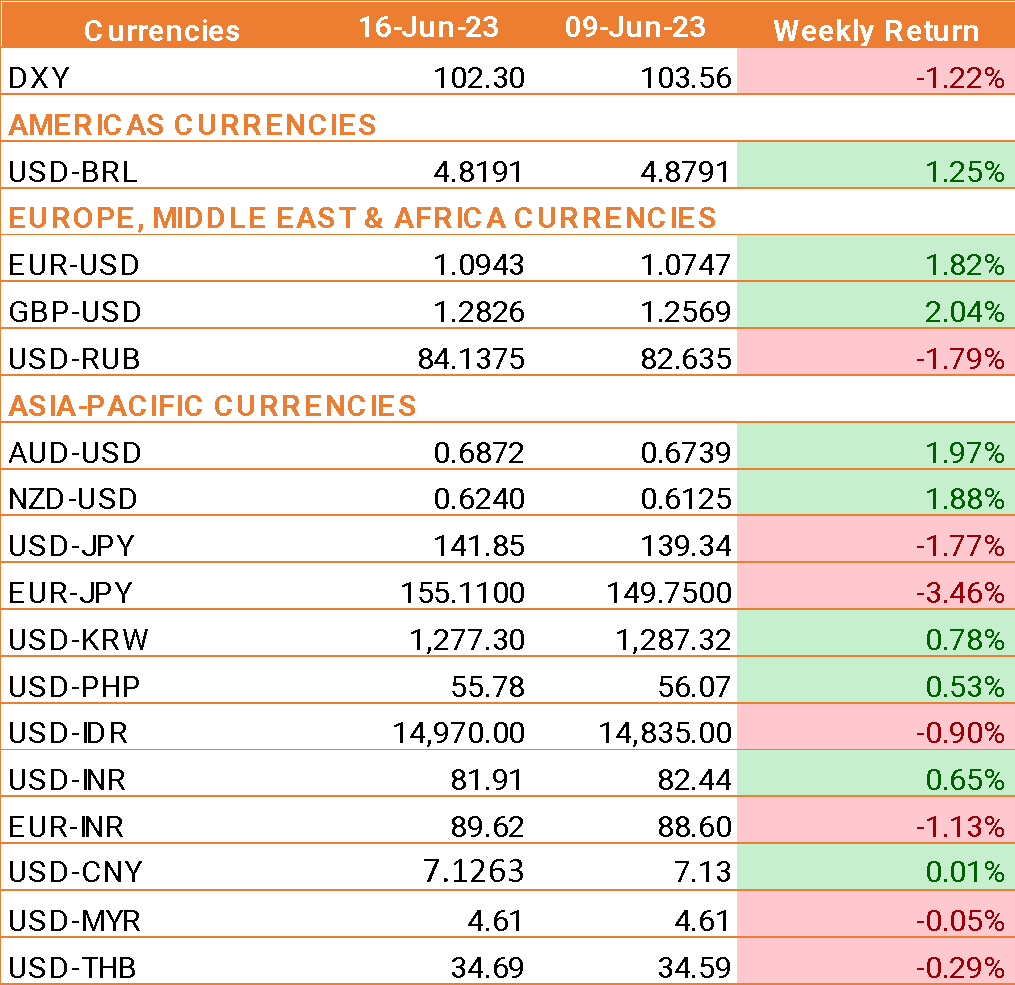

- The USD traded lower against major world currencies after the Fed decided to maintain the status quo in its latest FOMC meeting.

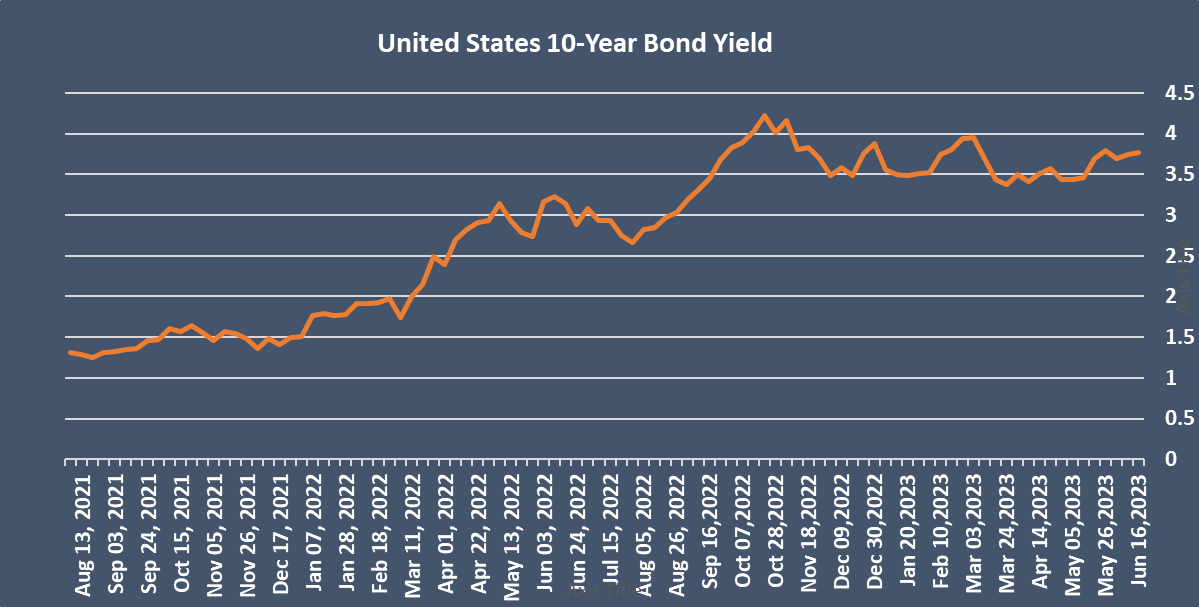

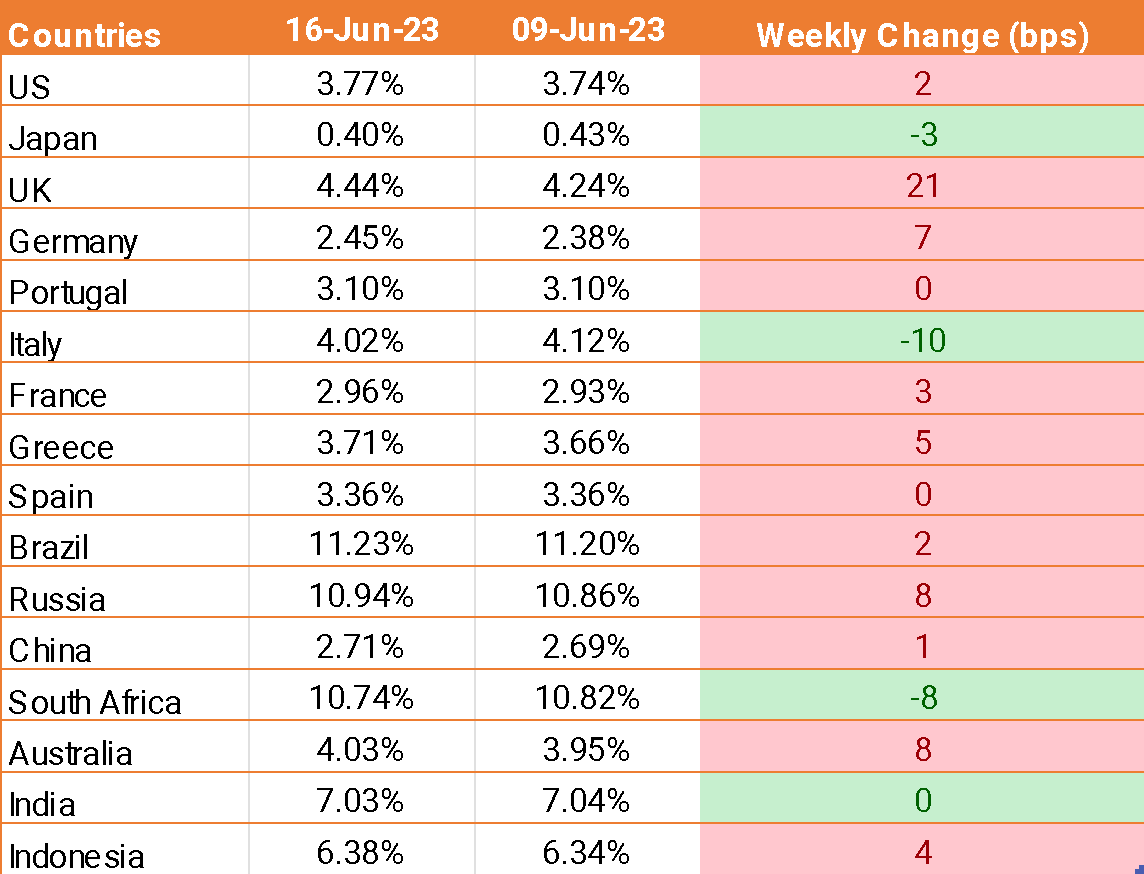

- The Fed kept rates on hold at 5%-5.25% after 10 consecutive hikes. However, the Fed indicated that it wasn't done with its hiking cycle, as it suggested that interest rates could be hiked two more times before the end of the year.

- The Federal Reserve also upwardly revised its growth forecast for the year to 1%, and core inflation was also revised higher to 3.9%.

- On the data front, US retail sales unexpectedly rose by 0.3% month-on-month, defying expectations of a fall of -0.1%.

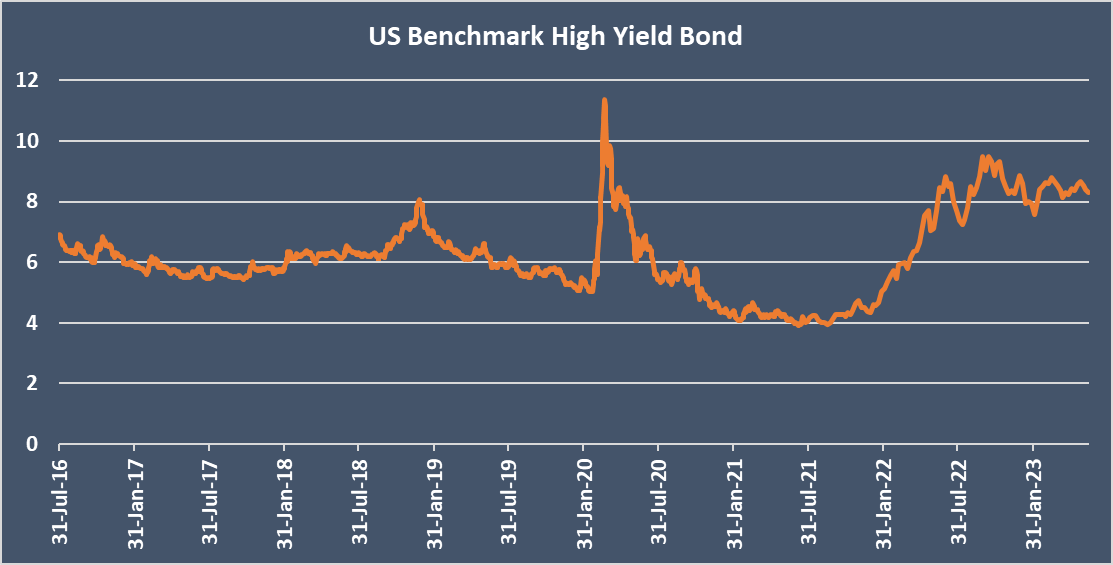

- On Thursday, the European Central Bank (ECB) announced its decision to raise its main rates by 25 basis points and offered a hawkish stance. President Christine Lagarde said the board is "not thinking about pausing."

- Last week, the People's Bank of China (PBoC) cut its short-term interest rate for the first time in 10 months in order to support the economy, which has been showing signs of slowing. In fact, recent data from China suggests that the post-pandemic recovery is stalling.

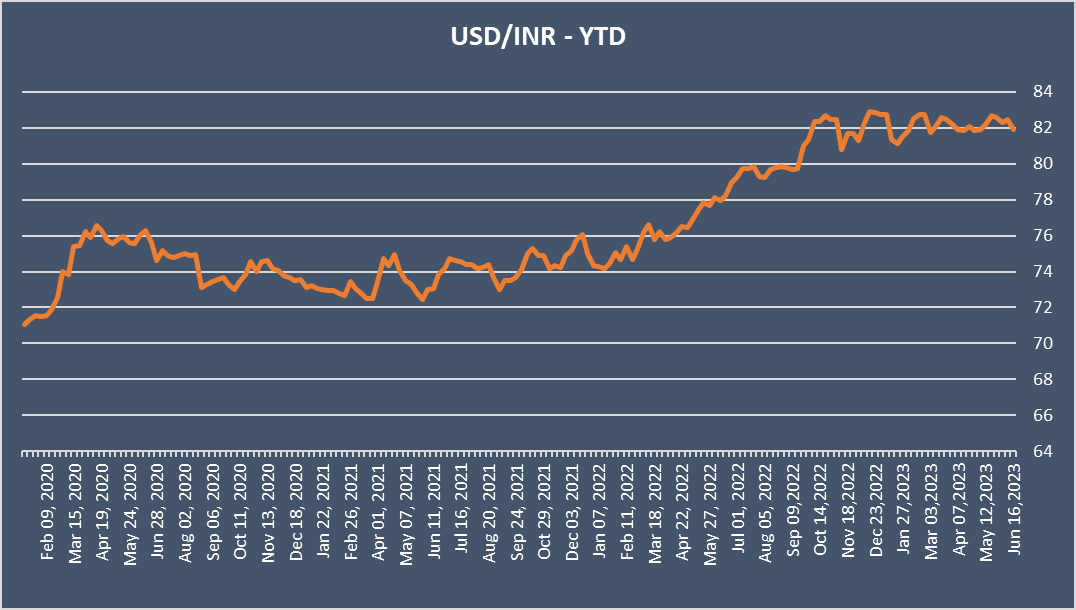

- India's retail inflation eased to a more than 2-year low of 4.25% in May on an annual basis, compared to 4.70% in April.

We would love to hear back from you. Please Click here to share your valuable feedback