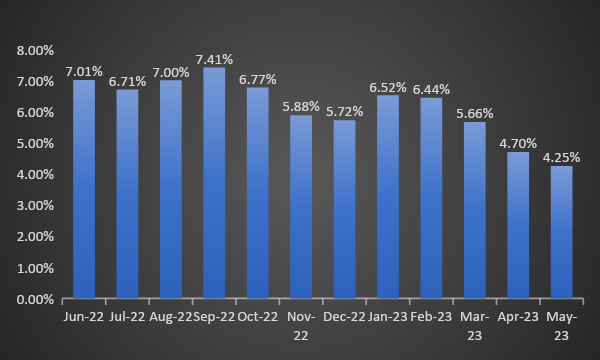

India’s consumer inflation softened to 4.25% in May 23 from 4.70% in April 23. The consumer food price index (CFPI) eased to 2.91% in May from 3.84% in April. Core inflation stood at 5.11% during May 23.

Going ahead, inflation is likely to stay below 5%, within the upper limit pegged by RBI. Therefore, it will prompt the central bank to maintain policy rates at the current level. Indian rupee appreciated to Rs 81.92 per USD driven by fall in inflation. Wholesale price inflation contracted by 3.48% in May on yearly basis as against a contraction of 0.92% in April.

Globally, the US Fed has left the fund rate at 5%-5.25% with indication of rate hikes in coming days on the basis of inflation level.

Index of Industrial Production-Domestic index of industrial production rose by 4.2% on an annual basis in the month of April from 1.1% in March and 6.75% in April 2022.

Trade deficit- India's merchandise trade deficit in May stood at $22.12 billion. During the month, exports in the month of May declined 10.3% to USD 34.98 billion while imports fell 6.65% to USD 57.1 billion.

Government bonds, SDL and OIS yield movements

On a weekly basis, the 10-year benchmark 7.26% 2033 yield stood unchanged at 7.04%. 7.06% 2028 yield also remained flat at 6.97%. 5.63% 2026 yield rose by 1 bp to 6.96%. Long-term paper, 7.40% 2062 yield rose by 5 bps to 7.29%.

The spread of 10-year bond over 5-year bond increased to 8 bps from 7 bps as compared to the previous week. The 15-year benchmark over 10-year benchmark rose to 10 bps from 8 bps while the 30-year benchmark over 10-year benchmark spread increased to 24 bps from 20 bps on a weekly basis.

10-yr SDL auction cut-off yield rose to 7.36% from 7.33% in previous week while spread stood unchanged 36 bps.

On a weekly basis, 1-year OIS yield rose by 2 bps to 6.66% while the 5-year OIS yield stood unchanged at 6.15%.

We would love to hear back from you. Please Click here to share your valuable feedback,