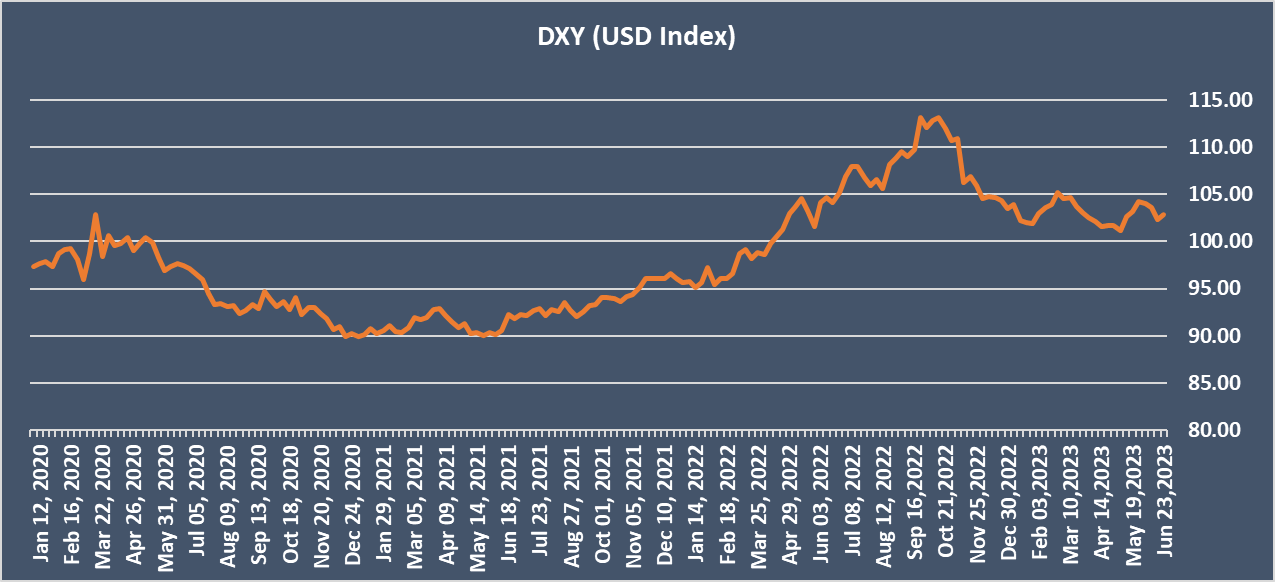

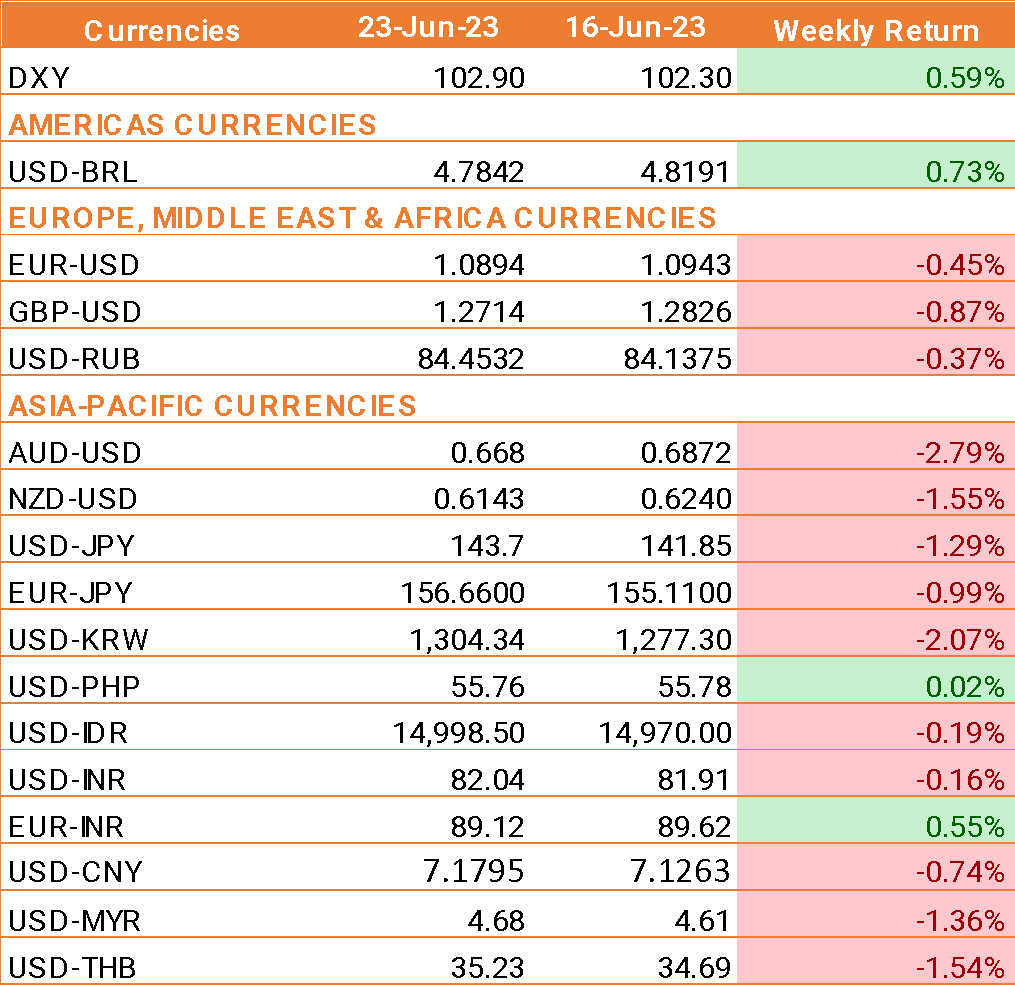

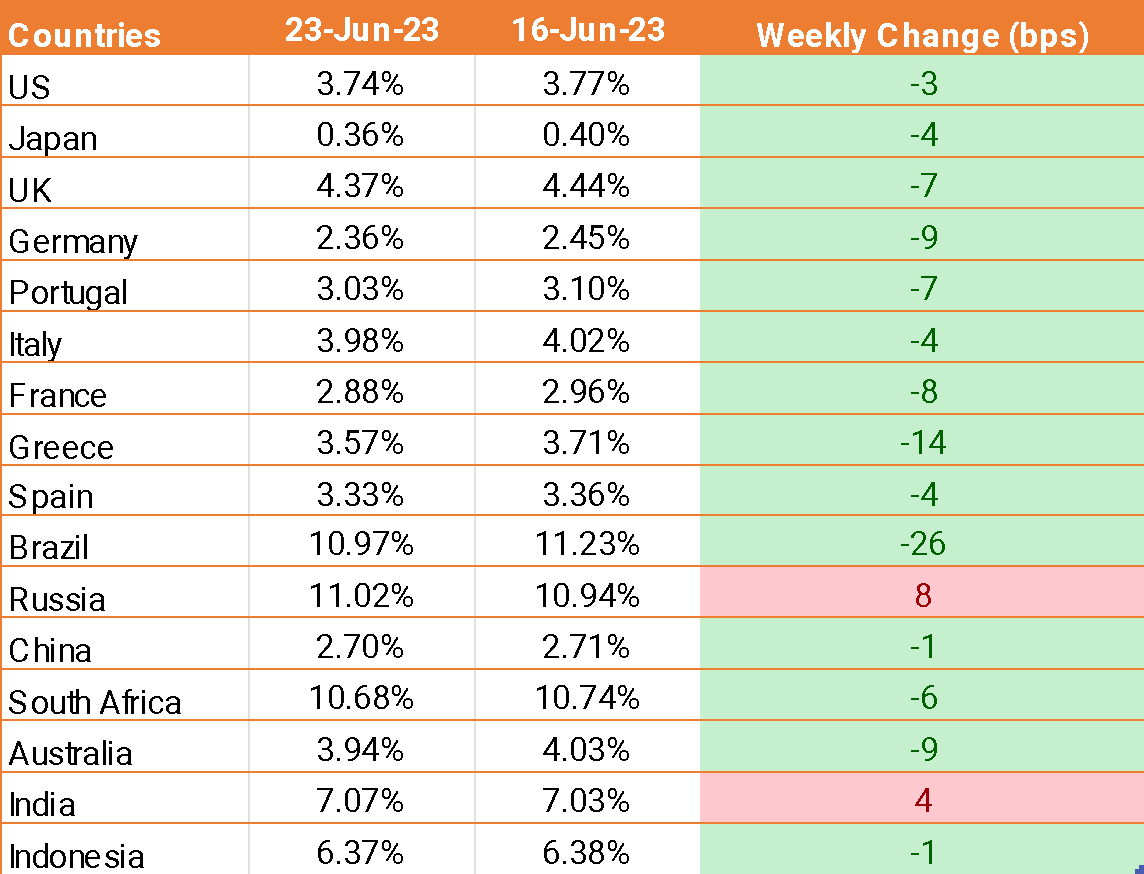

- The USD traded higher against major world currencies amid a rising risk-off environment as more aggressive monetary tightening by a series of central banks, including the Bank of England, prompted a bout of risk aversion.

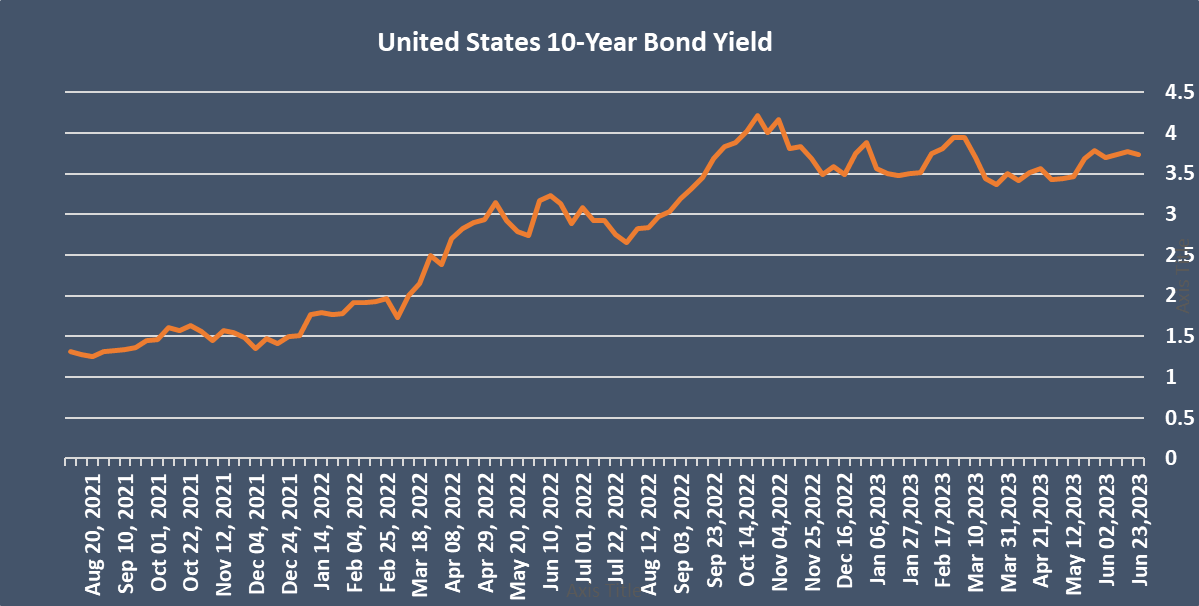

- Federal Reserve Chair Jerome Powell reiterated his hawkish stance on his second day of testimony before Congress.

- Powell further reiterated his view that more interest rate hikes are likely in the months ahead to rein in inflation. He also added that the Federal Reserve will be data-dependent, but two more hikes could be a good guess.

- U.S. business activity fell to a three-month low in June as services growth eased for the first time this year, and the contraction in the manufacturing sector deepened.

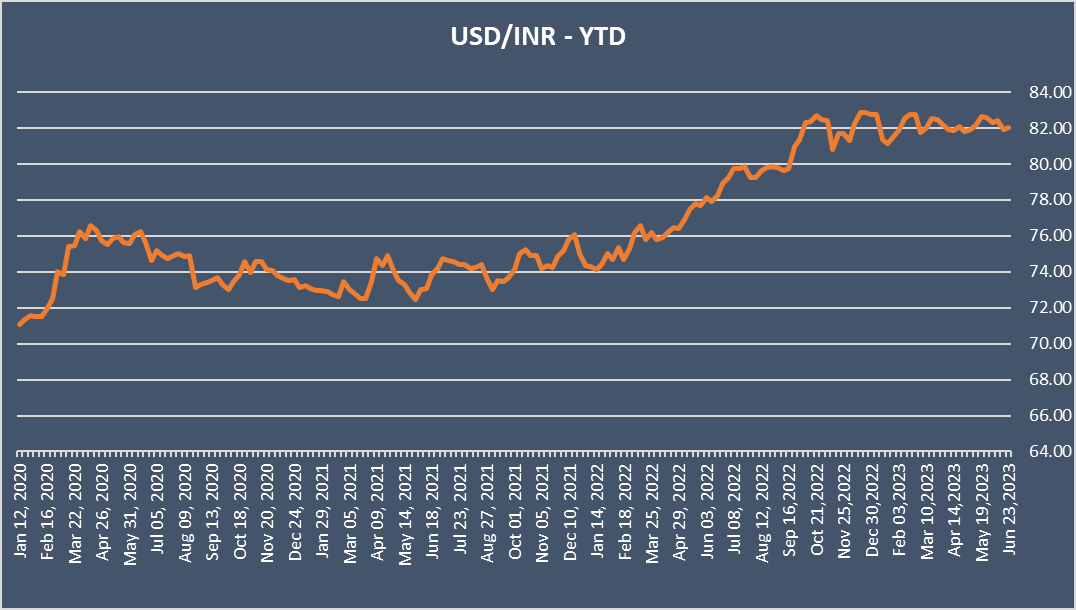

- The INR exhibited some resilience against the stronger USD as it is supported by a rise in domestic equities. Persistent foreign inflows into Indian equities have pushed stocks to record highs, backed by a robust macroeconomic backdrop.

- Foreign investors have invested more than USD 8.99 billion so far this financial year. In contrast, they were net sellers in the previous fiscal years.

- The Chinese Yuan came under pressure, reaching a near seven-month low of 7.1939 against the USD, after the People's Bank of China cut its key loan prime rate on Tuesday. The cut was the PBOC's first such move in 10 months and comes as Beijing struggles to shore up a slowing local economic rebound.

We would love to hear back from you. Please Click here to share your valuable feedback