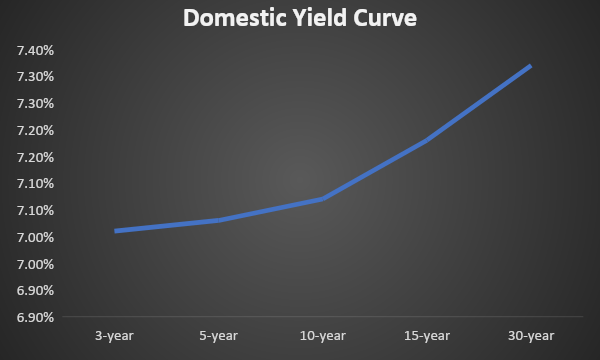

Current g-sec yield curve is flat between 3 to 10 years while it is steeper at the longer end. In the wake of falling inflation, RBI’s status quo on repo rate and current liquidity level, yield curve is likely to remain flat at short end.

Liquidity-As of 22nd June, system liquidity stood at Rs 378 billion of surplus level. Owing to advance tax outflow, liquidity has come down. Going ahead, it is expected to rise.

Domestic currency-Owing to fall in inflation, rupee has appreciated to Rs 82 per USD from Rs 82.74 since past one month.

Trade deficit- India's merchandise trade deficit in May stood at $22.12 billion. During the month, exports in the month of May declined 10.3% to $34.98 billion while imports fell 6.65% to $57.1 billion.

Government bonds, SDL and OIS yield movements

On a weekly basis, the 10-year benchmark 7.26% 2033 yield rose by 3 bps to 7.07%. 7.06% 2028 yield increased by 6 bps to 7.03%. 5.63% 2026 yield rose by 5 bps to 7.01%. Long-term paper, 7.40% 2062 yield rose by 3 bps to 7.32%.

The spread of 10-year bond over 5-year bond decreased to 4 bps from 8 bps as compared to the previous week. The 15-year benchmark over 10-year benchmark rose to 11 bps from 10 bps while the 30-year benchmark over 10-year benchmark spread increased to 26 bps from 24 bps on a weekly basis.

10-yr SDL auction cut-off yield rose to 7.3% from 7.36% in previous week while spread declined to 33 bps from 36 bps.

On a weekly basis, 1-year OIS yield rose by 4 bps to 6.70% while the 5-year OIS yield increased by 12 bps to 6.27%.

We would love to hear back from you. Please Click here to share your valuable feedback,