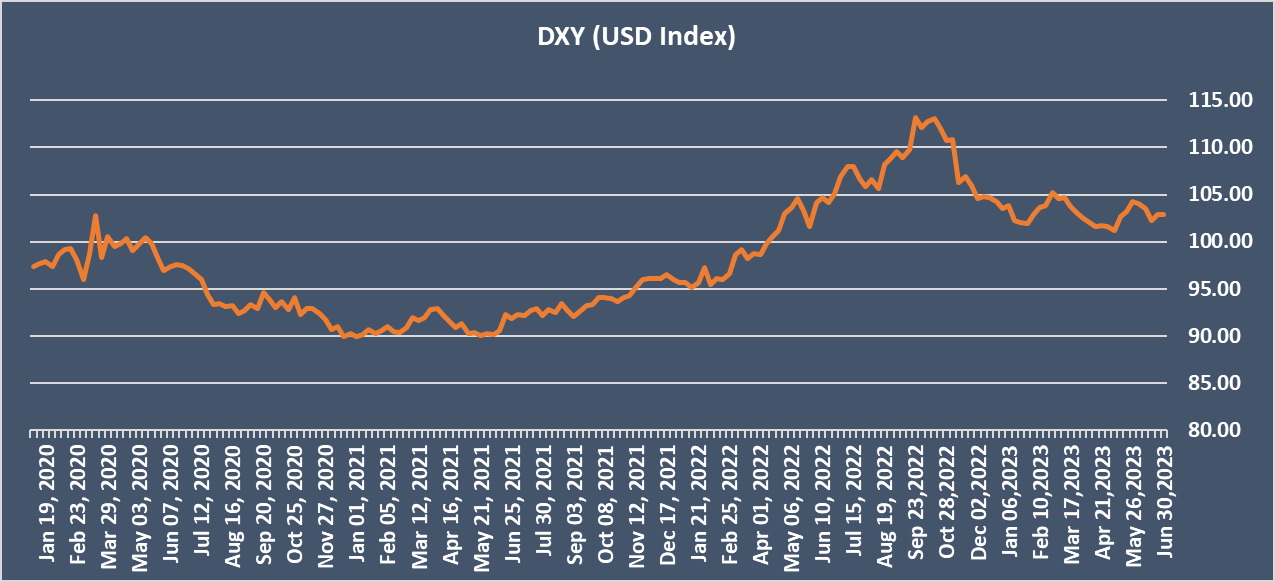

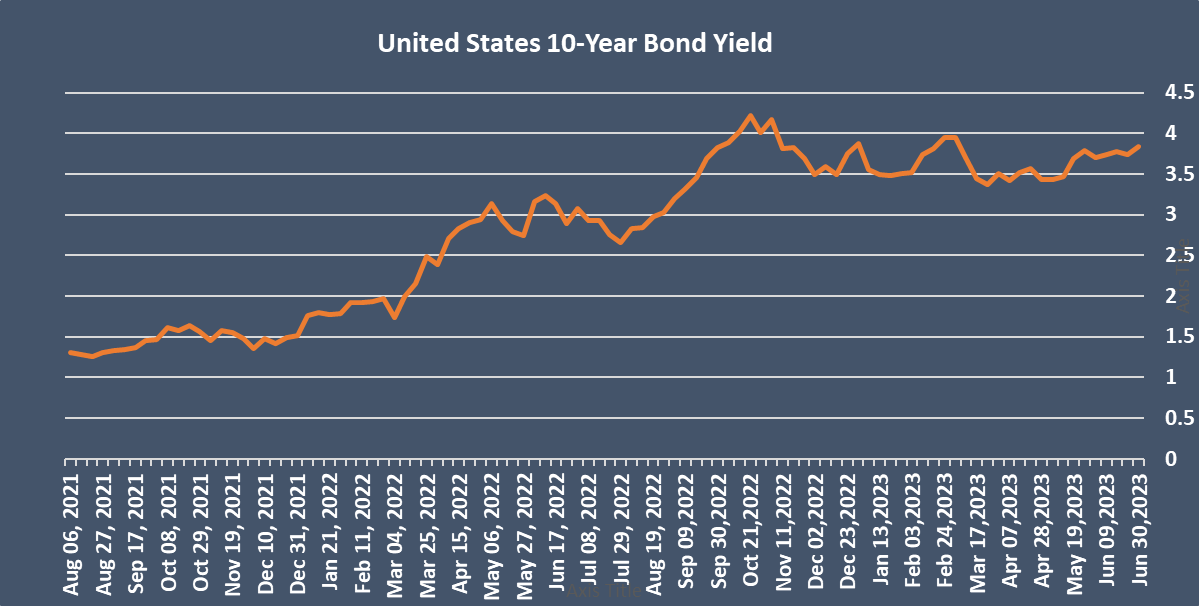

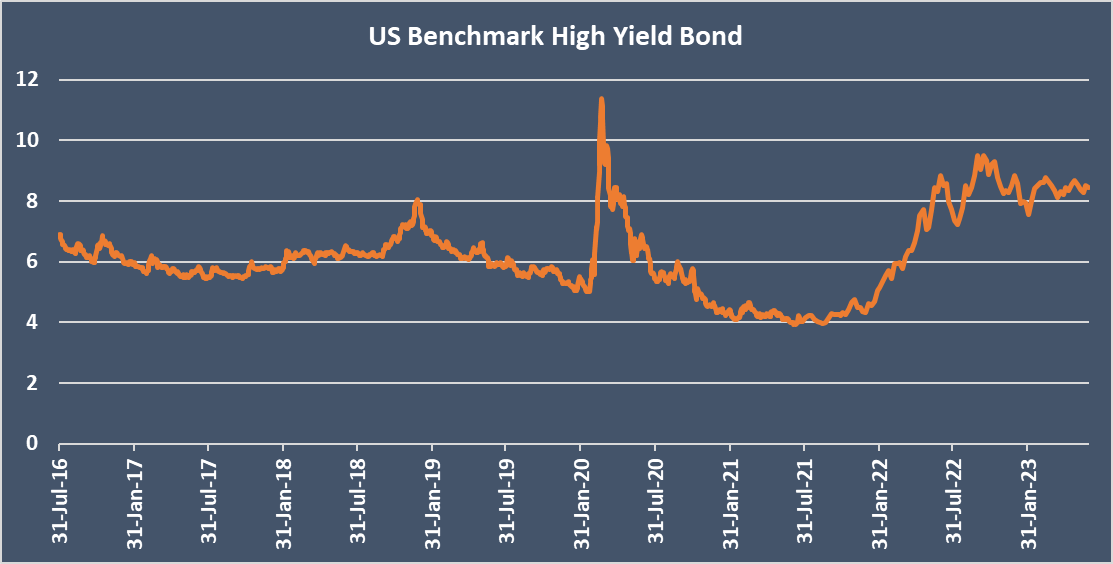

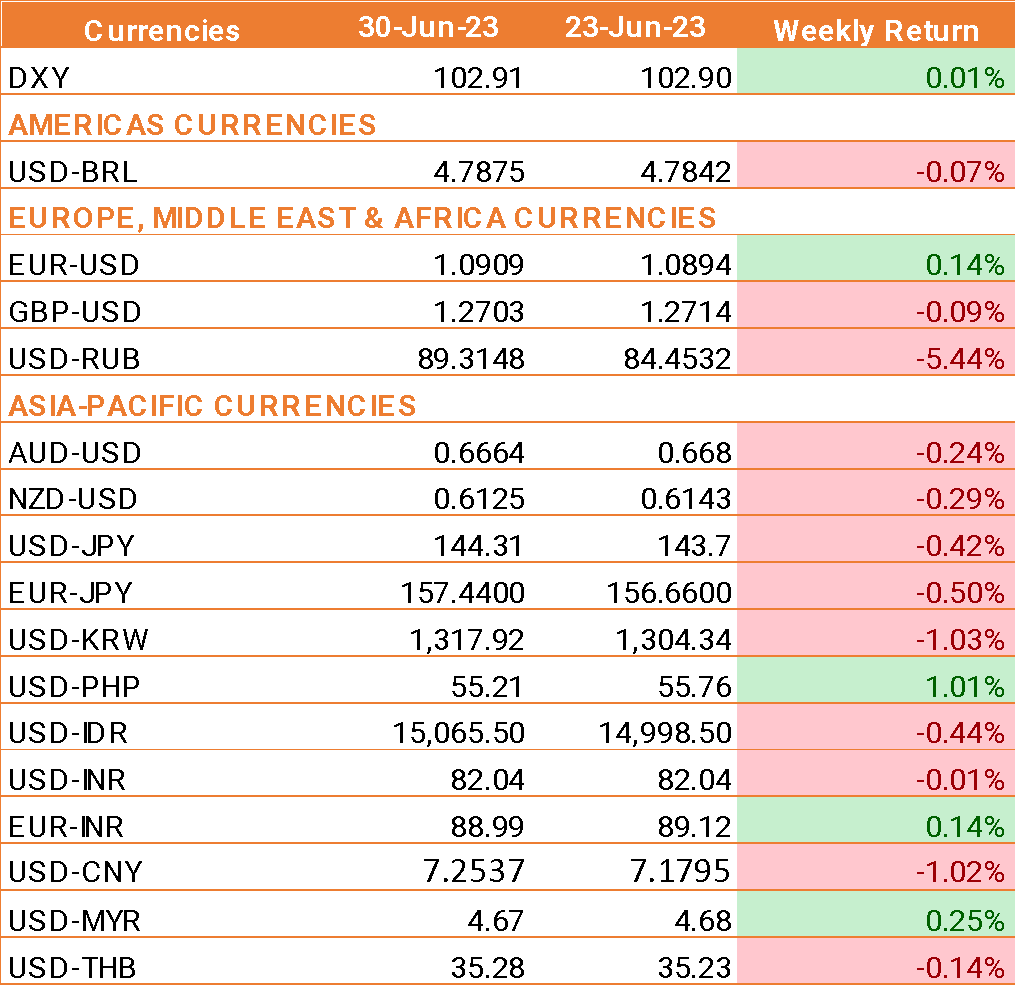

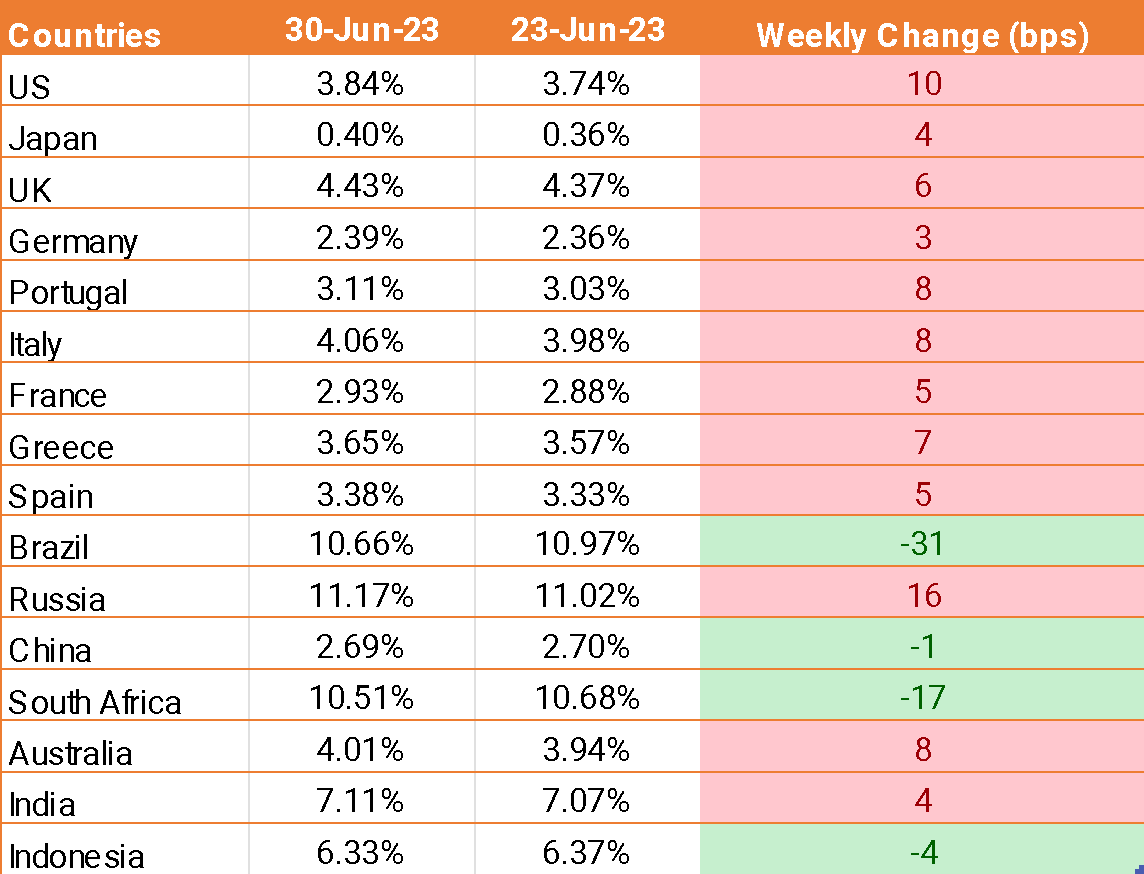

- The USD ended the week on a higher note after U.S. Federal Reserve Chair Jerome Powell's hawkish comments at the ECB's annual meeting.

- The Fed chair hinted that the Federal Reserve could raise interest rates at consecutive meetings, while Fed in its recently concluded FOMC meeting indicated that they would raise interest rates twice more throughout the year.

- Furthermore, data released on Thursday showed that the U.S. economy grew much more than initially thought in the first quarter, while the jobless claims data indicated a still strong labour market.

- US GDP data showed that the U.S. economy grew by 2% QoQ annualized in Q1, up from 1.3%.

- The U.S. personal consumption expenditure index, the Fed's preferred inflation gauge, rose 3.8% compared to a 4.3% rise in April.

- U.S. consumer confidence jumped to 109.7 in June, the highest level since January 2022 and up from 102.3 in May.

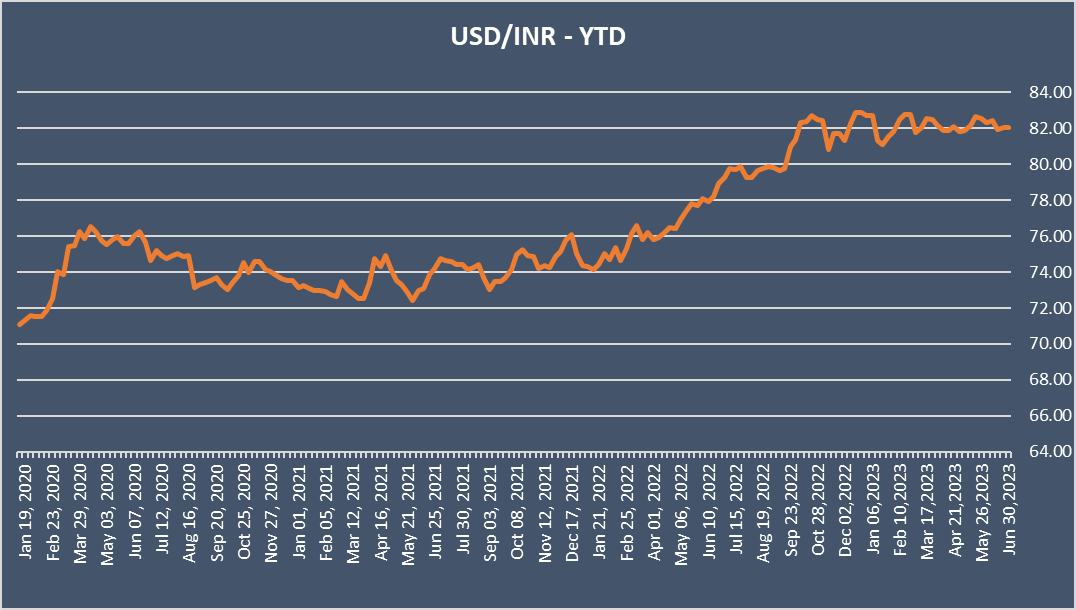

- The INR may have fallen marginally against the USD this week but is heading for its best monthly performance since January.

- USD 3.5 billion of inflows into Indian equities in June have pushed the BSE Sensex and the Nifty 50 index to record highs. The INR has fared better than most other Asian currencies this month.

- Meanwhile, oil prices are holding steady after stockpile data showed a huge draw on inventories of 9.6 million barrels. Even so, oil prices remain around USD 70 level ahead of the OPEC meeting next week.

We would love to hear back from you. Please Click here to share your valuable feedback