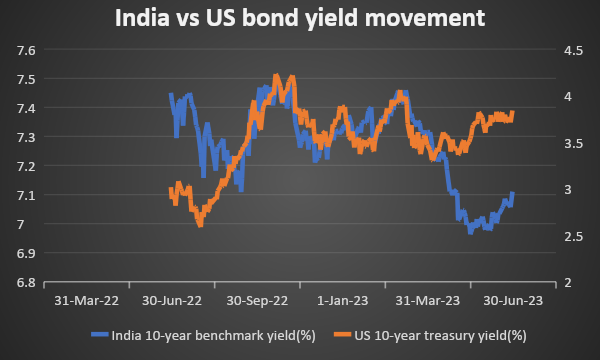

Domestic government bond yield has increased recently in tandem with US treasury yield movement. Last week benchmark yield rose by 6 bps to 7.12%.

US treasury yield has witnessed uptrend driven by possible rate hike by FOMC as indicated by Fed Chairman. Federal Reserve Chair Jerome Powell reiterated his hawkish stance on his second day of testimony before Congress. Powell further reiterated his view that more interest rate hikes are likely in the months ahead to rein in inflation. He also added that the two more rate hikes are on cards based on macro-economic data.

RBI MPC policy guidance-RBI has maintained status quo on policy repo with withdrawal of accommodation to control inflation in the last MPC meeting.

Current Account Deficit-India’s current account deficit decreased to US$ 1.3 billion (0.2% of GDP) in Q4FY23 from US$ 16.8 billion (2.0% of GDP) in Q3FY23, and US$ 13.4 billion (1.6% of GDP) a year ago.

India’s External Debt-At end-March 2023, India’s external debt stood at US$ 624.7 billion while external debt to GDP ratio declined to 18.9% at end-March 2023 from 20.0% at end-March 2022.

GST collection-India’s GST collection rose by 12% on yearly basis to Rs 1.61 trillion in June 23.

Government bonds, SDL and OIS yield movements

On a weekly basis, the 10-year benchmark 7.26% 2033 yield rose by 5 bps to 7.12%. 7.06% 2028 yield increased by 5 bps to 7.08%. 5.63% 2026 yield rose by 4 bps to 7.05%. Long-term paper, 7.40% 2062 yield rose by 4 bps to 7.36%.

The spread of 10-year bond over 5-year bond stood unchanged at 4 bps as compared to the previous week. The 15-year benchmark over 10-year benchmark stood flat at 10 bps from 11 bps while the 30-year benchmark over 10-year benchmark spread decreased to 14 bps from 26 bps on a weekly basis.

10-yr SDL auction cut-off yield stood flat at 7.40% from 7.39% in previous week while spread remained flat at 34 bps from 33 bps.

On a weekly basis, 1-year OIS yield rose by 4 bps to 6.74% while the 5-year OIS yield increased by 3 bps to 6.30%.

We would love to hear back from you. Please Click here to share your valuable feedback,