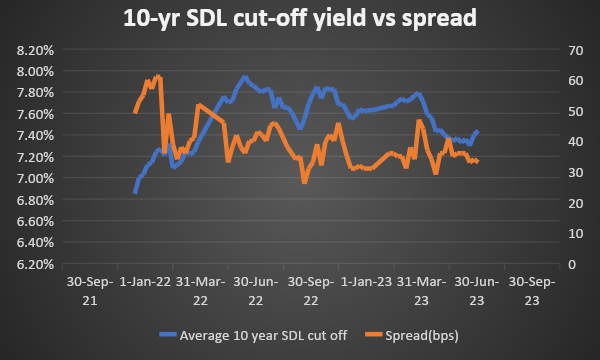

As per RBI notification, states of India are going to borrow Rs 2373.60 billion during Q2FY24 as compared to Rs 2115.52 billion during Q2FY23. During Q1FY24, gross state borrowing amounted to Rs 1614.5 billion as compared to Rs 907 billion during Q1FY23. Owing to higher borrowing, SDL yield is expected to rise in the coming days. During the last auction of SDLs, 10-year SDL auction cut-off rose to 7.44% from 7.40% in the previous auction.

Government bonds, SDL and OIS yield movements

On a weekly basis, the 10-year benchmark 7.26% 2033 yield rose by 4 bps to 7.16%. 7.06% 2028 yield increased by 5 bps to 7.13%. 5.63% 2026 yield rose by 5 bps to 7.1%. Long-term paper, 7.25% 2063 yield stood at 7.40%.

The spread of 10-year bond over 5-year bond stood flat 3 bps to 4 bps as compared to the previous week. The 15-year benchmark over 10-year benchmark stood flat at 9 bps from 10 bps while the 30-year benchmark over 10-year benchmark spread increased to 23 bps from 14 bps on a weekly basis.

10-yr SDL auction cut-off yield rose to 7.44% from 7.40% in previous week while spread remained flat at 33 bps from 34 bps.

On a weekly basis, 1-year OIS yield rose by 6 bps to 6.80% while the 5-year OIS yield increased by 10 bps to 6.40%.

We would love to hear back from you. Please Click here to share your valuable feedback,