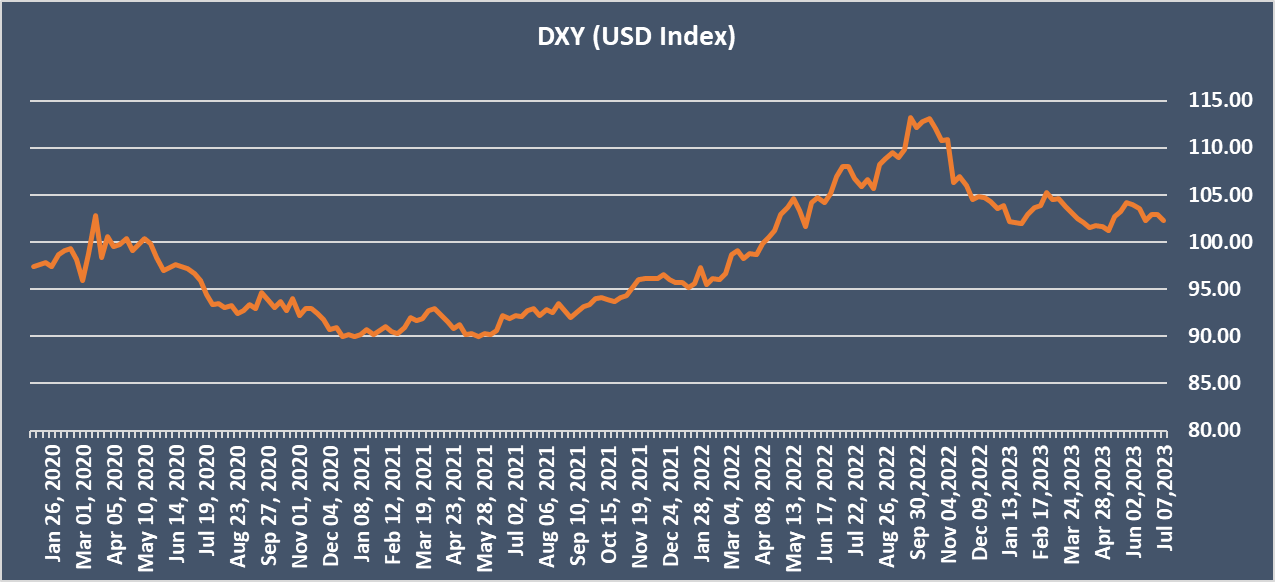

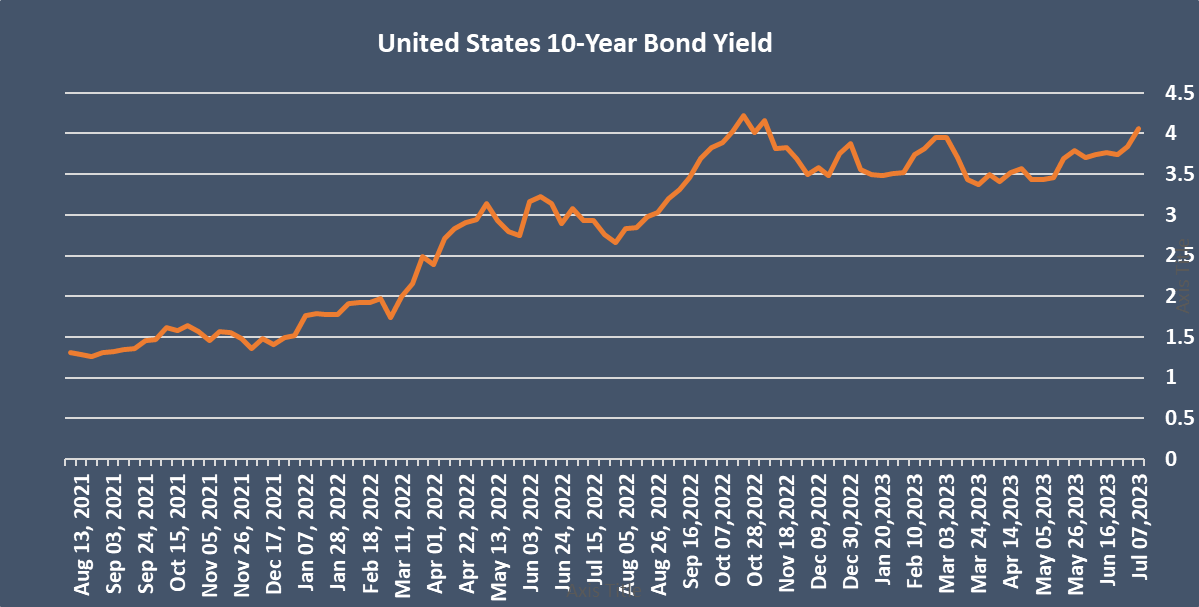

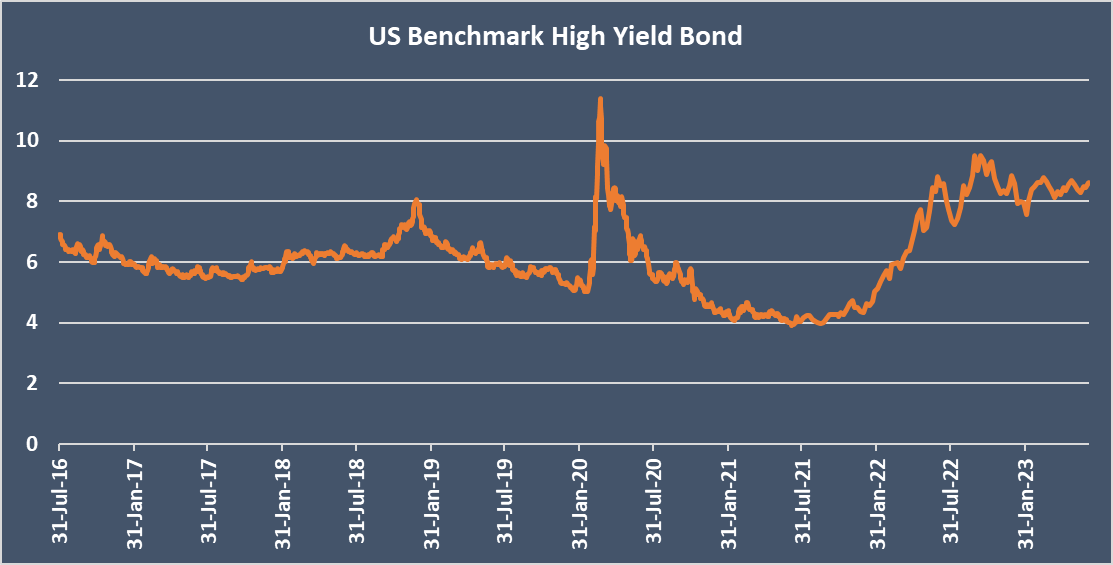

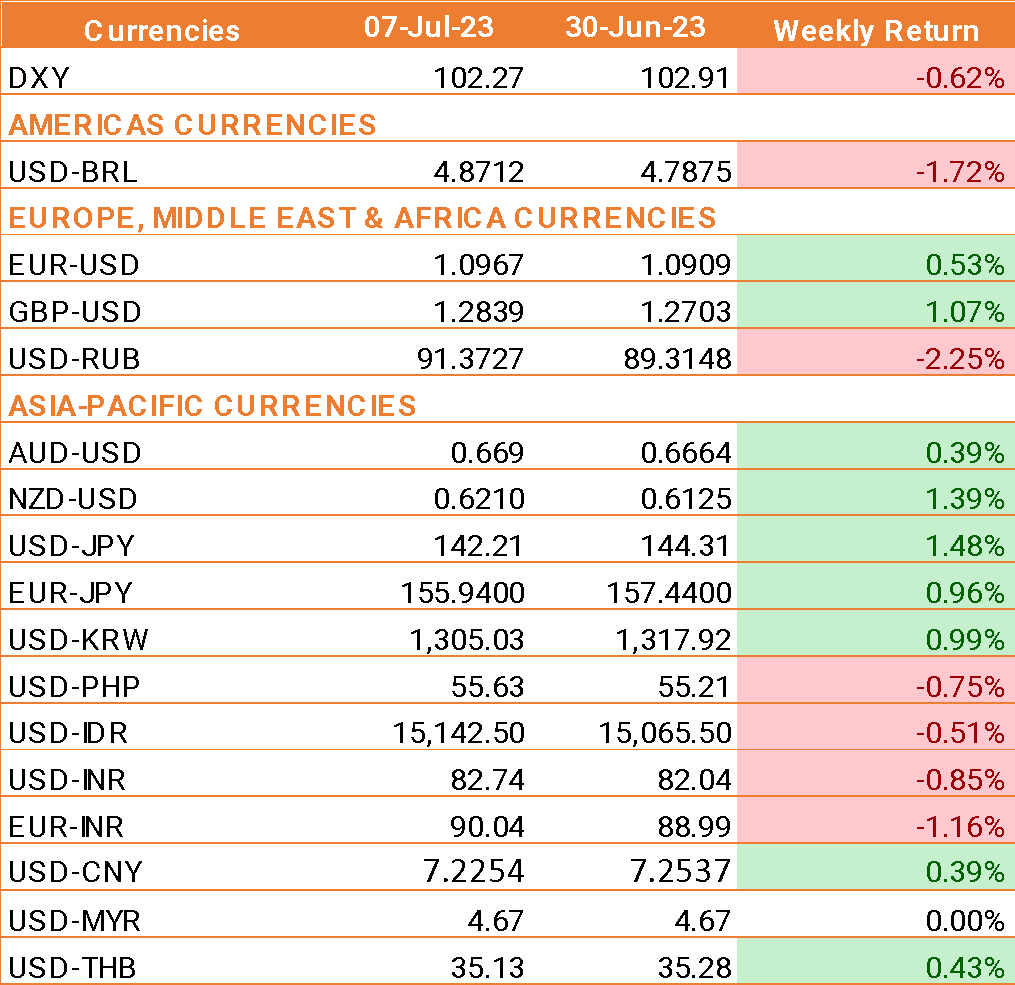

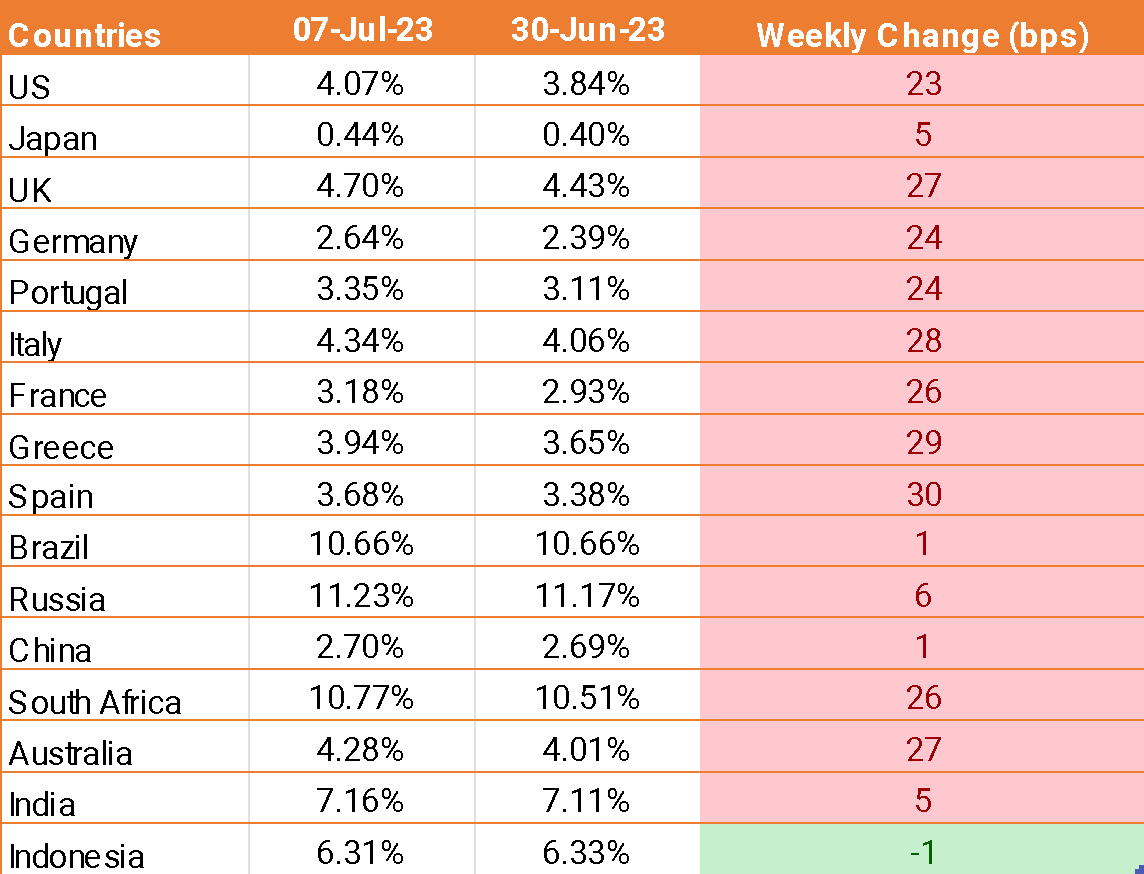

- The USD ended the week on a lower note as the US non-farm payroll came below expectations, after exhibiting gains following the release of minutes from the Federal Reserve's last meeting, which pointed to another rate hike later this month.

- U.S. nonfarm payrolls (NFP) in the US rose by 209,000 in June, as reported by the US Bureau of Labor Statistics on Friday. This reading came in below the market expectation of 225,000. May's increase of 339,000 was revised lower to 306,000.

- The unemployment rate edged lower to 3.6% from the expected 3.7%, and the annual wage inflation, measured by Average Hourly Earnings, remained unchanged at 4.4% against the expectation of 4.2%.

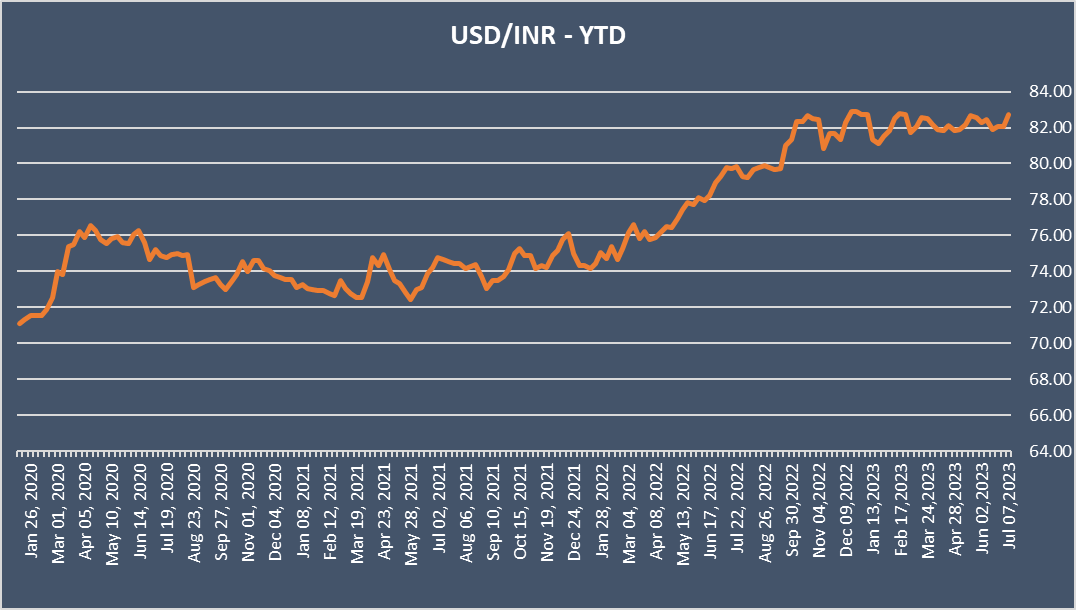

- INR remained under pressure due to worries that the Federal Reserve will keep hiking interest rates higher for longer.

- Separately, oil prices rose this week, boosted by Russia and Saudi Arabia's oil production cuts announced earlier in the week, as well as by upbeat US economic data.

We would love to hear back from you. Please Click here to share your valuable feedback