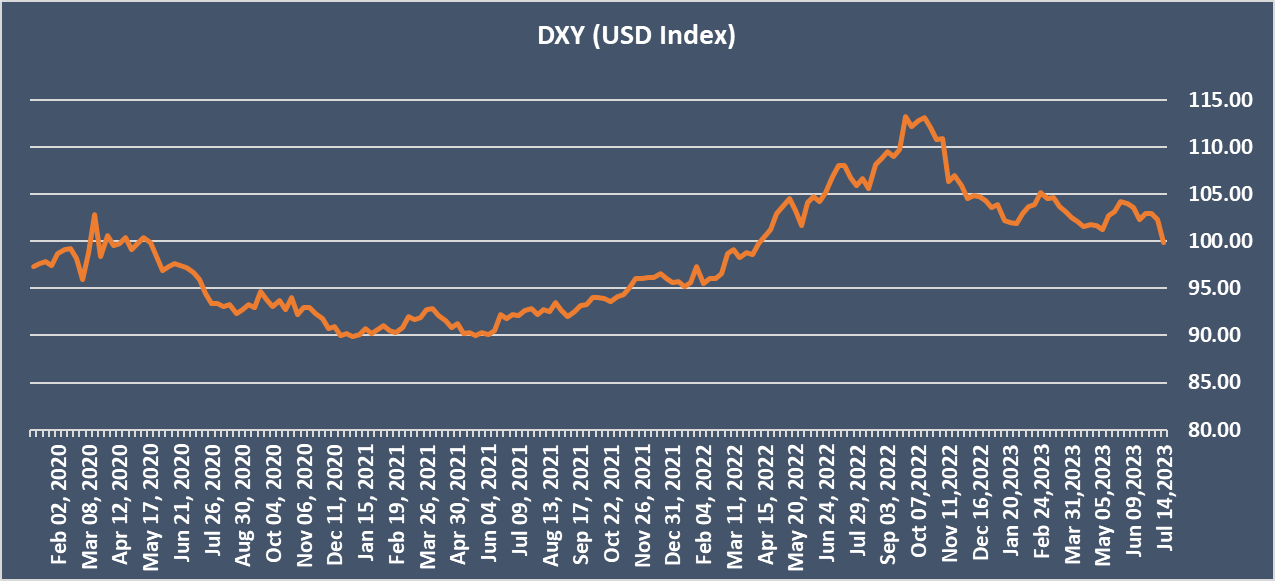

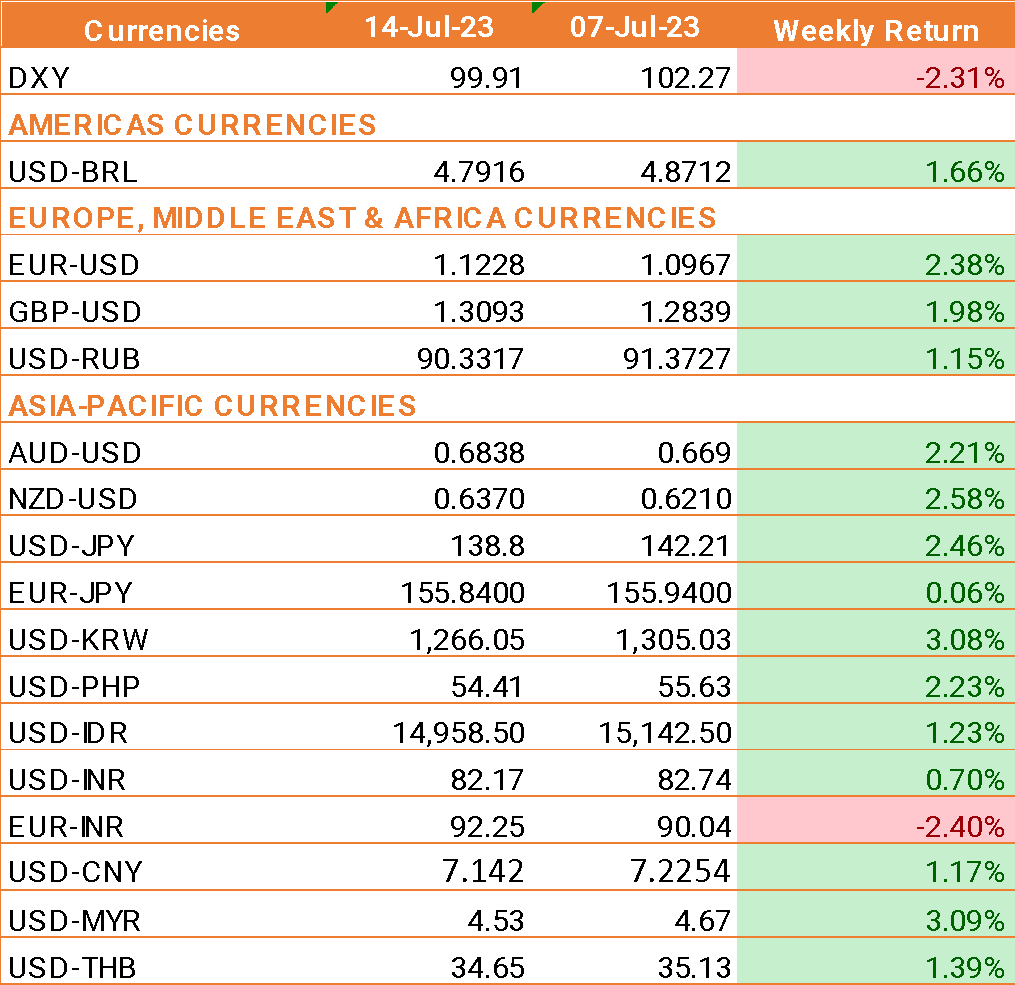

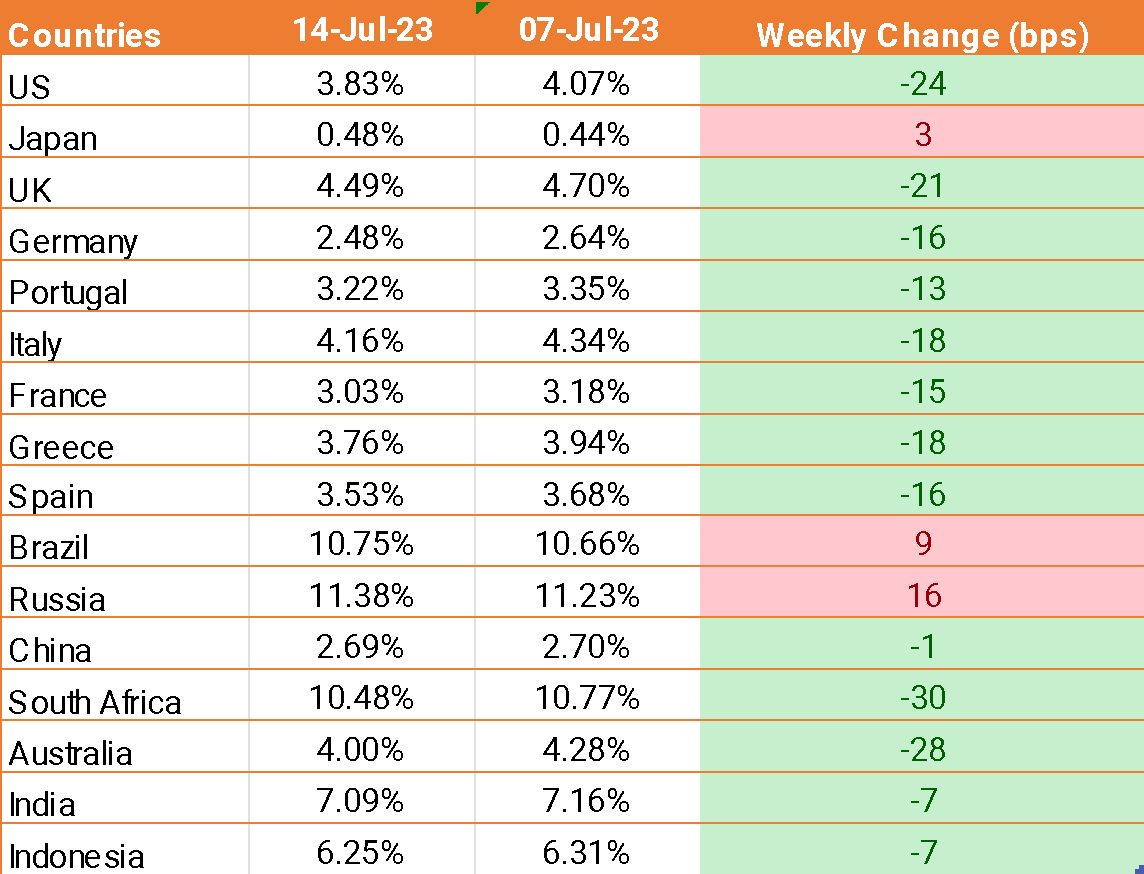

- The USD ended the previous week lower after cooler-than-expected US inflation data. However, the market is still anticipating a 25-bps interest rate increase by the Federal Reserve at the FOMC meeting on July 18th – 19th.

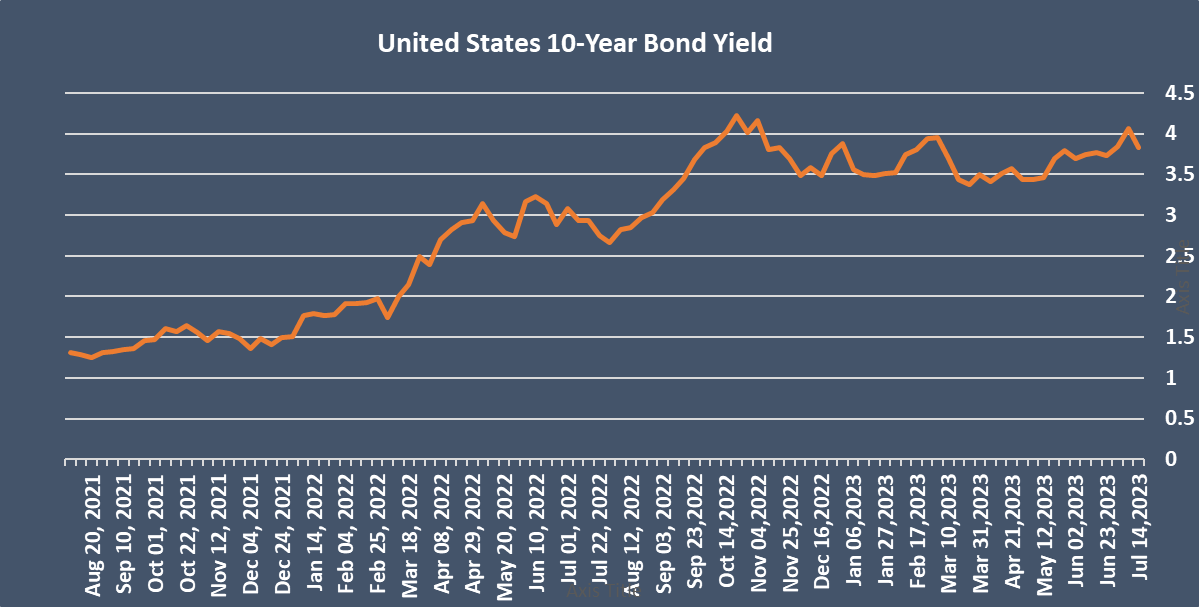

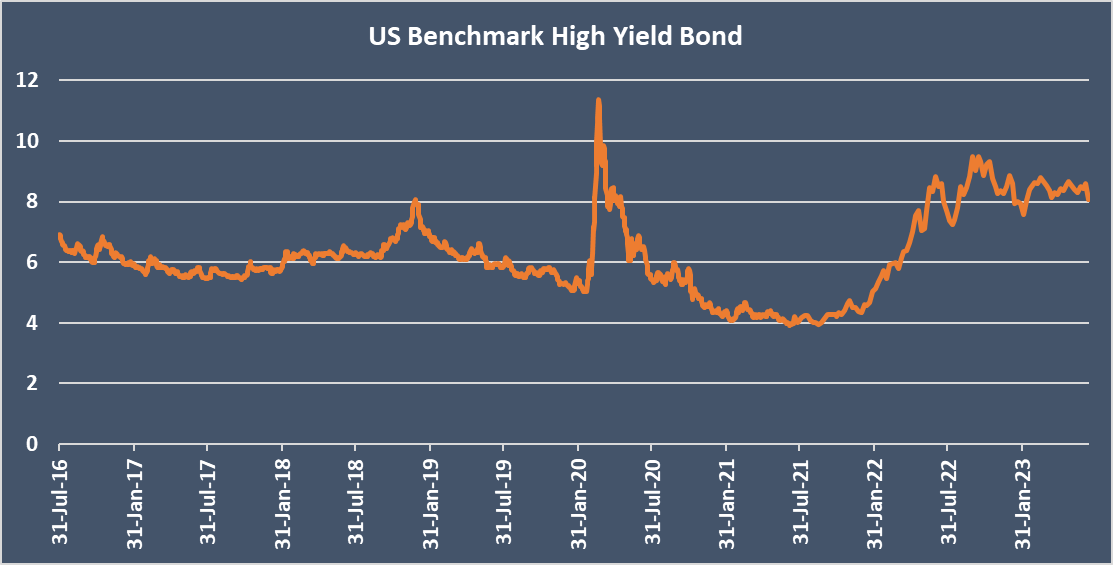

- Fed officials have cautioned that the bank will continue to adopt a data-driven approach to rate hikes. Governor Christopher Waller stated on Thursday that the relative strength of the U.S. economy still provides the bank with more leeway to raise rates, and he has not ruled out the possibility of at least two more hikes this year.

- The US consumer price index eased to 3% year on year in June, down from 4% in May. Expectations were for inflation to cool to 3.1%.

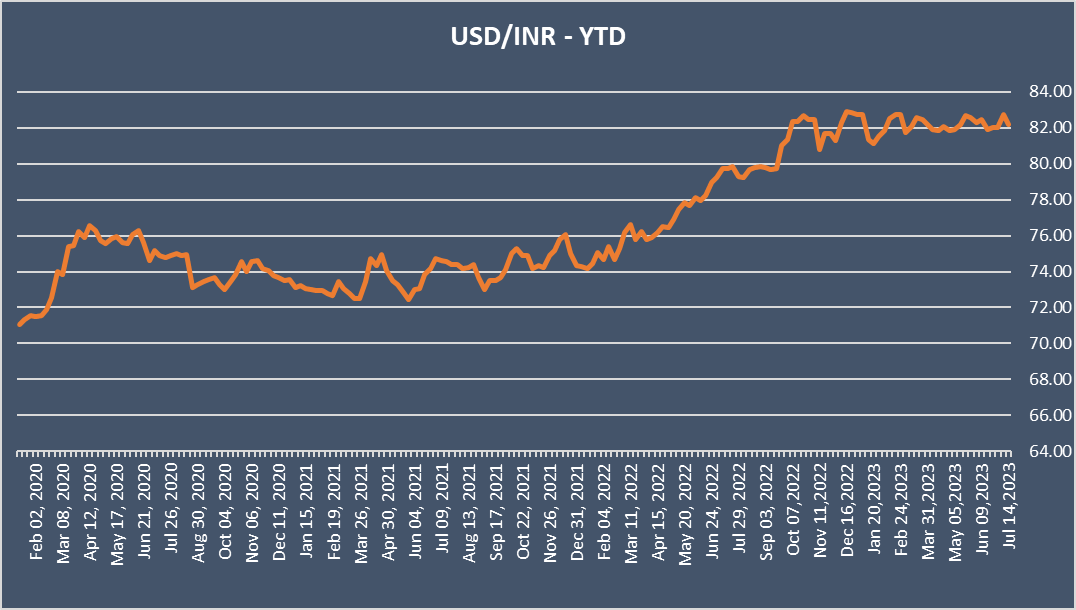

- The INR ended higher against the USD as the market sentiment remains positive following the moderation of US inflation. However, concerns arise due to China's trade data.

- China's exports experienced the largest decline in three years in June, dropping by a worse-than-expected 12.4% year on year. This follows a 7.5% drop in May. The decline in exports coincides with a slowdown in global growth.

We would love to hear back from you. Please Click here to share your valuable feedback