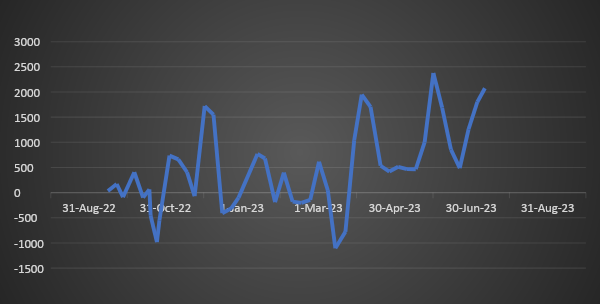

System liquidity has regained an ample surplus level since March 2023. As of 13th July 23, it stood at Rs 2073 billion. During Oct 22-March 23, system liquidity was mostly in deficit zone due to rate hike and withdrawal of accommodative stance of monetary policy by RBI. Going ahead, system liquidity is expected to stay in adequate surplus level in the view of RBI’s pause in rate hike.

Consumer Inflation-During June 23, domestic consumer inflation stood at 4.81% in June 23 as compared to 4.25% in previous month. The consumer food price index rose to 4. 49% in June from 2.91% in May.

Trade deficit-India's merchandise trade deficit narrowed to USD 20.13 billion in June 2023 from USD 22.07 billion in June 2022. Exports declined by 22.0% on yearly basis to USD 32.97 billion while imports decreased by 17.5% to USD 53.1 billion during June 23.

Government bonds, SDL and OIS yield movements

On a weekly basis, the 10-year benchmark 7.26% 2033 yield declined by 7 bps to 7.09%. 7.06% 2028 yield decreased by 6 bps to 7.07%. 5.63% 2026 yield came down by 6 bps to 7.04%. Long-term paper, 7.25% 2063 yield decreased by 9 bps to 7.31%.

The spread of 10-year bond over 5-year bond stood flat 2 bps to 3 bps as compared to the previous week. The 15-year benchmark over 10-year benchmark stood flat at 10 bps from 9 bps while the 30-year benchmark over 10-year benchmark spread decreased to 21 bps from 23 bps on a weekly basis.

10-yr SDL auction cut-off yield declined to 7.42% from 7.44% in previous week while spread remained flat at 33 bps.

On a weekly basis, 1-year OIS yield declined by 3 bps to 6.77% while the 5-year OIS yield increased by 12 bps to 6.28%.

We would love to hear back from you. Please Click here to share your valuable feedback,