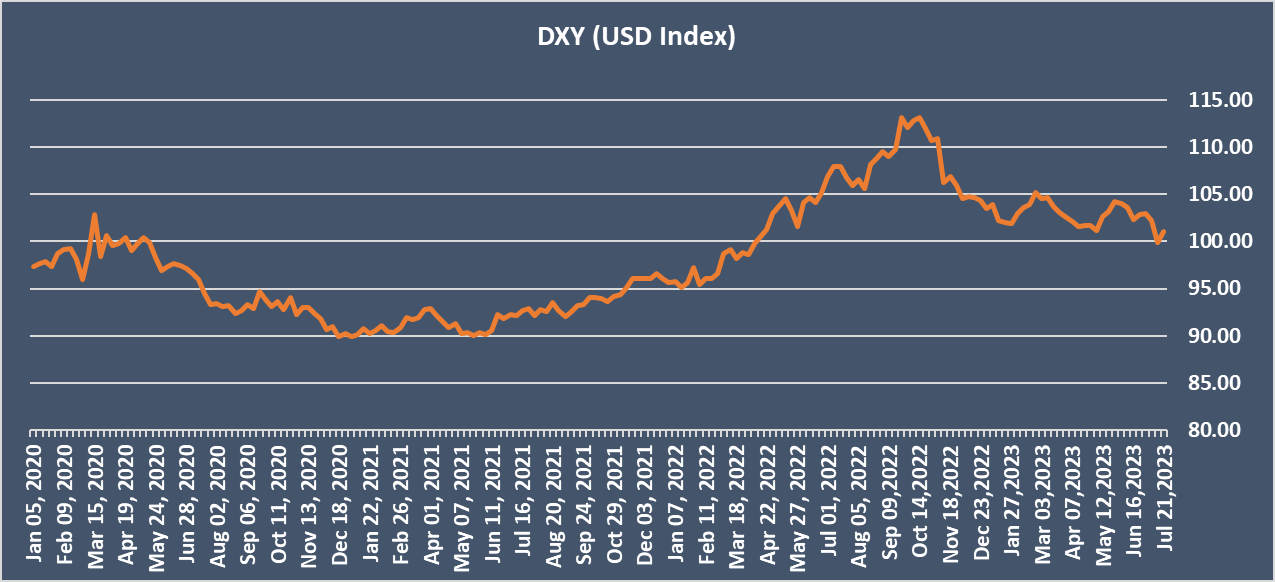

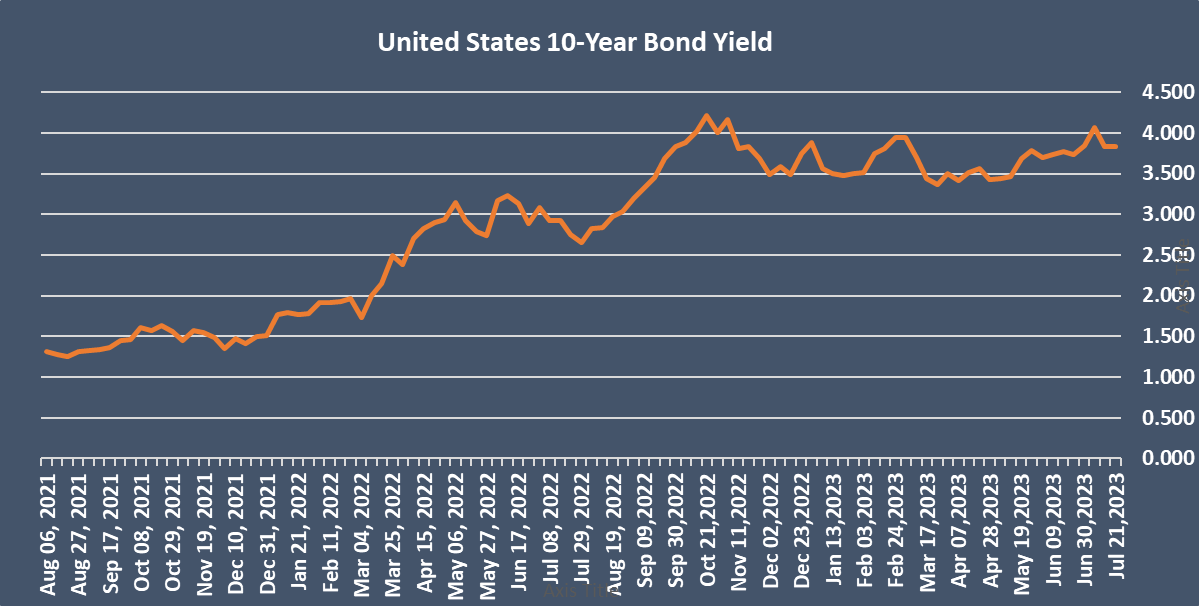

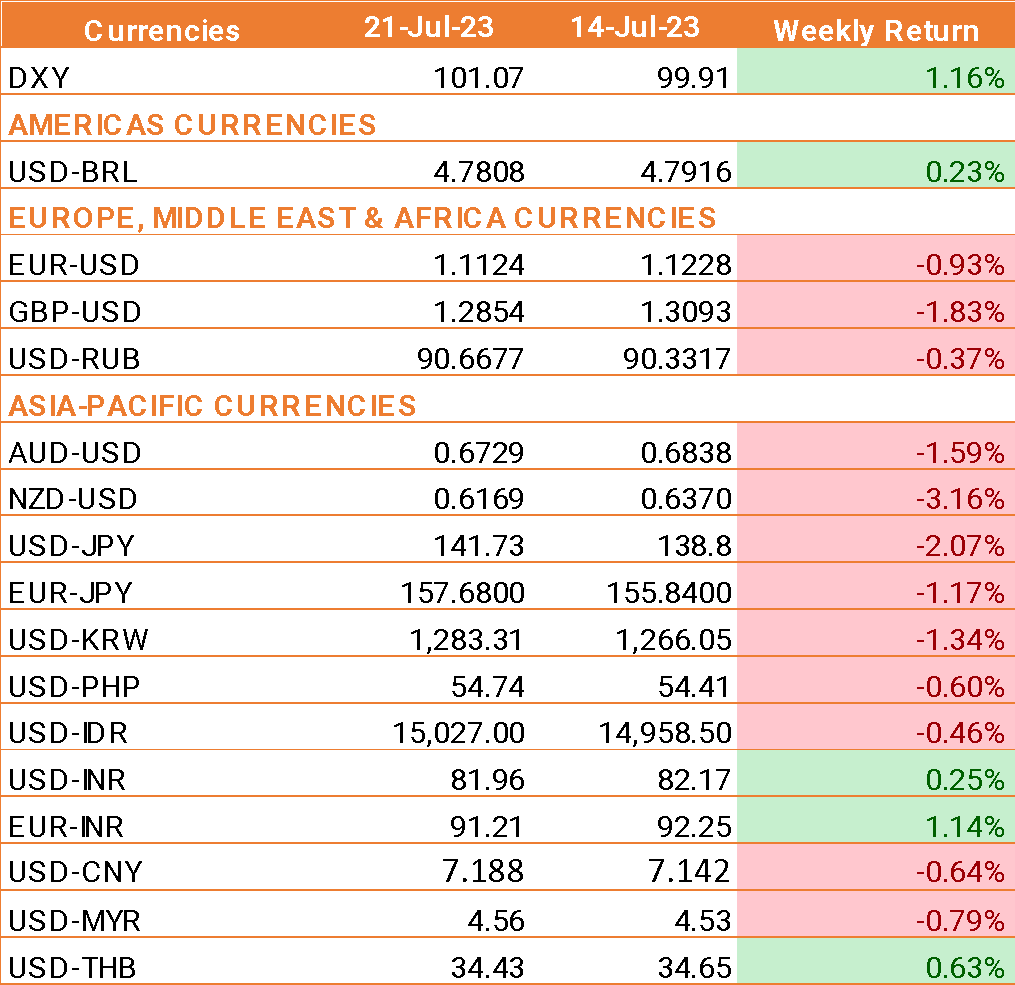

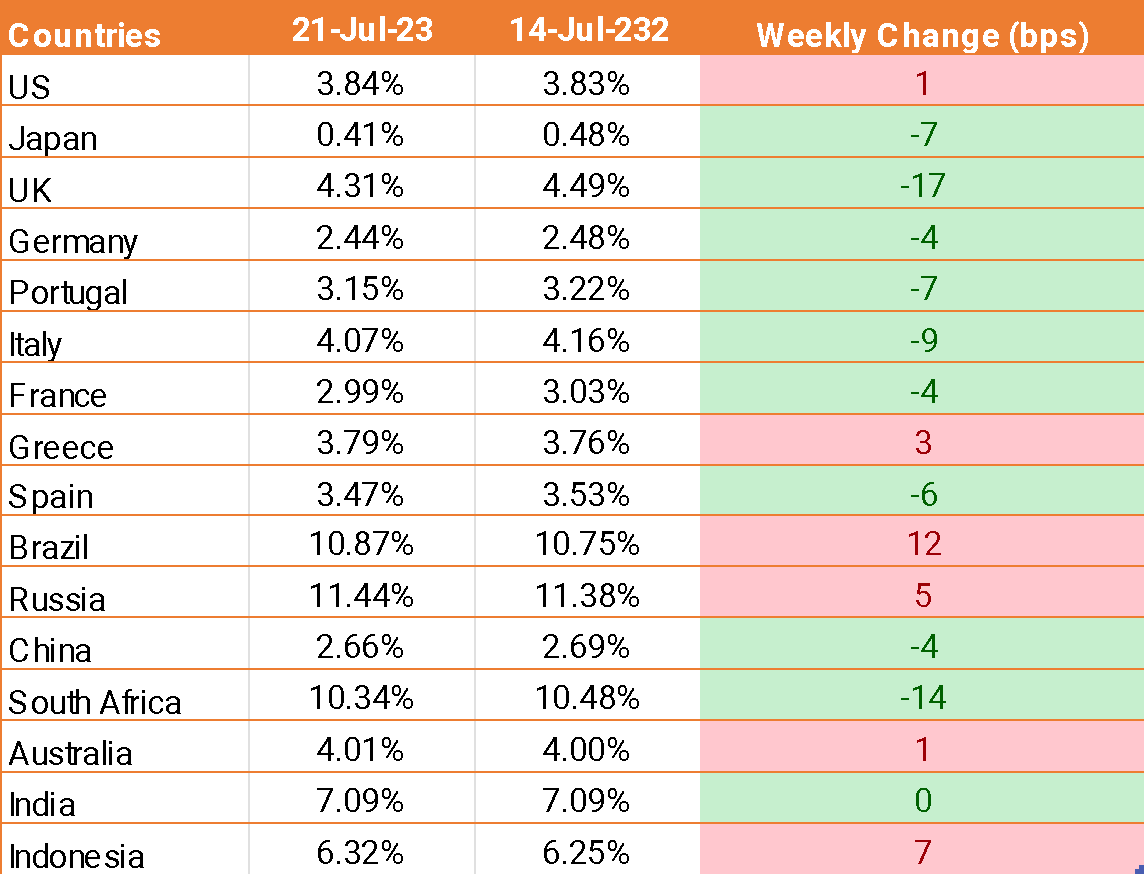

- USD ended a two-week losing streak ahead of the Federal Reserve's widely expected rate hike next week. The Federal Reserve will kick off its two-day meeting on Tuesday, with many expecting the meeting to culminate in a 0.25% rate hike following a pause at the June meeting.

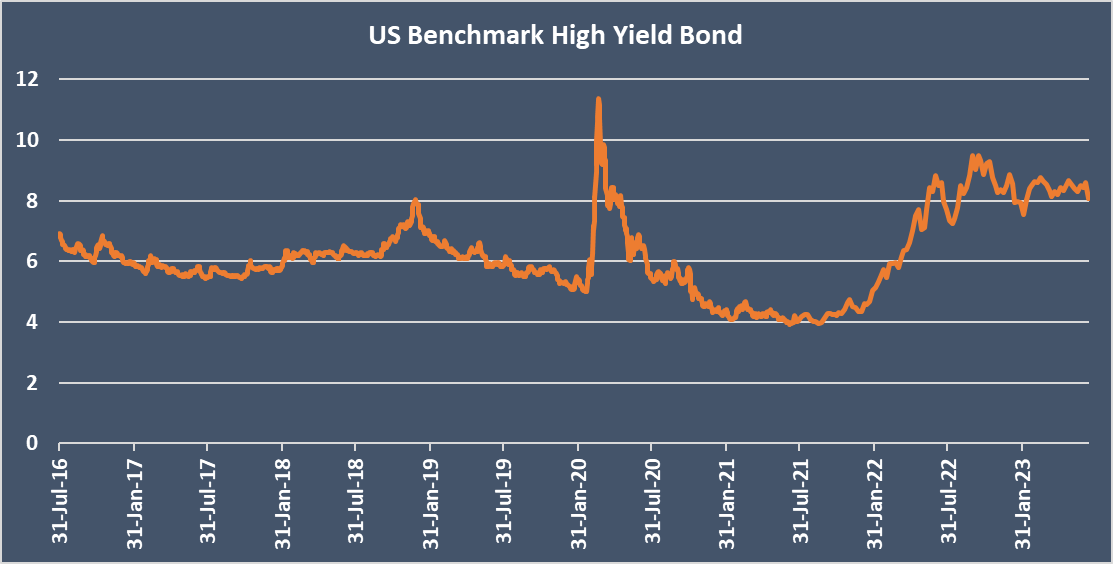

- The Fed is expected to lift interest rates next week and likely push back against bets that it won't follow through with another hike, but this would be only "temporary support for the USD."

- USD is extending gains after US jobless claims data surprised to the downside once again. The number of Americans filing for unemployment benefits for the first time unexpectedly fell to its lowest level in two months, highlighting the ongoing tightness in the US labor market despite the Federal Reserve hiking interest rates aggressively.

- According to data from the labor department, the number of initial claims for unemployment benefits dropped to 228,000, down from 237,000 in the previous week and well below the forecast of 242,000.

- Furthermore, the data showed that retail sales rose 0.2% month on month, below the 0.5% forecast. However, the May figure was upwardly revised to 0.5%. The data suggests that the US consumer is resilient despite high-interest rates.

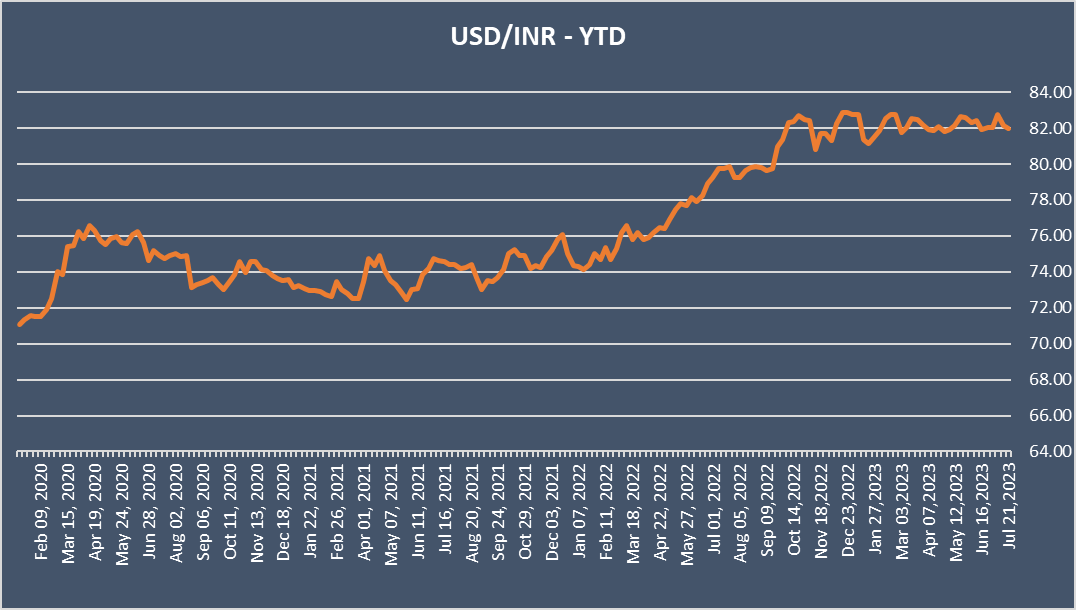

- INR is proving to be resilient against a stronger USD. INR has found some support from improvement in risk appetite after the Chinese authorities took moves to support the yuan.

We would love to hear back from you. Please Click here to share your valuable feedback