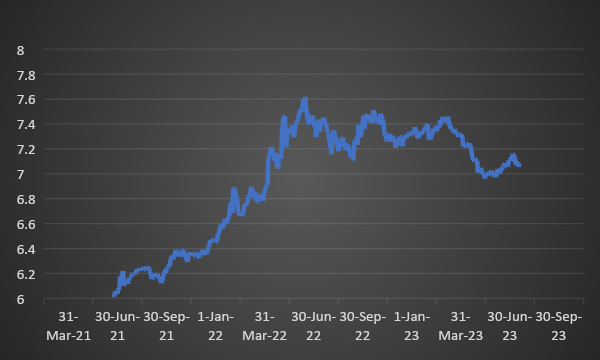

In the current economic scenario, g-sec yield is moving in a range bound manner driven by domestic and international factors. Falling consumer inflation and RBI’s status quo on policy rates caused 10-year g-sec yield to fall below 7%. It is expected that the central bank will continue current policy rates in the coming days.

Globally, it is expected that the US Fed will raise the fund rate by 25 bps in a forthcoming policy meeting with an end to its rate hike cycle. Consequently, it will lead to g-sec yield to move upward. However, up movement may not sustain to a longer duration and it is likely to correct.

Domestic system liquidity recovered to a comfortable position. As of 20th July 23, it stood at Rs 1149 billion.

Historical 10-year g-sec auction performance-

Date of Issuance | G-sec | Cut-off yield | Latest yield |

1-Dec-20 | 5.85% GS 2030 | 5.85% | 7.10% |

12-Jul-21 | 6.10% GS 2031 | 6.10% | 7.10% |

22-Aug-22 | 7.26% GS 2032 | 7.26% | 7.12% |

6-Feb-23 | 7.26% GS 2033 | 7.26% | 7.08% |

Government bonds, SDL and OIS yield movements

On a weekly basis, the 10-year benchmark 7.26% 2033 yield declined by 1 bp to 7.08%. 7.06% 2028 yield stood flat at 7.07%. 5.63% 2026 yield rose by 1 bp to 7.05%. Long-term paper, 7.25% 2063 yield decreased by 2 bps to 7.29%.

The spread of 10-year bond over 5-year bond stood flat 1 bp to 2 bps as compared to the previous week. The 15-year benchmark over 10-year benchmark stood flat at 9 bps from 10 bps while the 30-year benchmark over 10-year benchmark spread increased to 28 bps from 21 bps on a weekly basis.

10-yr SDL auction cut-off yield declined to 7.37% from 7.42% in previous week while spread remained flat at 32 bps.

On a weekly basis, 1-year OIS yield rose by 3 bps to 6.80% while the 5-year OIS yield increased by 4 bps to 6.32%.

We would love to hear back from you. Please Click here to share your valuable feedback,