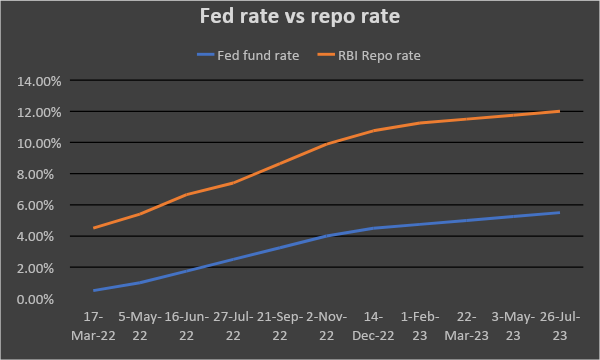

As per market expectation, US Fed hiked fund rate by 25 bps to 5.25%-5.50% which is highest since 2001. Although the US inflation rate is still higher than the target rate of 2%, it is expected that the FOMC will consider further rate action based on economic data in coming meetings. Maximum 25 bps rate hike is possible in 2023 considering inflation data ahead with an end to rate hike cycle.

Driven by Fed rate hike, domestic g-sec yields witnessed an uptrend as expected. Post rate hike, 10-year benchmark rose by 7 bps as of last Friday. However, this spike is not likely to continue. Market awaits forthcoming monetary policy outcomes of RBI MPC and its stance which will determine further direction of g-sec yield movement.

Government bonds, SDL and OIS yield movements

On a weekly basis, the 10-year benchmark 7.26% 2033 yield rose by 8 bps to 7.16%. 7.06% 2028 yield rose by 8 bps to 7.15%. 5.63% 2026 yield rose by 6 bps to 7.11%. Long-term paper, 7.25% 2063 yield increased by 1 bp to 7.30%.

The spread of 10-year bond over 5-year bond stood flat 1 bp as compared to the previous week. The 15-year benchmark over 10-year benchmark stood flat at 9 bps while the 30-year benchmark over 10-year benchmark spread decreased to 20 bps from 28 bps on a weekly basis.

10-yr SDL auction cut-off yield rose to 7.40% from 7.37% in previous week while spread declined to 30 bps from 32 bps.

On a weekly basis, 1-year OIS yield rose by 7 bps to 6.87% while the 5-year OIS yield increased by 18 bps to 6.50%.

We would love to hear back from you. Please Click here to share your valuable feedback,