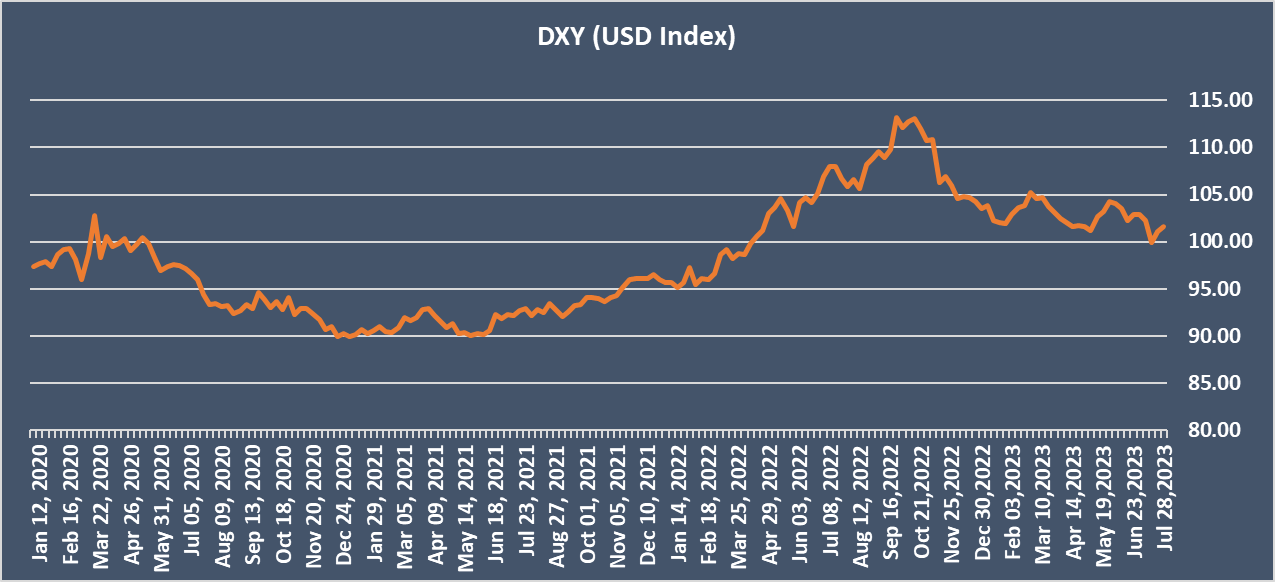

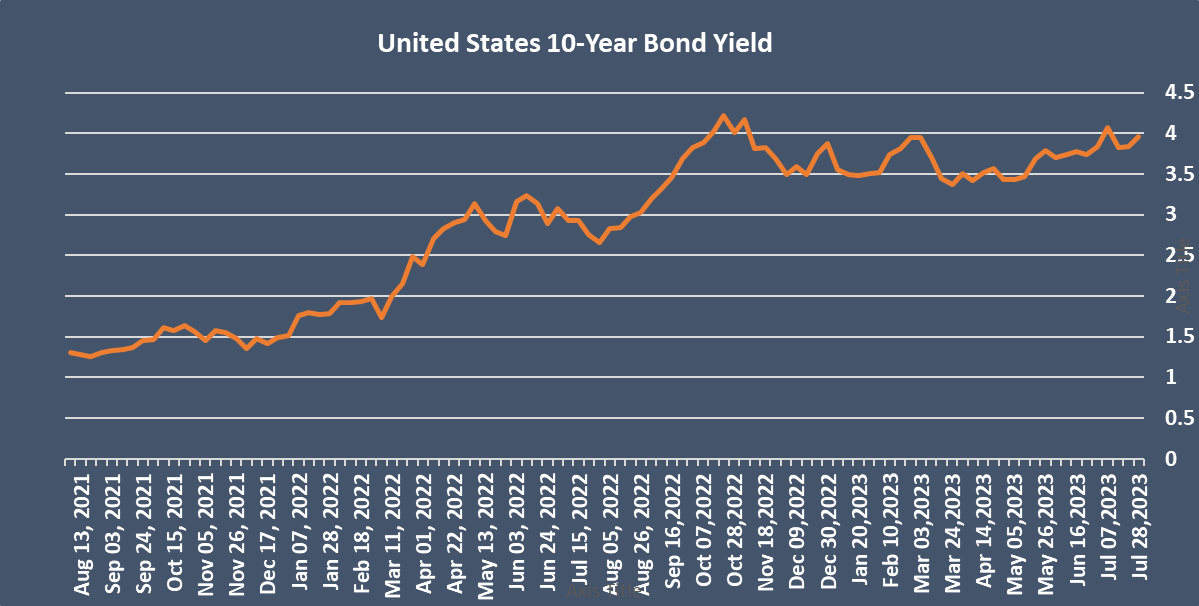

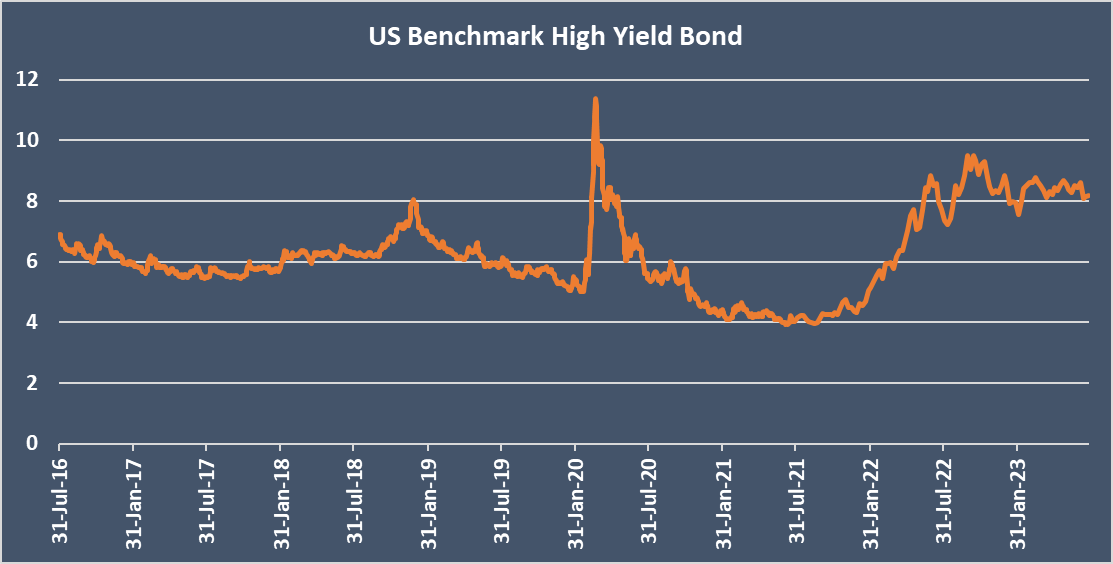

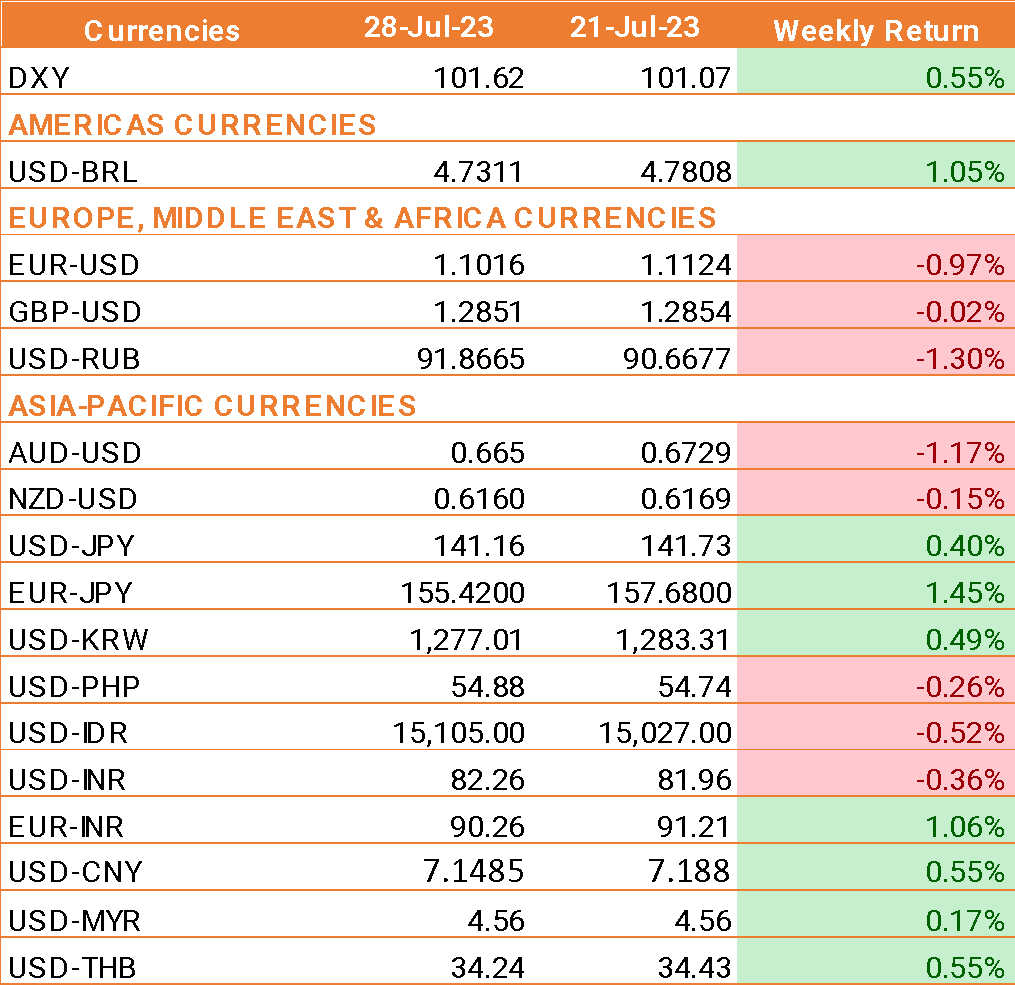

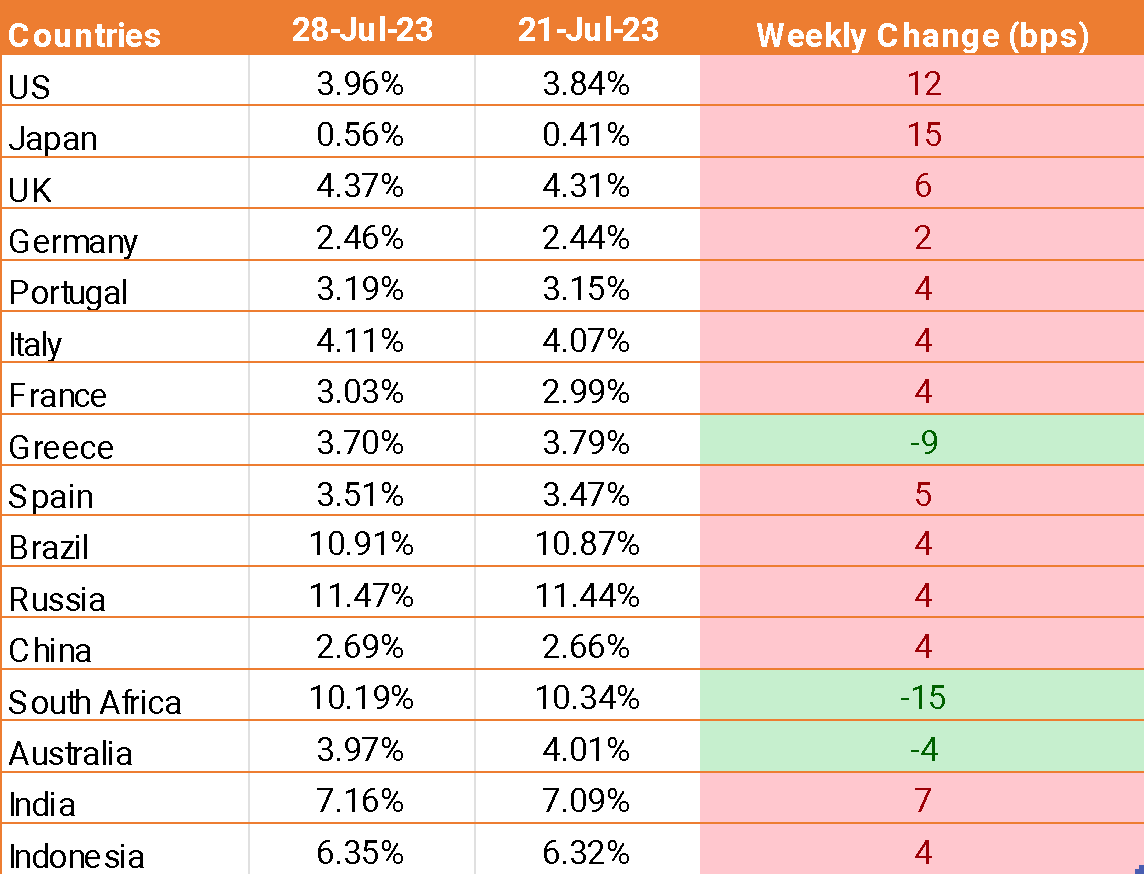

- USD ended the week higher after the Federal Reserve raised interest rates by 0.25%, in line with expectations. This was the 11th interest rate hike in 12 meetings and takes the rate range to 5.25% to 5.5%, its highest level in over two decades.

- Fed Chair Powell acknowledged that rate hikes appear to be working in slowing the economy and taming inflation, although he added that June's inflation print was just one data point. More data needs to be looked at to decide whether or not to hike rates again in September.

- According to data from the U.S. Labor Department, the number of initial claims for unemployment benefits dropped to 228,000, down from 237,000 in the previous week and well below the expected 242,000.

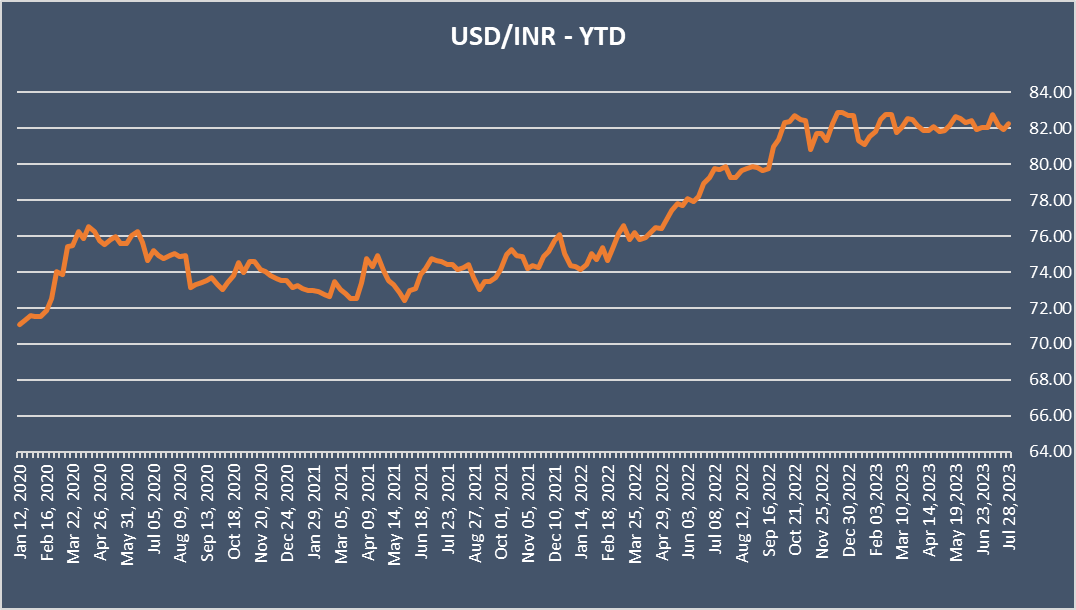

- INR remains resilient against a stronger USD. INR has found some support from the improvement in risk appetite after the Chinese authorities took moves to support the yuan.

- Oil prices are also rising on hopes that the US, the world's largest oil consumer, could avoid a recession. Supply worries are also boosting the price ahead of the OPEC+ meeting next week.

We would love to hear back from you. Please Click here to share your valuable feedback