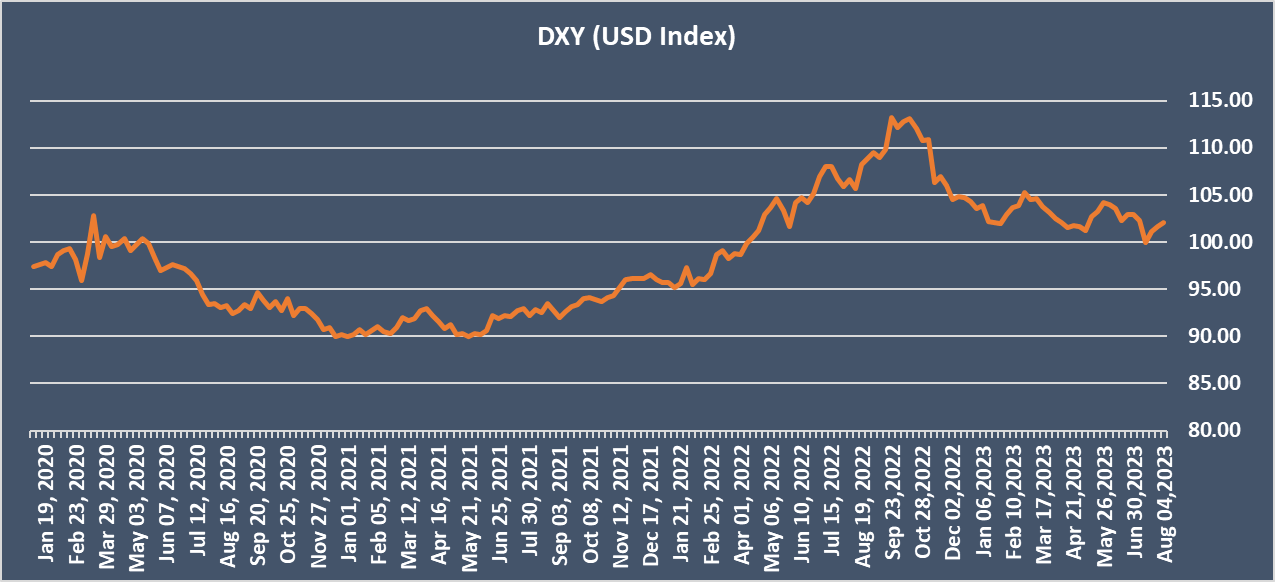

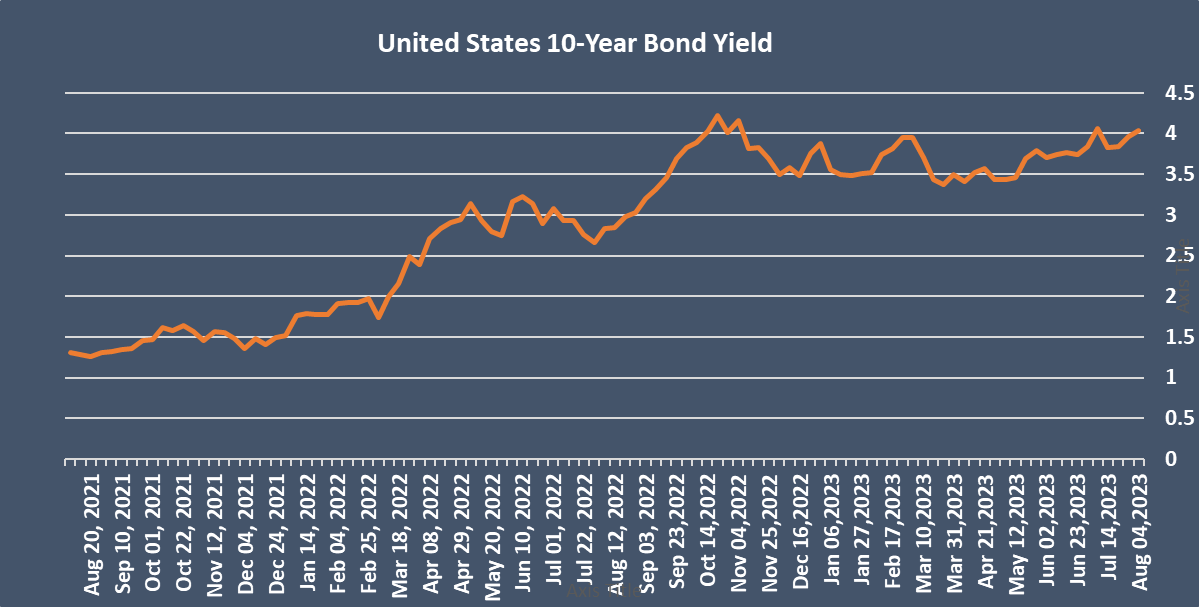

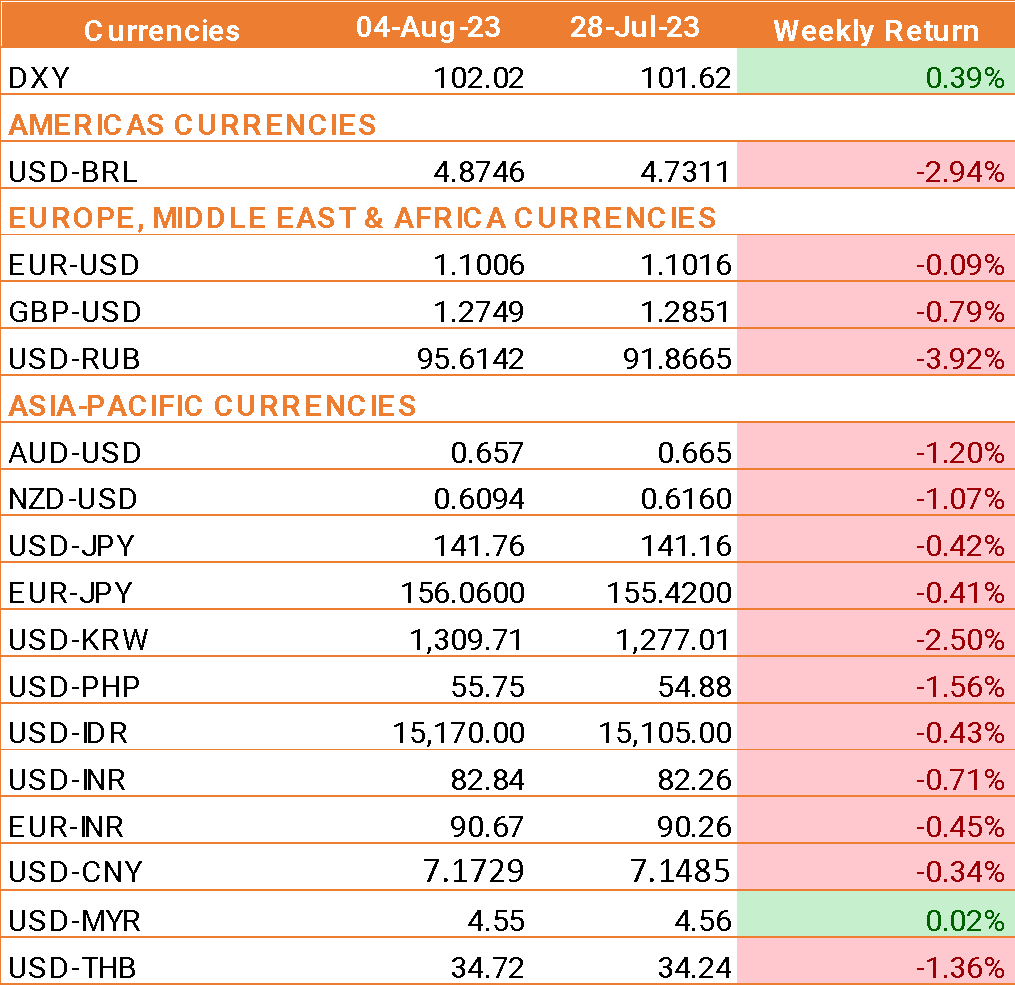

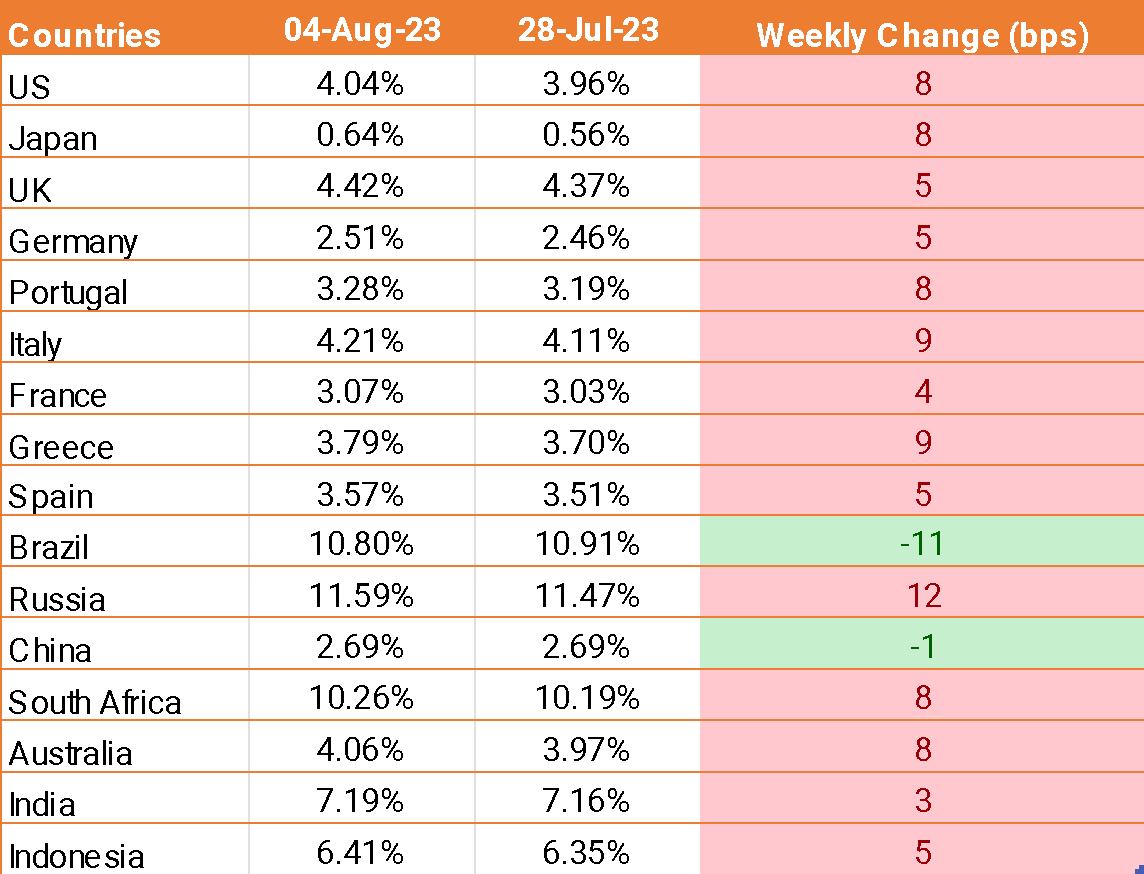

- USD ended the week higher as investors shrugged off Fitch's U.S. credit rating downgrade. Furthermore, slowing U.S. jobs growth in July encouraged hopes of a soft economic landing, but higher wages suggested the Federal Reserve may need to keep interest rates higher for longer.

- Fitch downgraded the United States to AA+ from AAA on Tuesday, drawing an angry response from the White House and surprising investors. This move came despite the resolution of a debt ceiling crisis two months ago.

- U.S. nonfarm payrolls increased by 187,000 jobs last month, falling short of the expectation of 200,000. Downward revisions in May and June job growth suggested that demand for labor was slowing after the Fed's hefty rate hikes.

- However, solid wage gains and a drop in unemployment to 3.5% signaled continued tightness in the labor market.

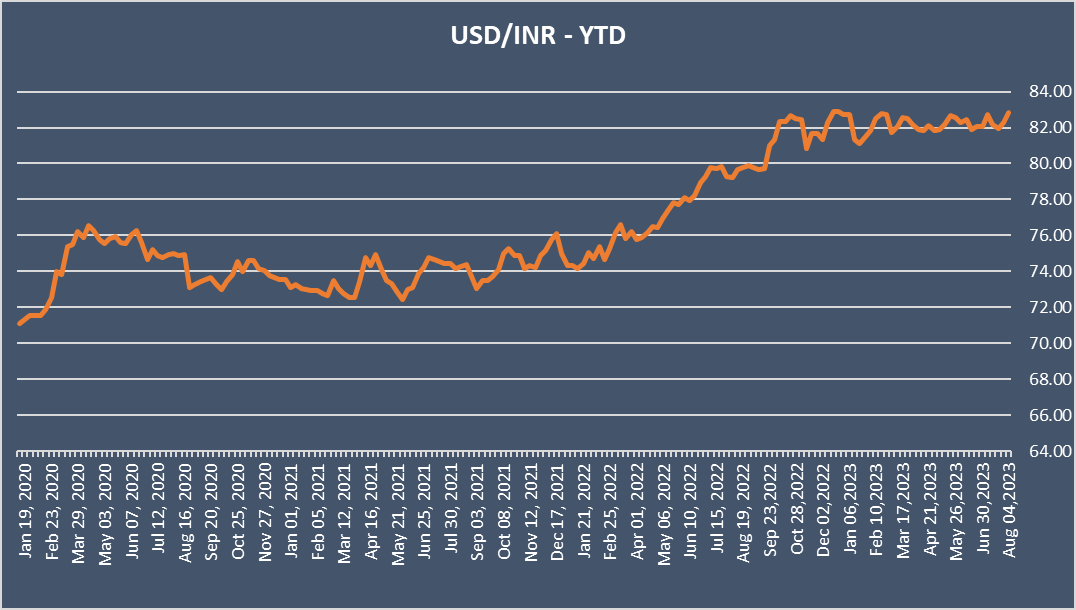

- INR ended the week lower against the USD as broad risk aversion weighed on sentiment.

- Crude oil benchmarks extended gains on Friday. Brent crude futures were trading higher at USD 85.25 per barrel, while WTI futures were trading higher at USD 81.73 per barrel.

We would love to hear back from you. Please Click here to share your valuable feedback