In the last RBI monetary policy meeting, the central bank kept the policy repo rate unchanged at 6%. The committee remains watchful and is prepared to act if necessary to fulfill its commitment to price stability. RBI expects July & August inflation prints to come in higher than expected due to sharp rise in vegetable prices and skewed south-west monsoon. Inflation target during Q2FY4 has been projected at 6.2%.

In order to absorb surplus liquidity caused by various factors, all scheduled banks will maintain an incremental cash reserve ratio (I-CRR) of 10% on the increase in their net demand and time liabilities (NDTL) between May 19, 2023 and July 28, 2023. As of 10th Aug, system liquidity stood at 2.64 trillion which is likely to fall due to introduction of I-CRR.

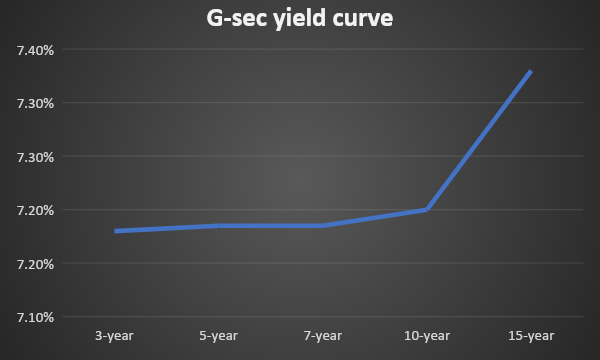

In the wake of falling system liquidity and rising inflation, g-sec yields will rise in coming days.

New 10-year g-sec auction cut-off yield stood at 7.18% during the last auction process.

US inflation- US consumer inflation rose to 3.2% in July from 3% in the previous month.

Government bonds, SDL and OIS yield movements

On a weekly basis, the 10-year benchmark 7.26% 2033 yield rose by 1 bp to 7.20%. 7.06% 2028 yield rose by 2 bps to 7.18%. 5.63% 2026 yield rose by 2 bps to 7.18%. Long-term paper, 7.25% 2063 yield stood unchanged at 7.37%.

The spread of 10-year bond over 5-year bond declined to 2 bps from 3 bps as compared to the previous week. The 15-year benchmark over 10-year benchmark declined to 6 bps as compared to 8 bps while the 30-year benchmark over 10-year benchmark spread decreased to 18 bps from 19 bps on a weekly basis.

10-yr SDL auction cut-off yield declined to 7.44% from 7.45% in previous week while spread came down to 28 bps from 30 bps.

On a weekly basis, 1-year OIS yield rose by 2 bps to 6.91% while the 5-year OIS yield decreased by 2 bps to 6.53%.

We would love to hear back from you. Please Click here to share your valuable feedback,