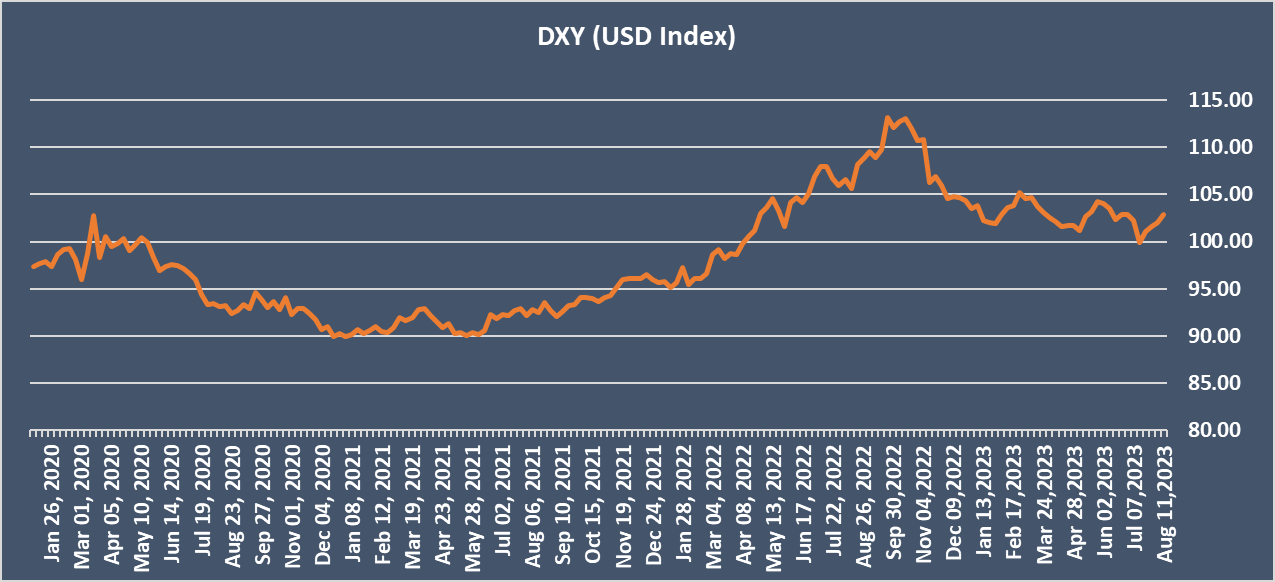

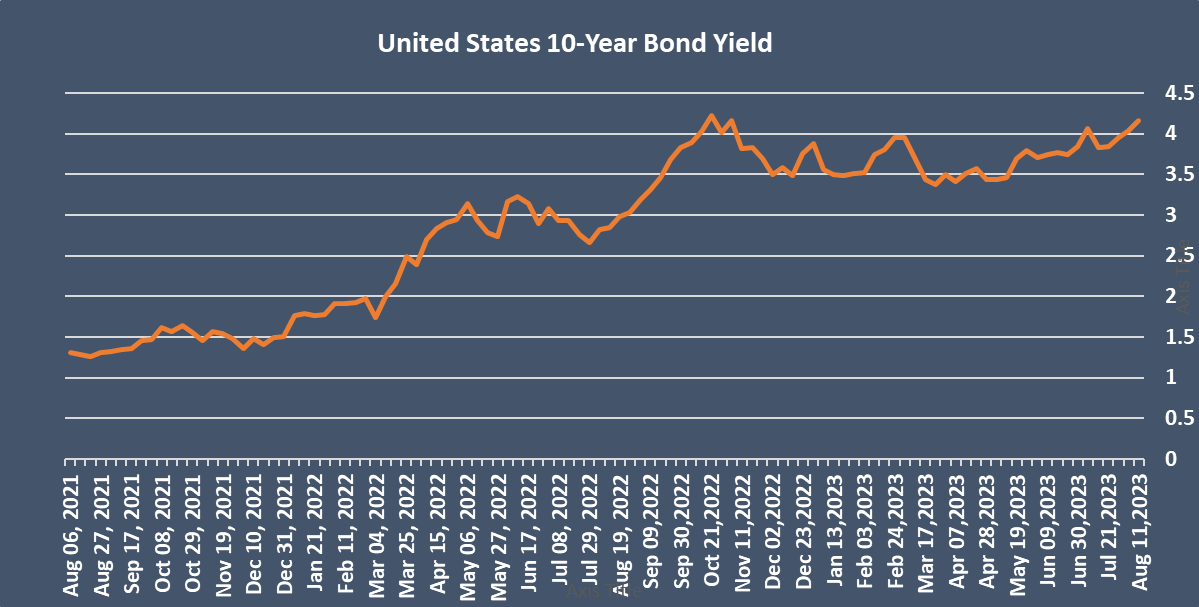

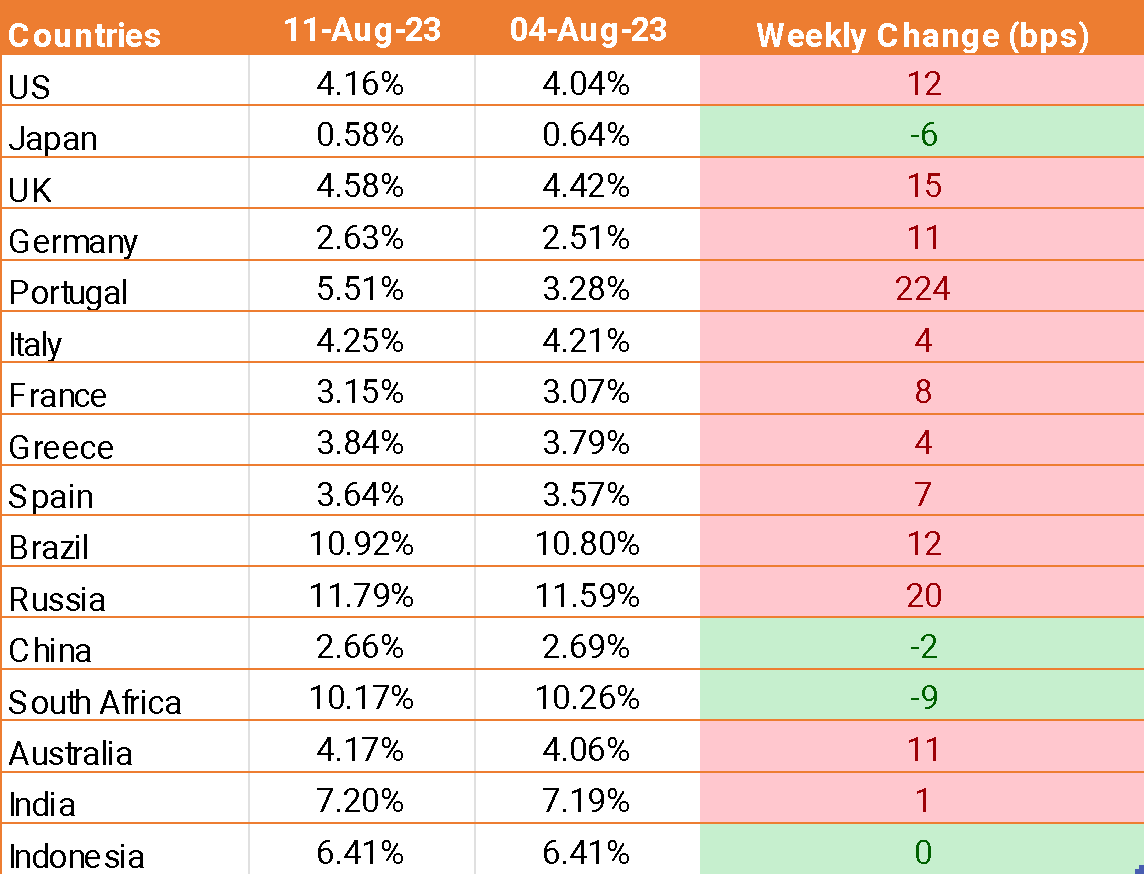

- The USD ended the week higher after the release of the latest inflation reading, which spurred bets that the Fed will keep rates on hold in September. It also led to markets trimming their expectations for a rate cut this year, with rates expected to remain at 22-year highs.

- The U.S. Consumer Price Index (CPI) rose largely in line with expectations. U.S. CPI increased by 3.2%, up from 3.0% in June, against an expectation of 3.3%.

- Philadelphia Fed President Patrick Harker suggested that interest rates are already high enough, echoing the view of Atlanta Fed President Raphael Bostic.

- Fed Chair Jerome Powell made it clear that the central bank was closely monitoring upcoming economic data for guidance leading up to September’s Fed meeting.

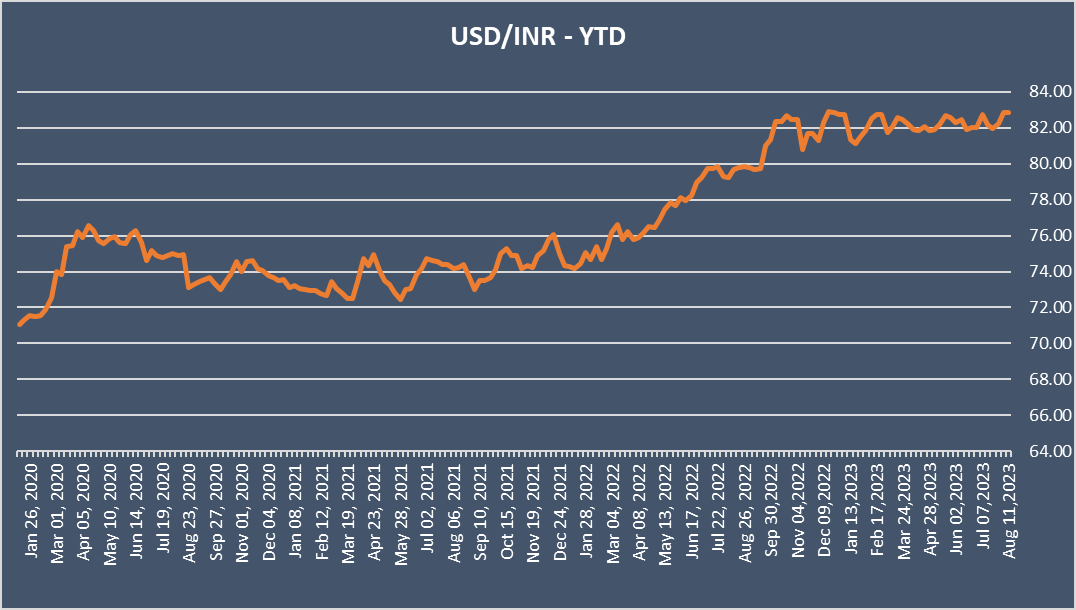

- The risk sentiment took a hit during the week after disappointing Chinese trade data indicated continued weakness in Asia’s largest economy.

- China's exports fell by an annual 14.5% in July, while imports contracted by 12.4%, marking their fastest pace of decline since the COVID pandemic in 2020.

We would love to hear back from you. Please Click here to share your valuable feedback