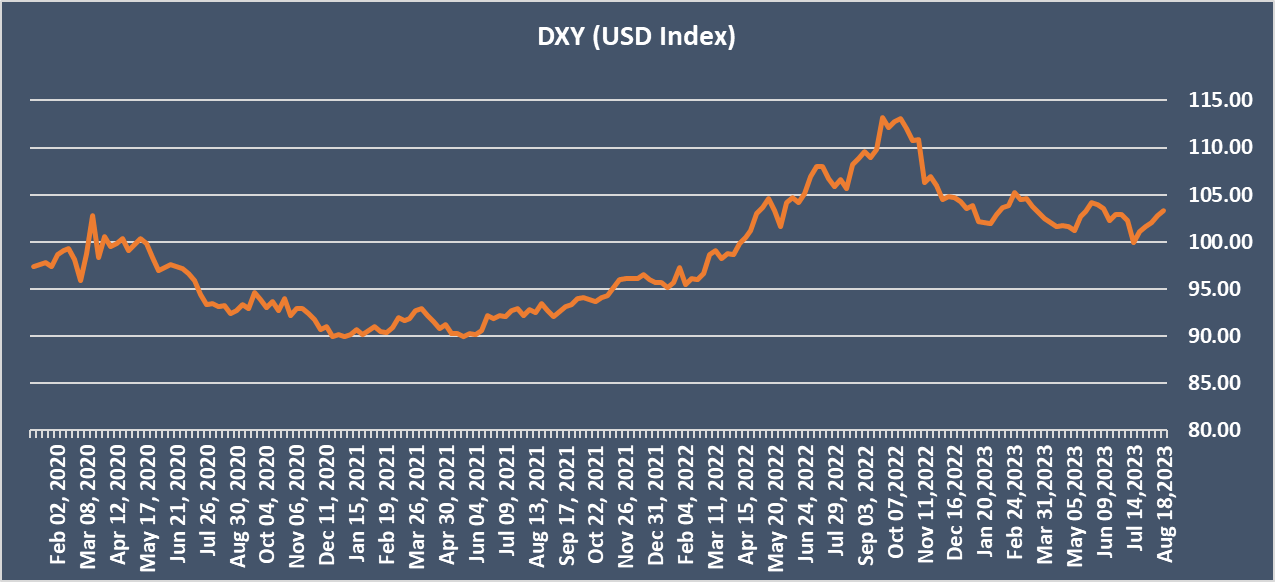

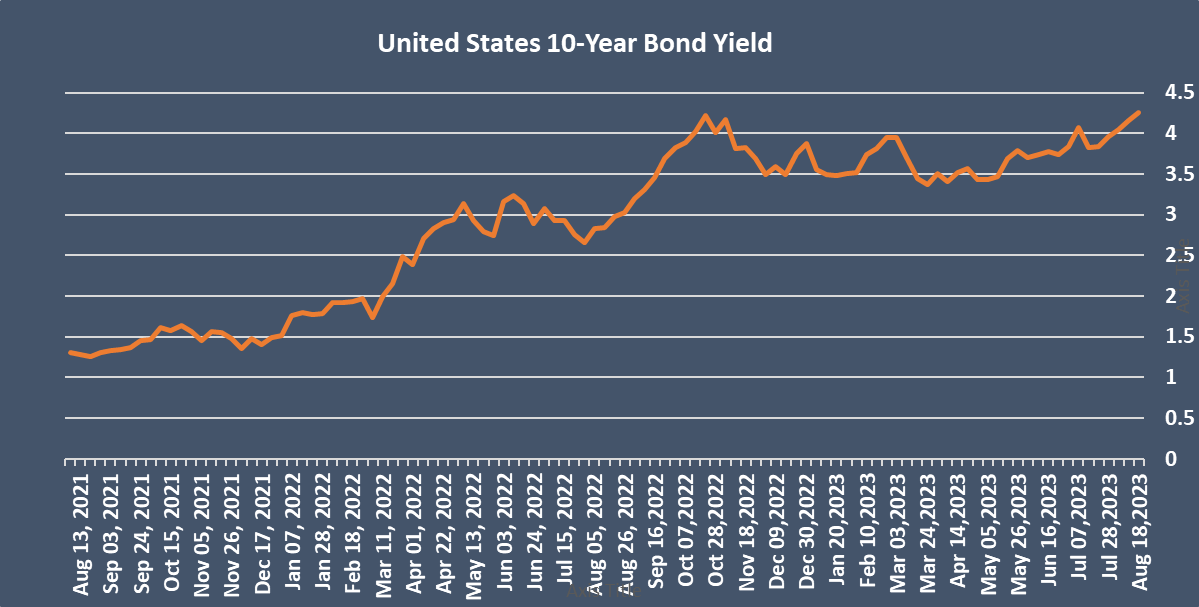

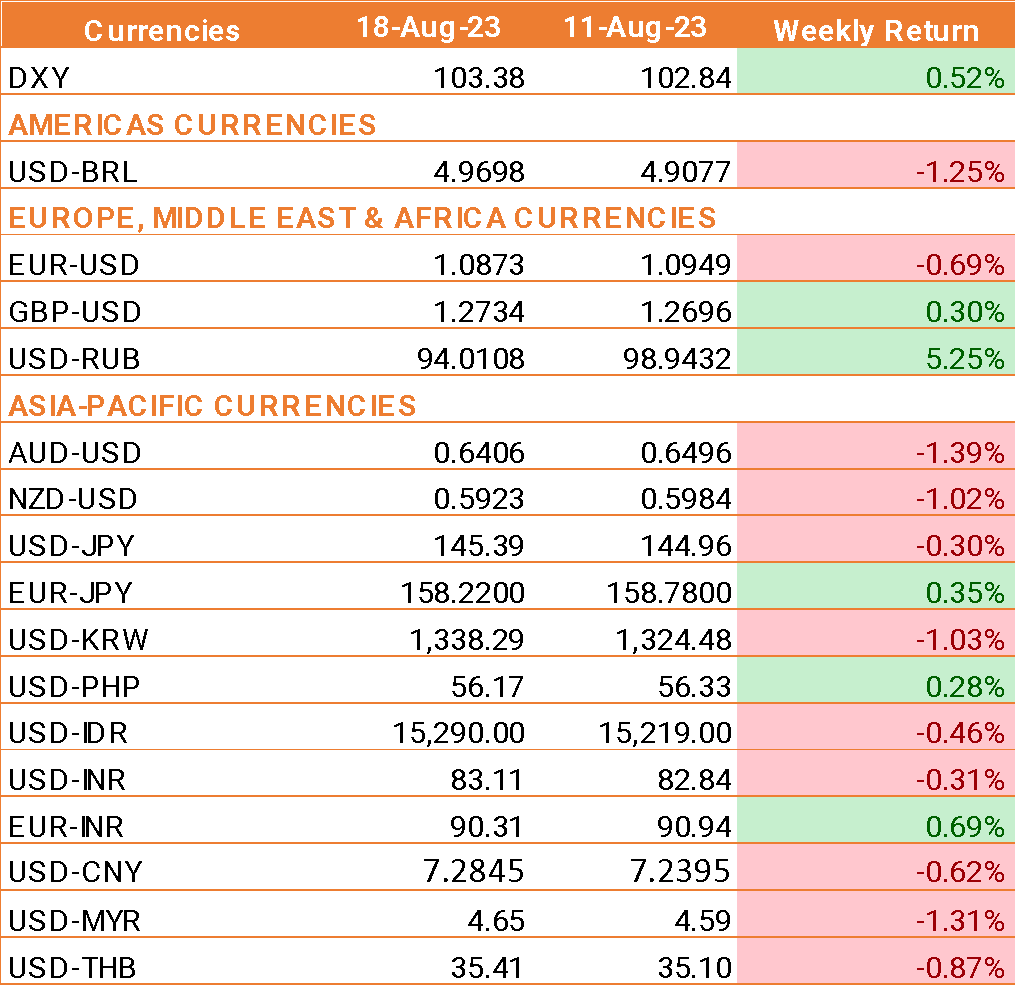

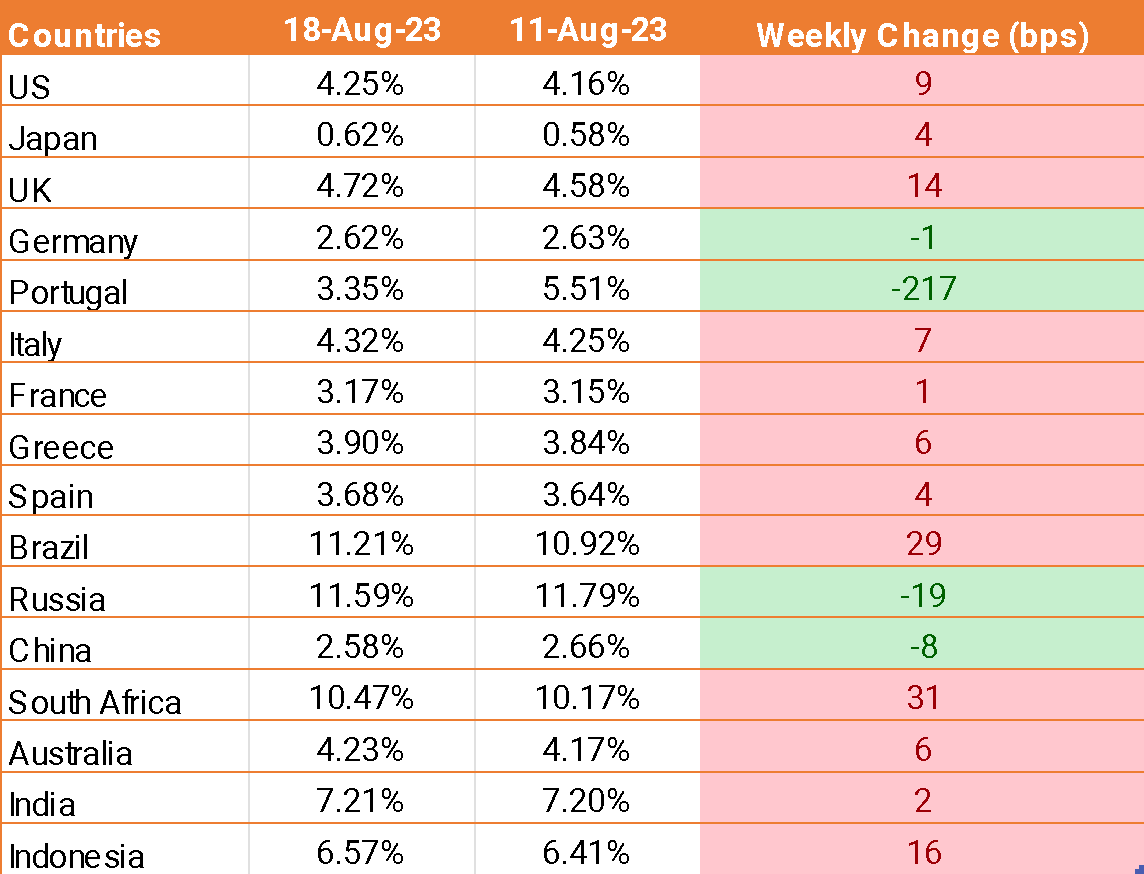

- The USD has risen throughout the week, reaching its highest level since early June, as treasury yields surged. The US 10-year treasury yield surged to 4.32% this week, just below the October 4.33% level and the level observed in 2007.

- The USD is being boosted by expectations that the Federal Reserve could raise interest rates once again and maintain them at higher levels for a longer duration. The minutes from the July FOMC meeting indicate that policymakers perceive an upside risk to inflation.

- US retail sales surpassed expectations in July, rising by 0.7% month on month, up from 0.3% and ahead of the anticipated 0.4%. This data suggests that the US consumer is spending well as inflation cools down and interest rates rise. Robust consumer spending has heightened expectations of further rate hikes by the Fed.

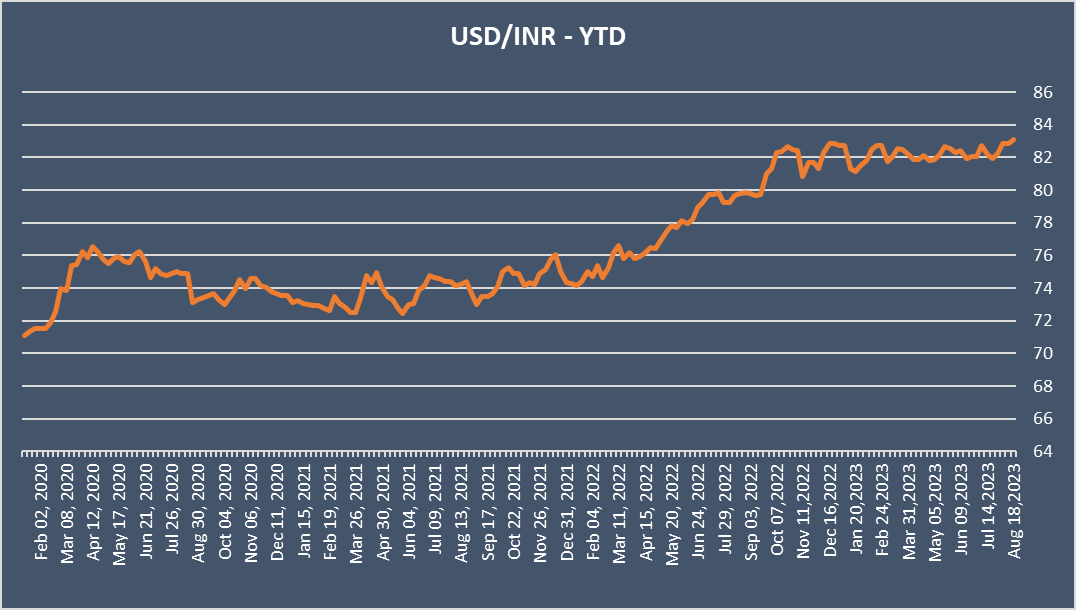

- The INR reached record lows on Wednesday amidst growing concerns about the health of the Chinese economy and the overall strength of the USD.

- The domestic situation in China seems to be deteriorating further following Evergrande's filing for bankruptcy protection in the US, and as Zhongrong International Trust, a significant player in the Chinese Trust sector, has failed to meet several debt servicing obligations in recent weeks.

We would love to hear back from you. Please Click here to share your valuable feedback