In the last RBI MPC meeting, the central bank announced incremental CRR to absorb excess liquidity. Consequently, system liquidity has declined to become deficit since the policy meeting. As of 22nd August, it stood at a deficit level of Rs 155 billion while it moved to surplus level of Rs 258 billion.

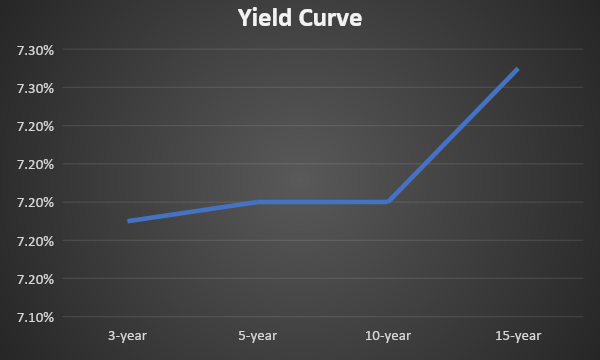

Driven by domestic factors such as high inflation and deficit system liquidity, short term g-sec yields have increased higher as compared to longer term bonds. As a result, the yield curve became flat at the shorter end. It can be seen that 10-yr, 5-yr & 3-yr g-sec yield stood at 7.20%, 7.20% & 7.19% respectively. Domestic inflation is expected to remain high till September.

Globally the US Fed has indicated further rate hikes to curb high inflation that has caused US Treasury yield to rise.

From the above factors, it can be told that g-sec yield is likely to experience an uptrend with higher gain by shorter term papers. Therefore, the yield curve will continue to exhibit flatness.

Government bonds, SDL and OIS yield movements

On a weekly basis, 7.18% 2033 yield declined by 2 bps to 7.18%. The 10-year benchmark 7.26% 2033 yield decreased by 2 bps to 7.20%. 7.06% 2028 yield stood unchanged at 7.20%. 5.63% 2026 yield came down by 1 bp to 7.19%. Long-term paper, 7.25% 2063 yield lost 4 bps to 7.35%.

The spread of 10-year bond over 5-year bond remained at 0 bps as compared to the previous week. The 15-year benchmark over 10-year benchmark declined to 7 bps as compared to 10 bps while the 30-year benchmark over 10-year benchmark spread came down to 16 bps from 18 bps on a weekly basis.

10-yr SDL auction cut-off yield stood flat at 7.49% from 7.50% in previous week while spread decreased to 27 bps from 29 bps.

On a weekly basis, 1-year OIS yield rose by 1 bp to 7.01% while the 5-year OIS yield decreased by 3 bps to 6.64%.

We would love to hear back from you. Please Click here to share your valuable feedback,