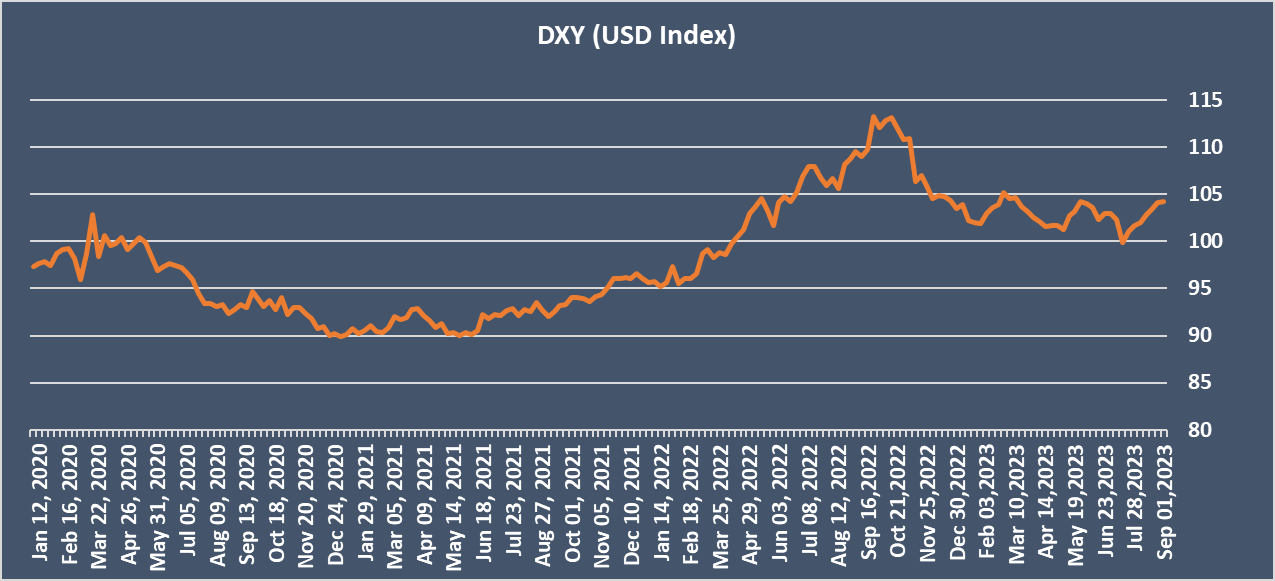

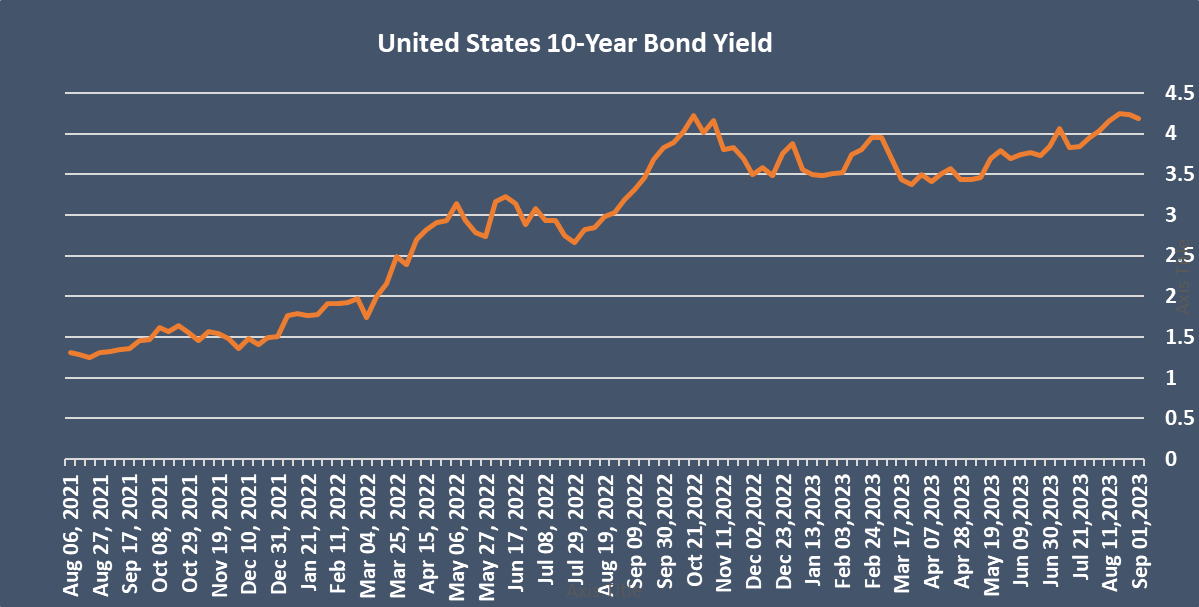

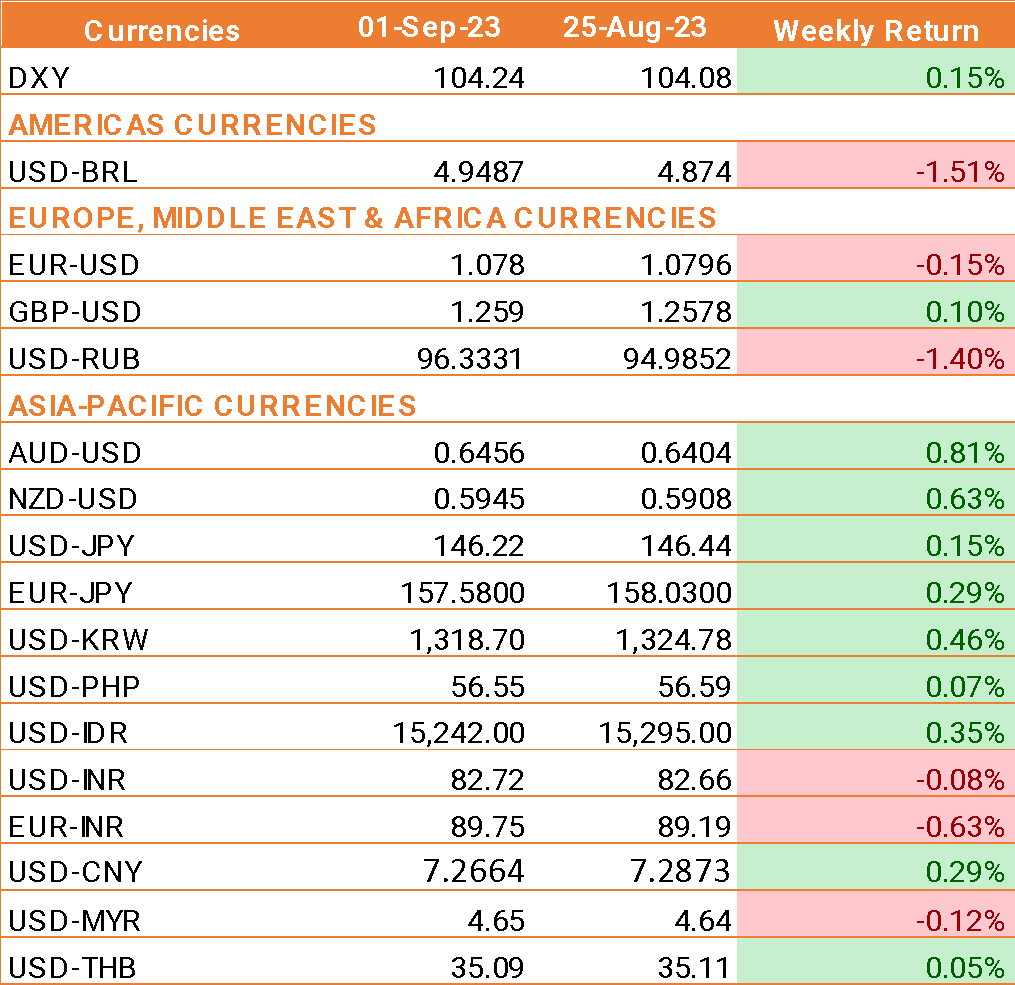

- The USD traded higher across the board after a stronger-than-expected US nonfarm payroll report. The closely watched report showed strong job creation, but wages grew at a slower pace than expectations.

- Data showed that 187,000 U.S. jobs were added to the payrolls in August, up from a downwardly revised 157,000 in July, against the expectations of 170,000.

- Wage growth eased to 0.2% month on month, down from 0.3% and missing the expectation of 0.3%. On an annual basis, wage growth was 4.3%.

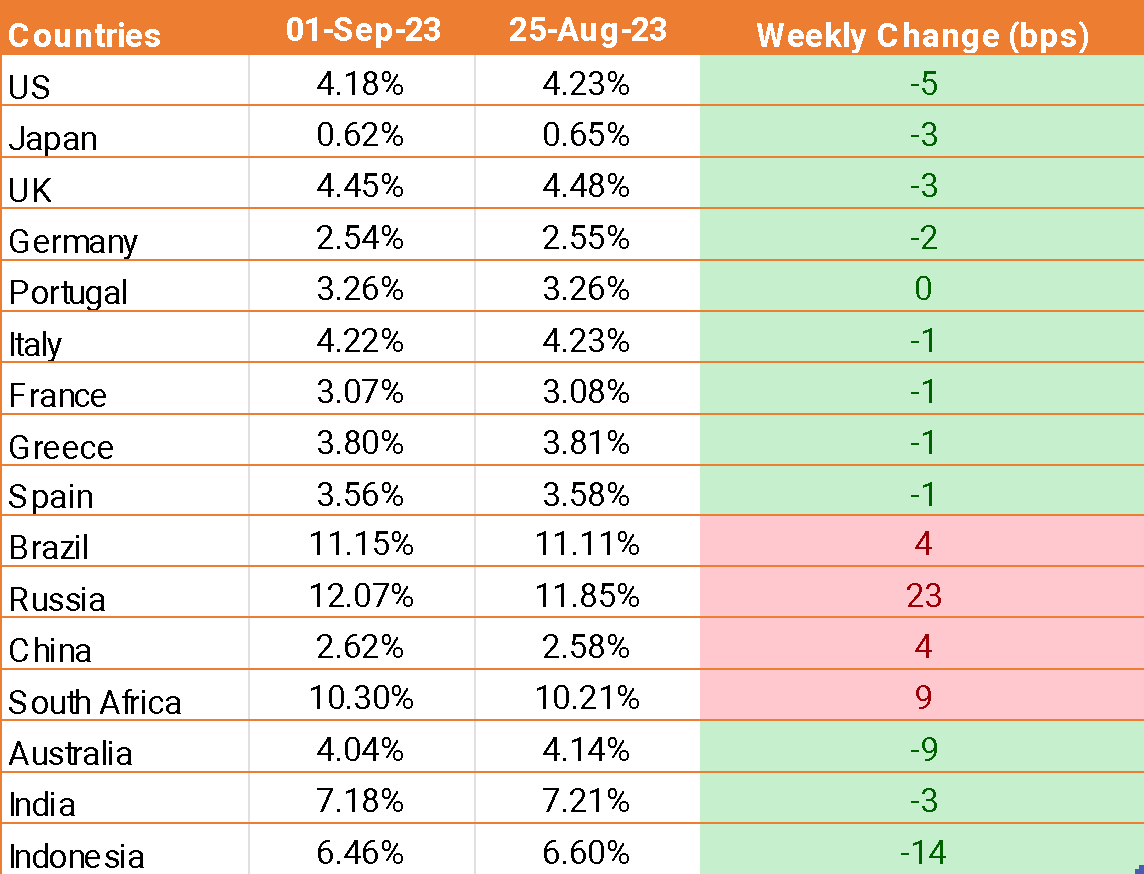

- US core PCE, the Federal Reserve’s preferred measure for inflation, rose to 4.2% YoY in July, up from 4.1% and in line with expectations.

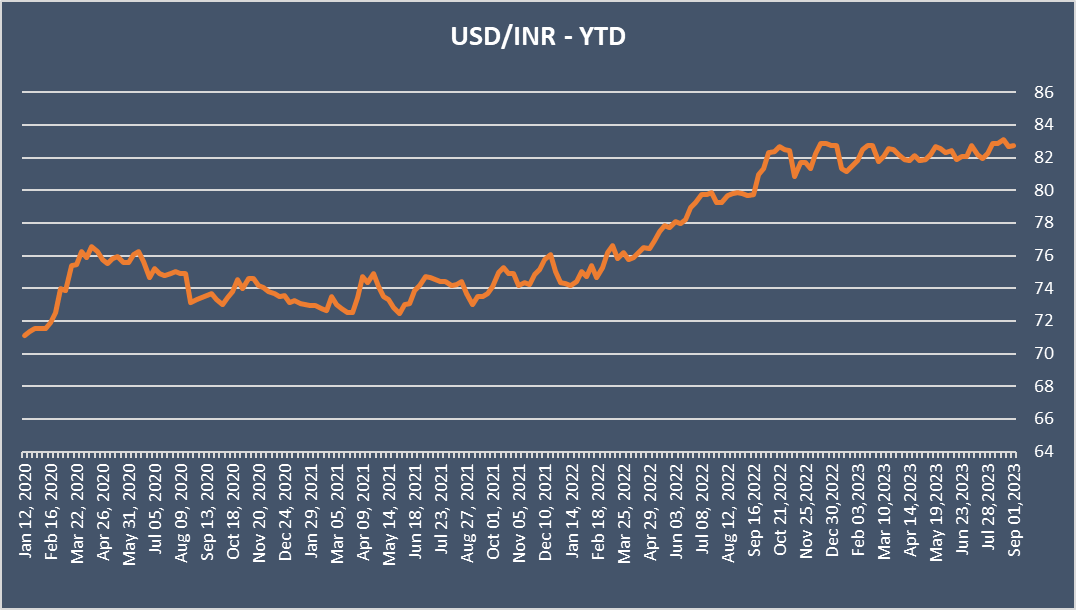

- The INR showed resilience against a stronger USD as Indian factory activity hit a three-month high. According to the latest PMI data, factory activity jumped to 58.6, up from 57.7 in July, marking the highest level since May. The level 50 separates expansion from contraction.

- India’s GDP growth data showed that the Indian economy grew 7.8% in the April to June quarter, its fastest pace of growth in a year. This was up from 6.1% growth in the previous quarter.

- GDP growth data confirms that India is one of the fastest-growing major economies, particularly given the slowdown being seen in China.

- Meanwhile, oil prices were pushed higher for 6 straight days as supply concerns overshadowed demand outlook worries.

We would love to hear back from you. Please Click here to share your valuable feedback