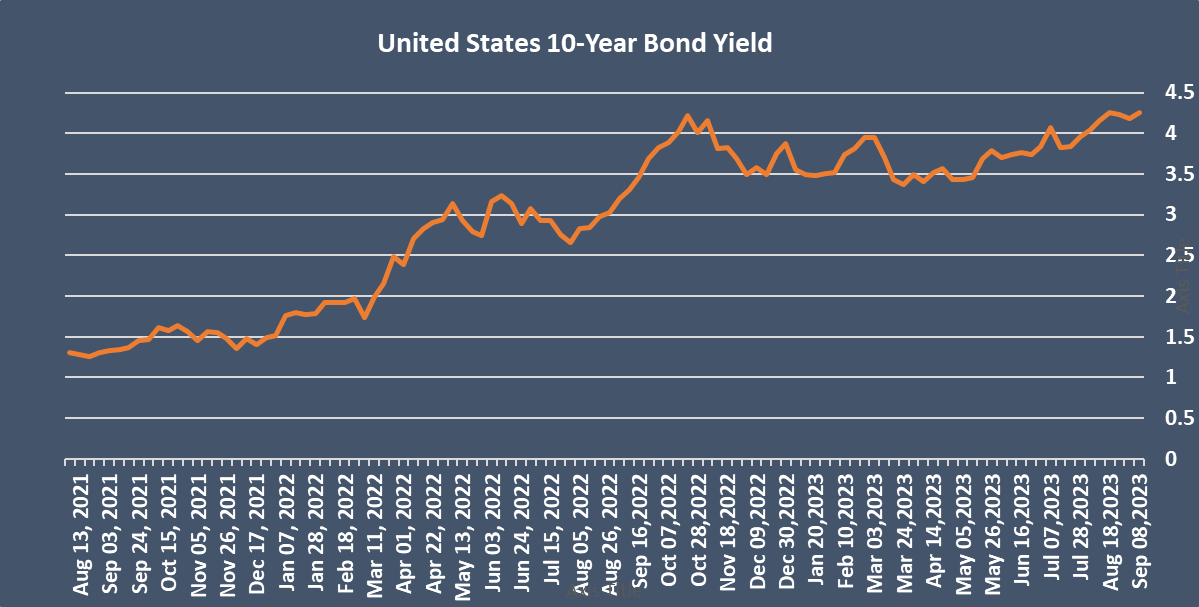

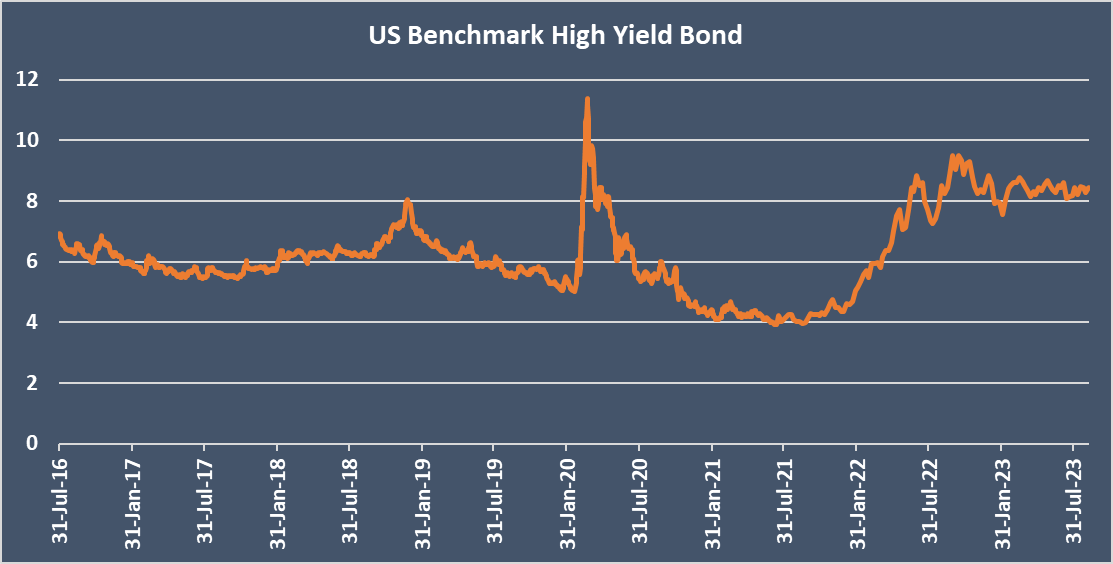

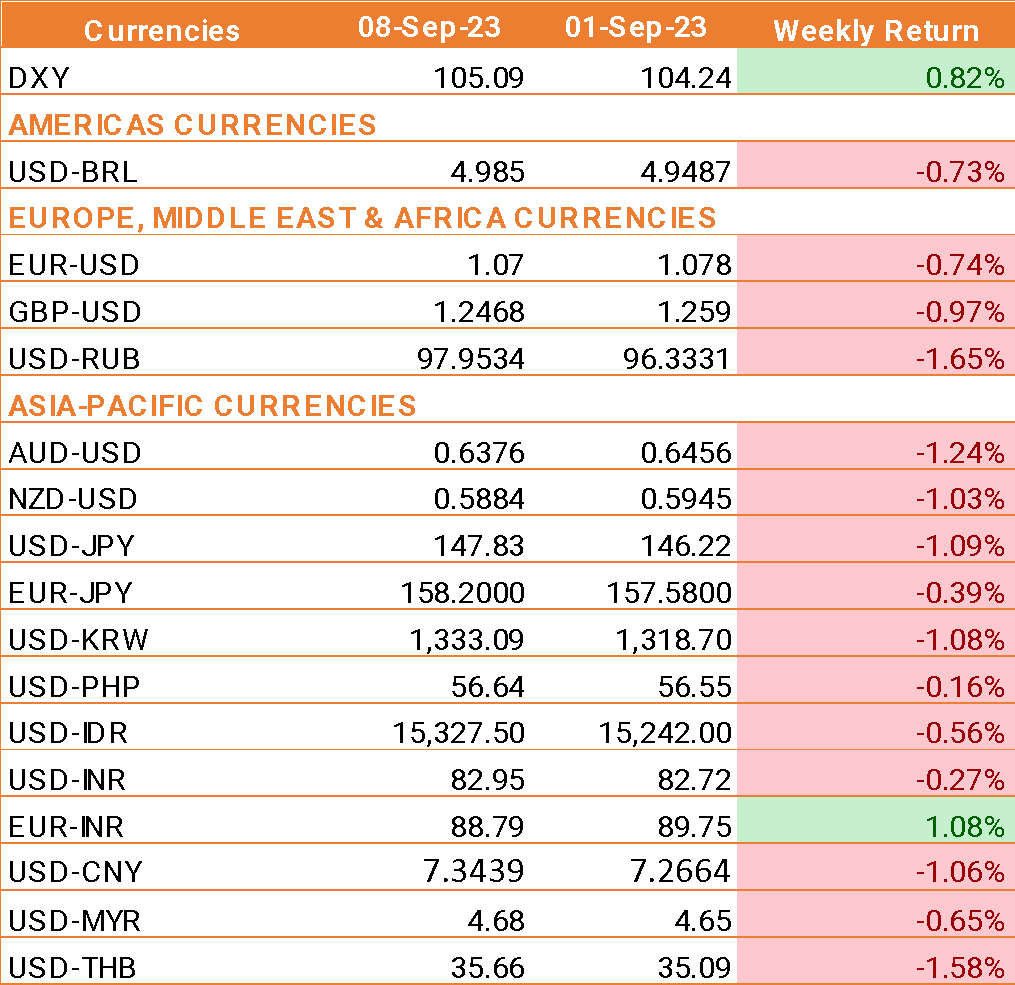

- USD traded higher across the board as data from the US has highlighted the economy's resilience there and boosted expectations that the Federal Reserve may need to raise interest rates again before the end of the year.

- US jobless claims unexpectedly fell to 216,000, down from 229,000 previously and below expectations of a rise to 34,000. Initial claims dropped to the lowest level since February.

- The PMI rose to 54.5, which is in expansionary territory. New orders and input prices paid also pointed to creating inflationary pressures.

- Oil prices have risen to a 10-month high in recent sessions, boosted by Saudi Arabia and Russia extending oil output cuts. The combined total of cuts is 1.3 million barrels a day, which will be extended until December.

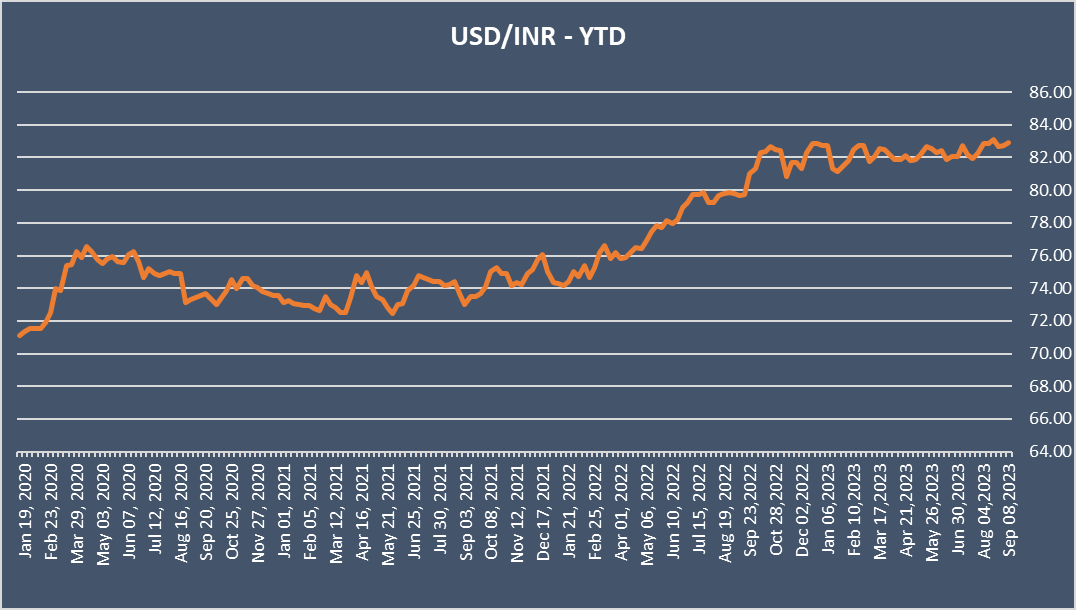

- Higher oil prices are an inflationary concern in the US, potentially sending the USD northwards. Higher oil prices are a drag on the Indian economy, an economy that imports over 80% of its oil needs.

- INR remained under pressure last week amid rising concerns over the health of the Chinese economy, rising oil prices, and broad USD strength.

We would love to hear back from you. Please Click here to share your valuable feedback