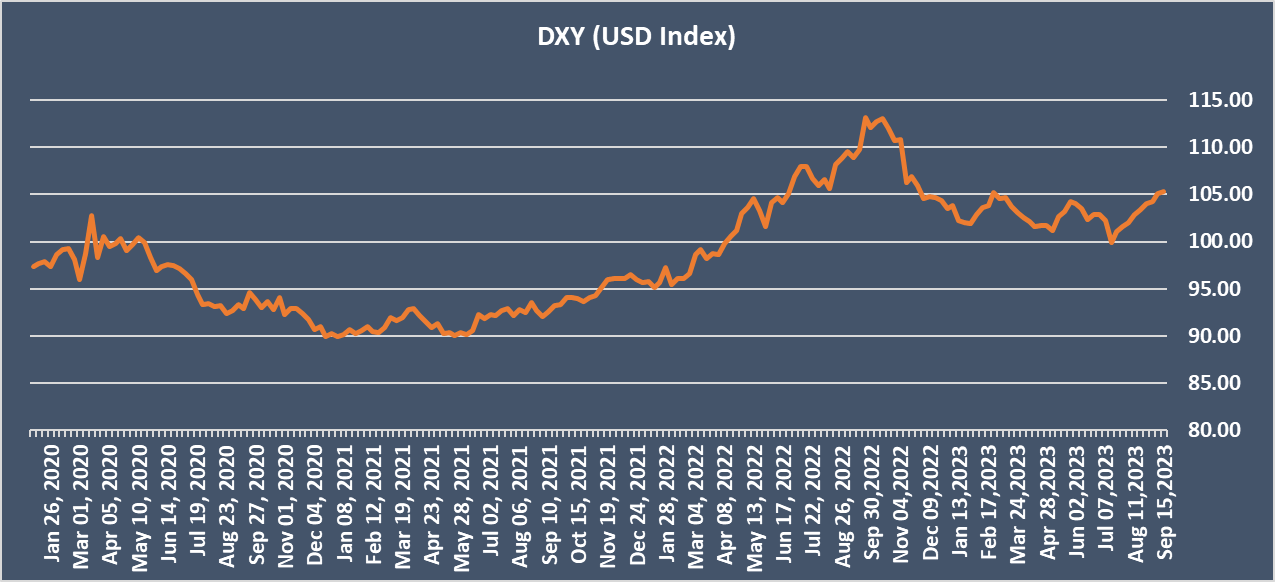

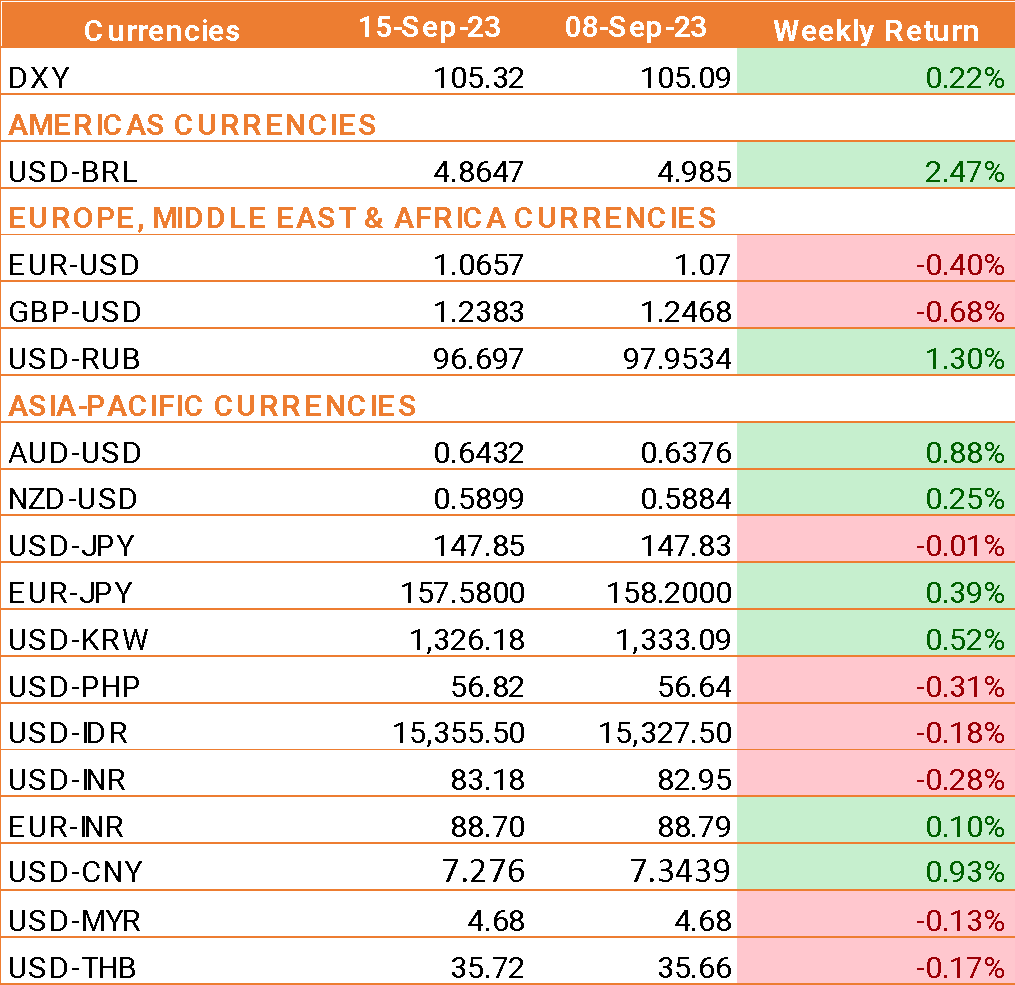

- The USD traded higher following strong U.S. economic data and a rate hike by the European Central Bank (ECB).

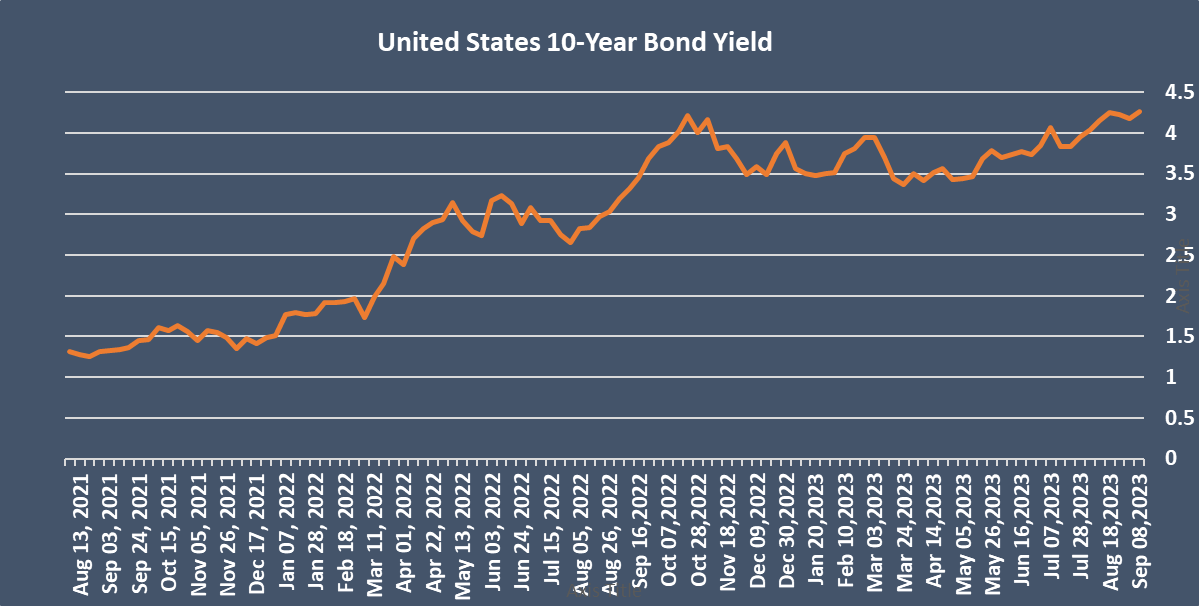

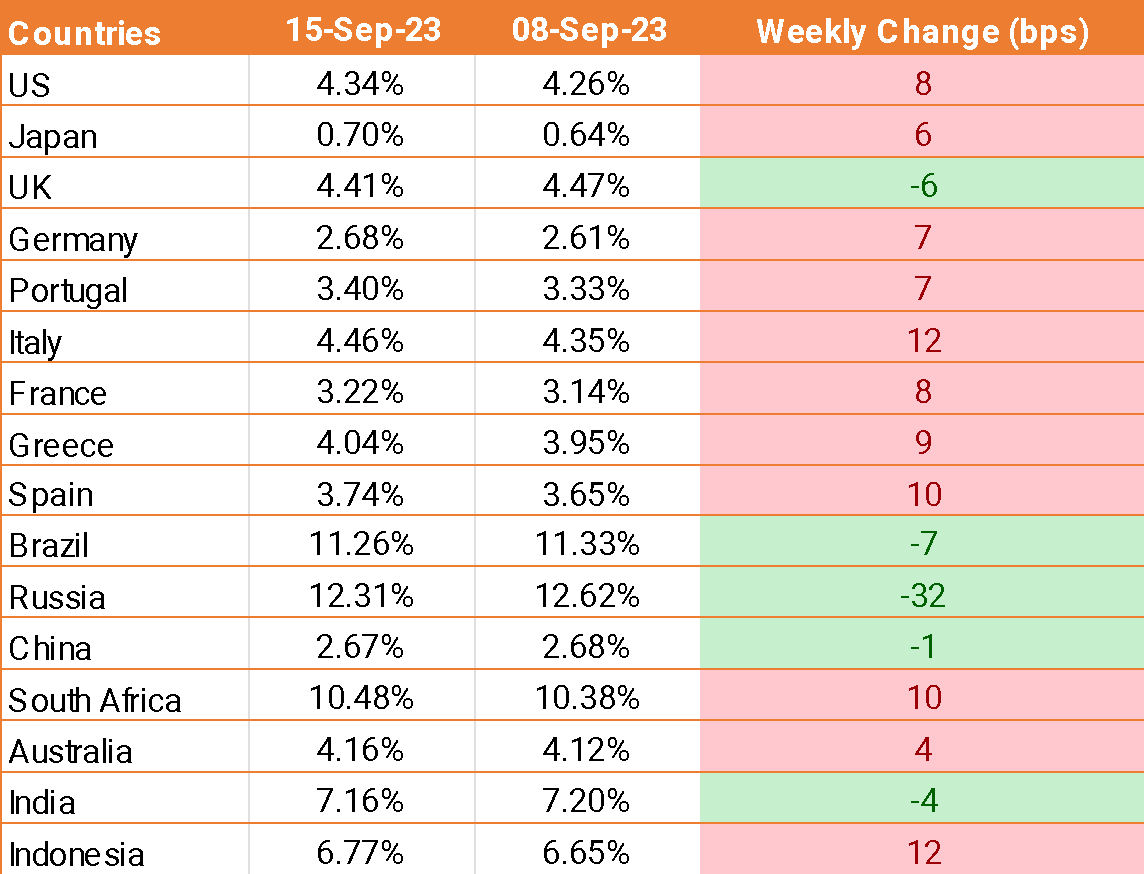

- US retail sales rose by 0.6% month-on-month in August, down slightly from 0.7% in the previous month but well ahead of expectations of 0.2%. Meanwhile, producer prices (PPI), which measure inflation at the factory gate, jumped 0.7%, the largest increase since June 2022.

- US jobless claims also came in ahead of expectations at 220,000, up from 216,000 in the previous week, a 7-month low but below the expectation of 225,000.

- On Thursday, the ECB raised rates to a record high of 4%. However, it signalled that this might be the end of its rate-hiking cycle as economic growth slows down.

- The ECB statement noted that the key interest rates have reached levels which, if sustained for a sufficiently long duration, will contribute significantly to inflation returning to target levels.

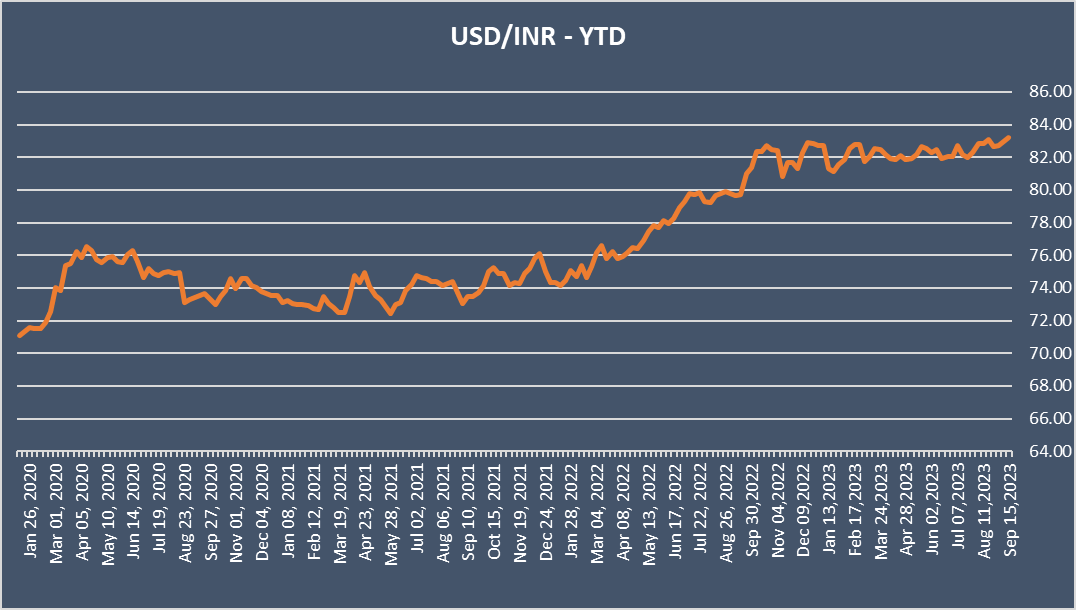

- INR is struggling against the USD despite the upbeat market mood following stronger-than-expected data from China. Data from Asia's largest economy revealed that retail sales rose at the fastest pace since April, and industrial production was also stronger than expected.

- India's CPI inflation was at 6.83%, down from 7.44% in July, which marked a 15-month high, against the expectation for the inflation to cool to 7%.

We would love to hear back from you. Please Click here to share your valuable feedback