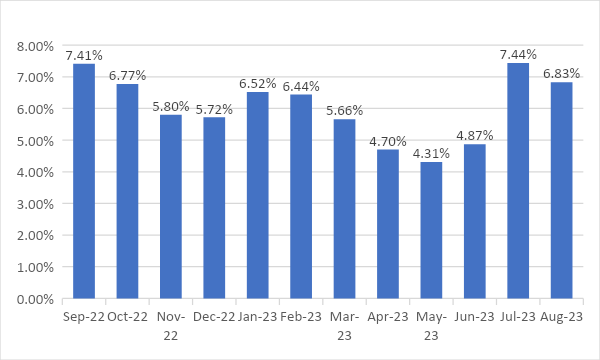

During August, domestic consumer declined as compared to the previous month. During last month, consumer inflation stood at 6.83% as compared to 7.44% in the previous month. The fall in inflation was driven by softening of vegetable prices. This can be seen from the fact that food inflation eased to 9.94% in August from 11.51% in July.

The fall in inflation has caused the g-sec yield to correct. On a weekly basis, 10-year g-sec yield has come down by 1 to 2 basis points. Going ahead, consumer inflation is likely to follow a downtrend.

US inflation rose to 3.7% in August as compared to 3.2% in July. Market eyes the outcomes of the FOMC meeting to be held this week.

India’s industrial output expanded by 5.7% in July 23 from 3.7% in June 23.

Liquidity-Owing to advanced tax outflow, system liquidity has come down significantly. As of 14th Sep, it stood at Rs 27 billion.

Government bonds, SDL and OIS yield movements

During the past week, there were several notable changes in bond yields:

The yield for the 7.18% 2033 bond decreased by 2 basis points to reach 7.16%. Similarly, the 10-year benchmark 7.26% 2033 bond saw a 1 basis point decline, reaching 7.20%. The 7.06% 2028 bond's yield decreased by 4 basis points, also reaching 7.17%. In contrast, the long-term paper, represented by the 7.25% 2063 bond, its yield rose by 3 bps to 7.36%.

The spread between the 10-year and 5-year bonds rose to 3 bps from 0 basis point difference in the previous week. The spread between the 15-year benchmark and the 10-year benchmark rose to 8 basis points from the previous 7 basis points. Additionally, the spread between the 30-year benchmark and the 10-year benchmark increased to 16 basis points from the prior 14 basis points over the week.

In terms of the 10-year SDL auction, the cutoff yield stood flat at 7.47%, while the spread declined to 4 basis points from 27 basis points.

Lastly, in the Overnight Indexed Swap (OIS) rates, the 1-year OIS yield rose by 8 basis points, reaching 7.05%, while the 5-year OIS yield increased by 14 basis points to 6.73%.

We would love to hear back from you. Please Click here to share your valuable feedback,