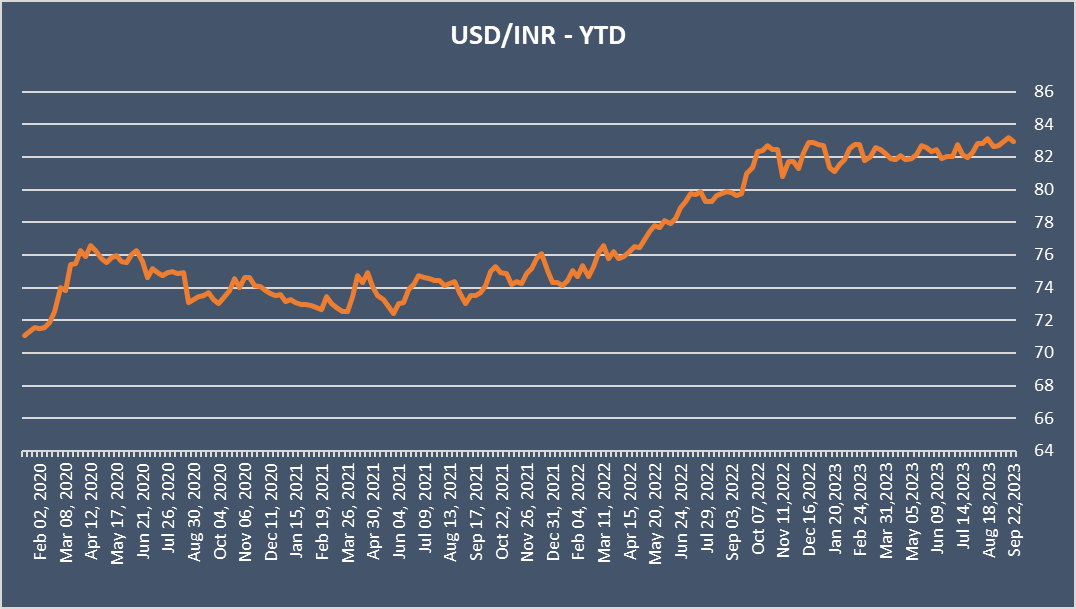

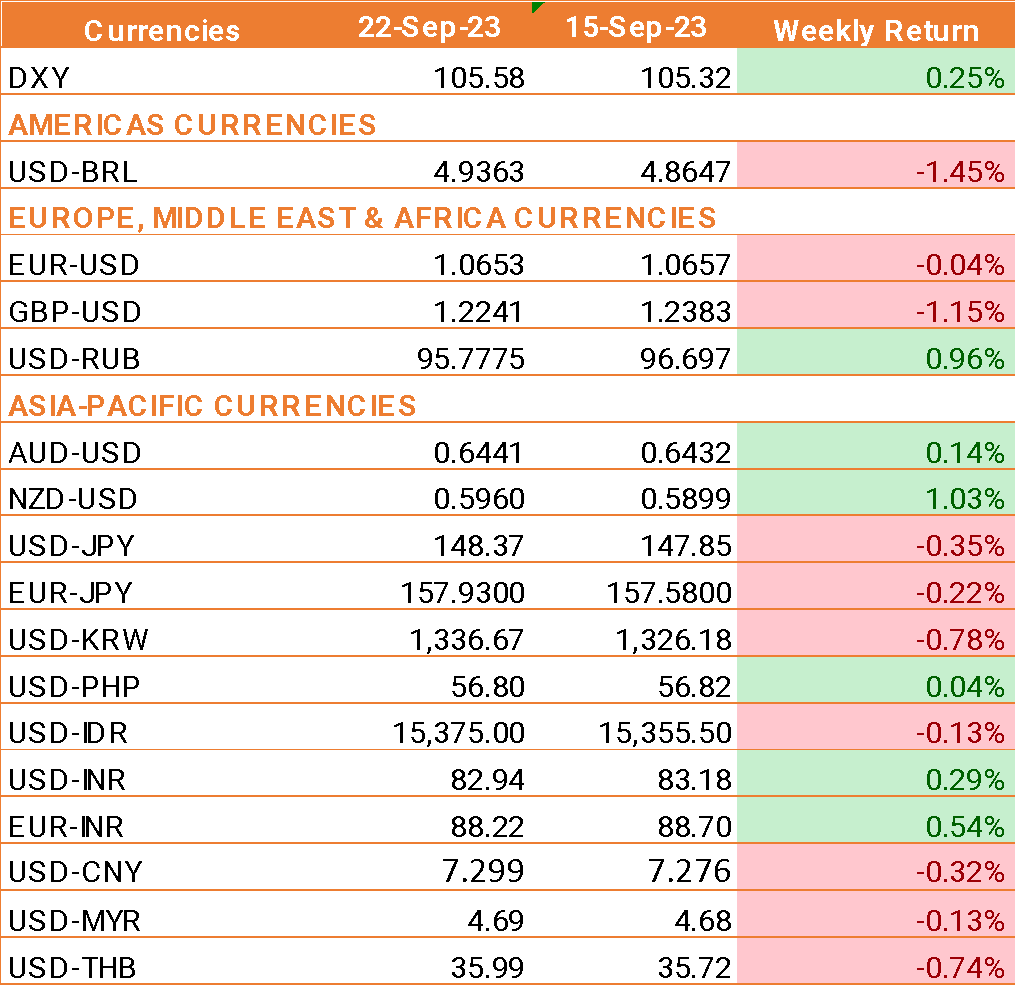

- INR Strengthened: Despite the USD showing strength in the broader market, the Indian Rupee (INR) strengthened. This was attributed to JPMorgan's decision to include India's government bonds in the emerging market index, which likely attracted foreign investment.

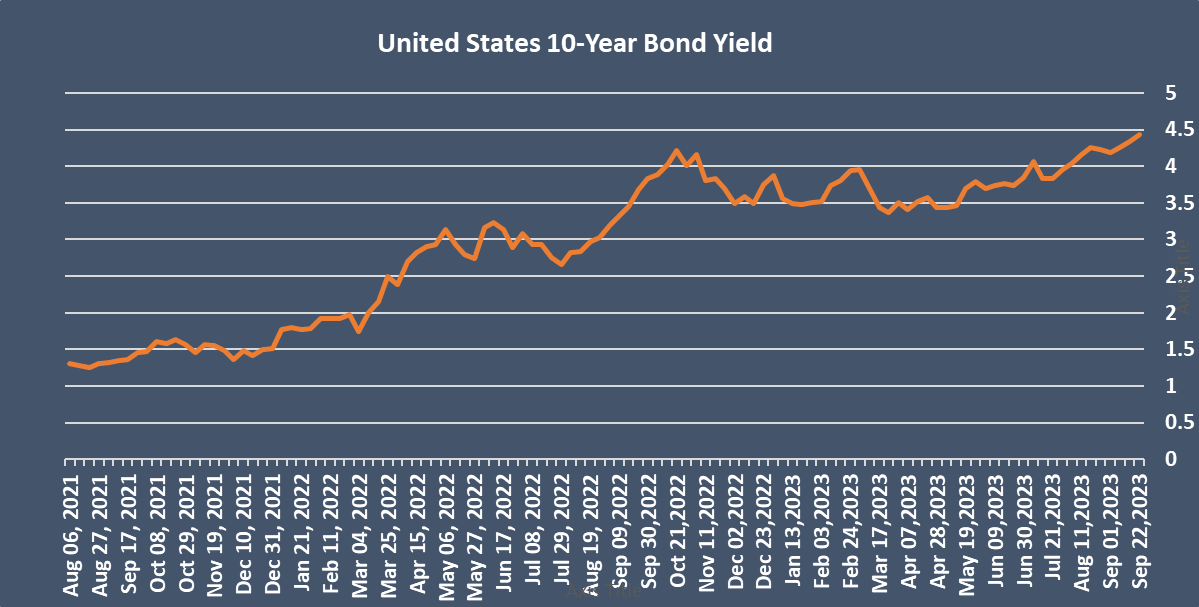

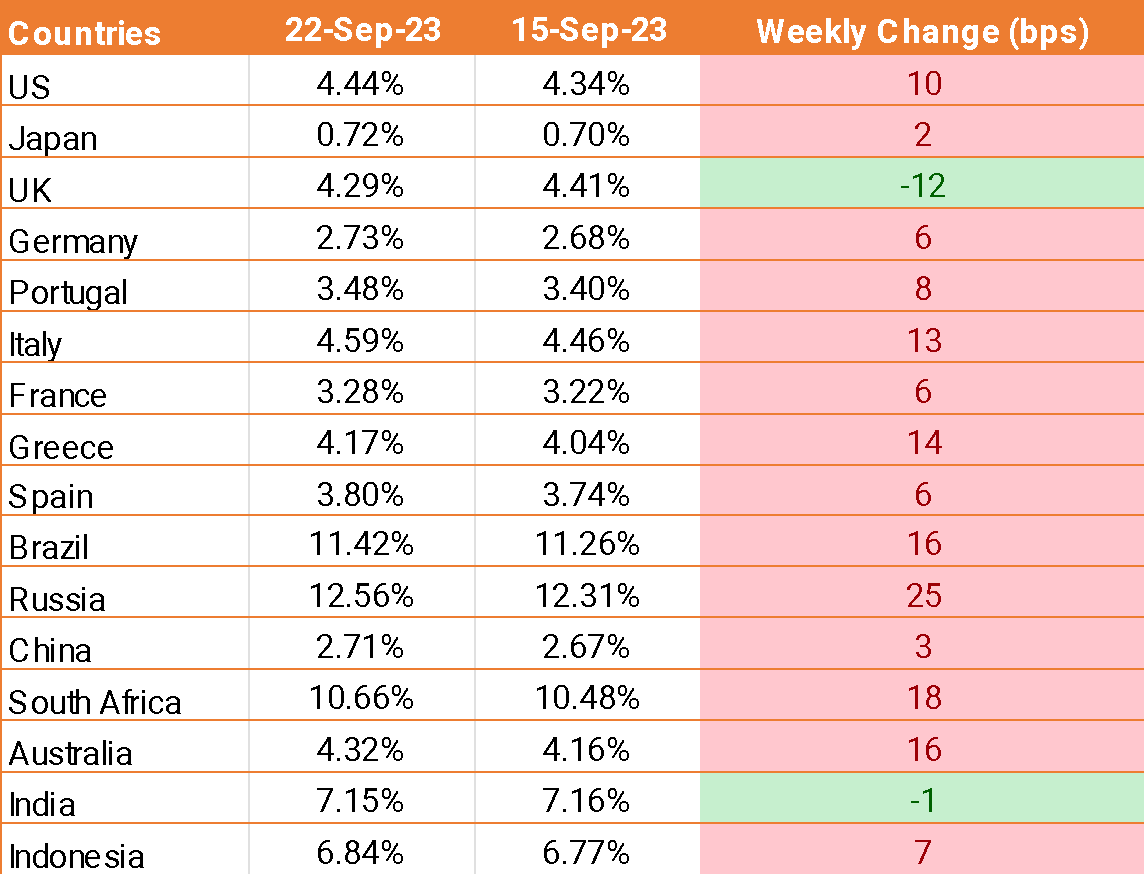

- USD Strength: The USD traded higher during the week due to signals from the U.S. Federal Reserve about continuing its restrictive monetary policy. Even though the Fed kept interest rates unchanged, it maintained a hawkish stance aimed at controlling inflation without causing significant economic harm.

- Fed's Monetary Policy: The Federal Reserve's decision to keep interest rates within a specific range (5.25%-5.50%) was in line with market expectations. The Fed's officials believe this policy can help manage inflation while avoiding major job losses.

- Strong U.S. Jobless Claims Data: Strong U.S. jobless claims data contributed to the bullish case for the USD. Jobless claims unexpectedly fell to an 8-month low of 201,000, indicating the continued strength of the U.S. labor market despite the Fed's tight monetary policy.

- Potential Inflows into Indian Bonds: The inclusion of Indian bonds in global bond indexes, like JPMorgan's emerging market index, is expected to attract passive inflows. Market believes that this could potentially lead to as much as USD 50 billion in investments in Indian bonds over the coming year if other global bond indexes follow suit.

- Rising Oil Prices: Oil prices have seen a significant increase in recent months, rising from USD 72 per barrel in June to over USD 90 per barrel at present. This trend has global implications, including potential impacts on the Indian economy.

- Indian Government's Concern: The Indian government has expressed concern about rising oil prices affecting the Indian economy. However, it also mentioned that the outlook remains positive due to a decrease in the prices of some key food items.

We would love to hear back from you. Please Click here to share your valuable feedback