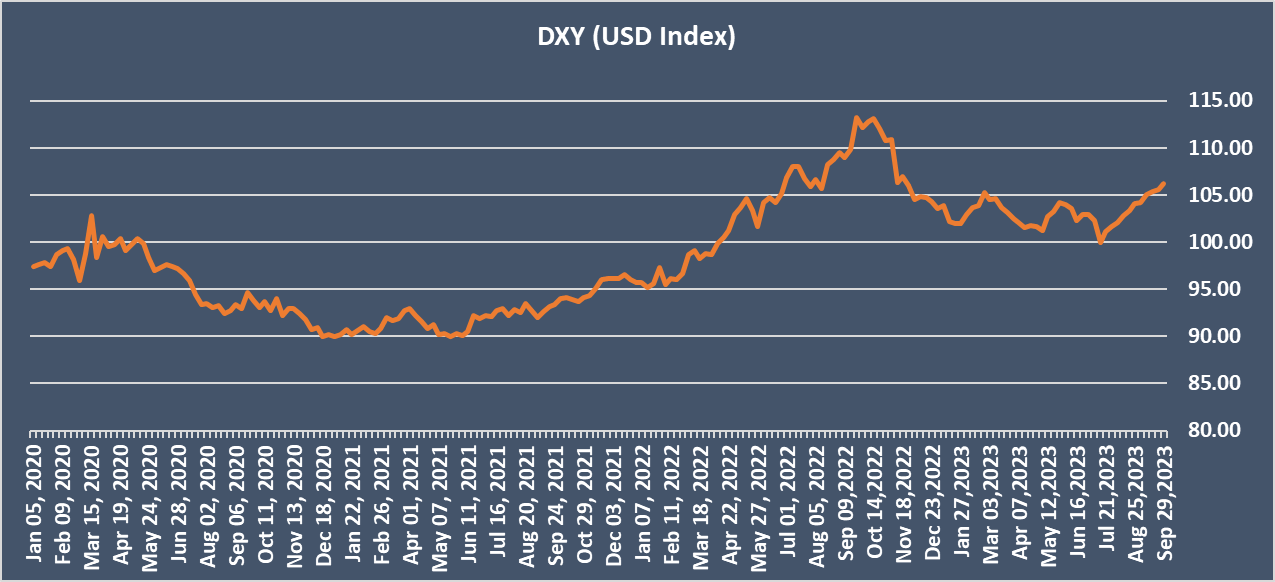

USD Strength and Factors:

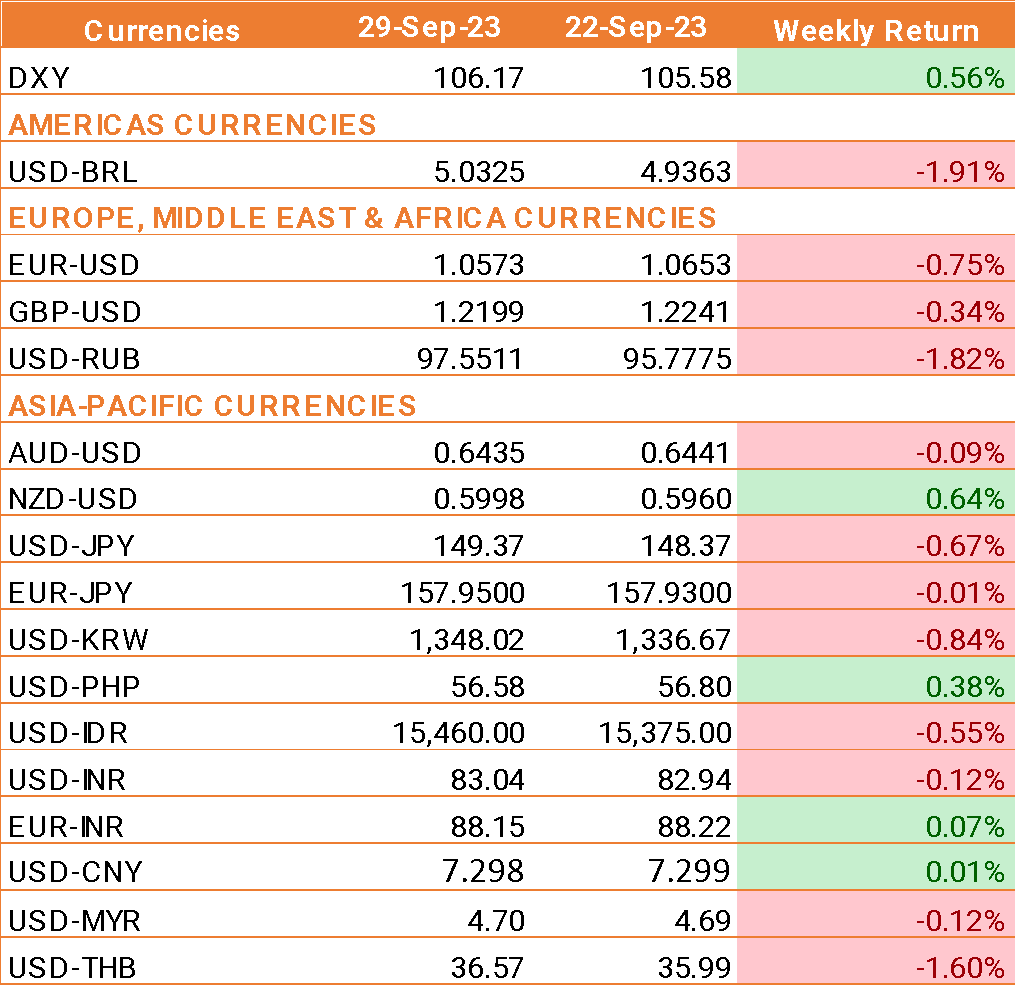

- The U.S. dollar (USD) gained strength against major world currencies.

- This was primarily attributed to positive U.S. economic data and optimistic comments from Federal Reserve officials.

Inflation Data:

- The August Personal Consumption Expenditures Price Index, the Federal Reserve's preferred inflation indicator, outperformed expectations.

- It showed an annual increase of 3.5% and a monthly increase of 0.4%.

- The Core PCE, which excludes fuel and food prices, stood at 3.9% annually and 0.1% monthly.

Oil Price Movement:

- Oil prices rose by 2% during the week.

- This increase was driven by supply constraints in the U.S. and optimism regarding higher demand in China during its Golden Week holiday.

Jobless Claims Data:

- U.S. jobless claims exceeded expectations, rising to 204,000 from the previous week's 202,000.

- This figure was below the expected 215,000, indicating ongoing strength in the U.S. job market ahead of the upcoming nonfarm payroll report.

U.S. GDP Growth:

- U.S. GDP data for the second quarter confirmed annualized growth of 2.1%.

- This result aligned with expectations and represented a slight increase from the 2% growth in the previous quarter.

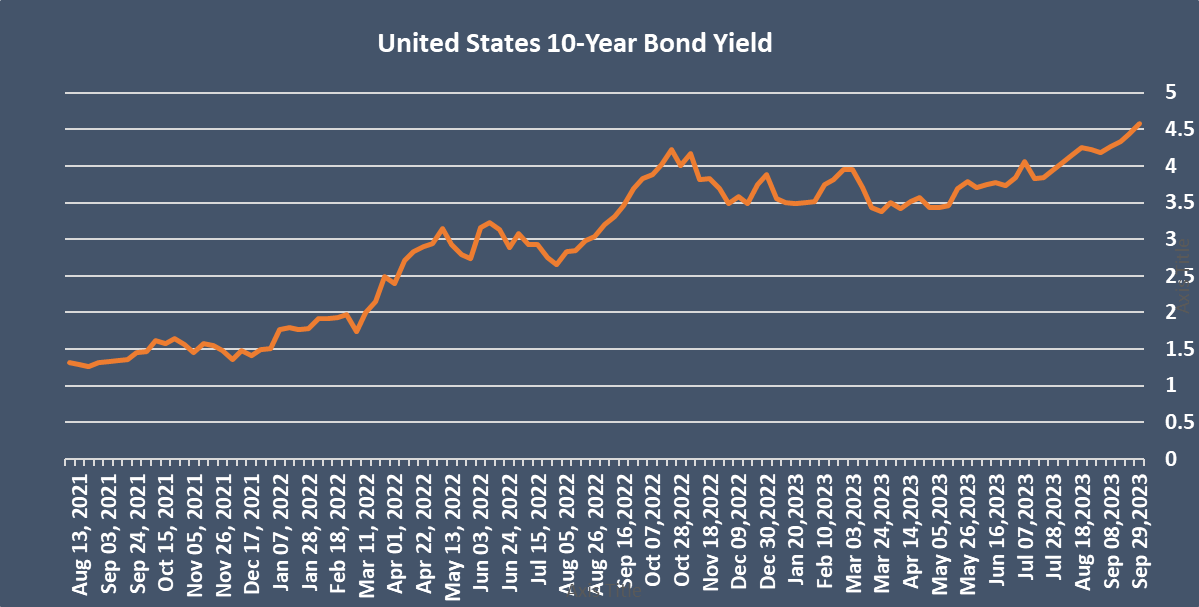

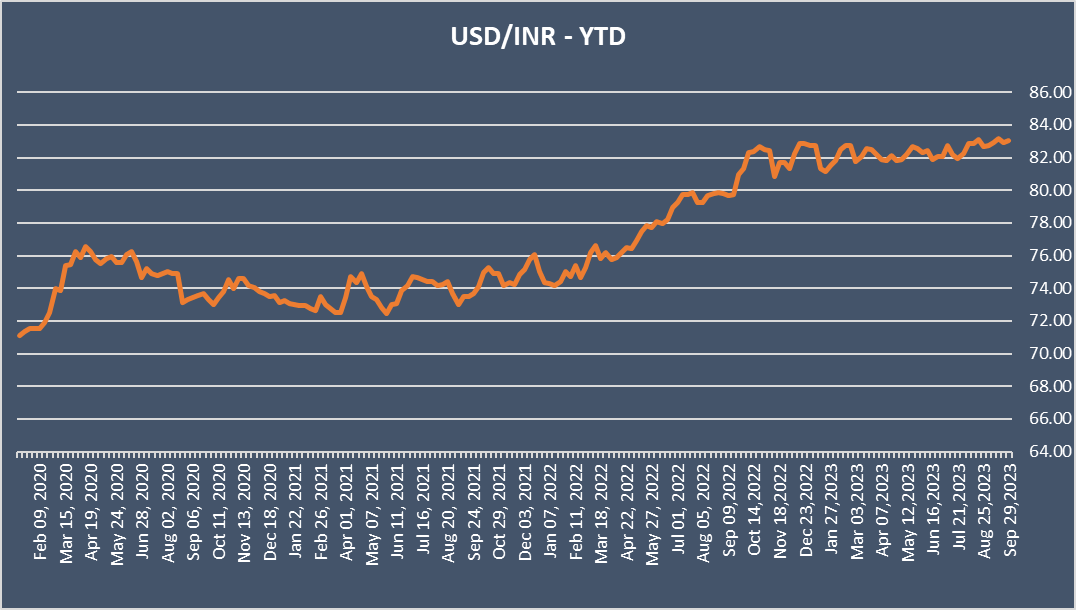

INR Performance:

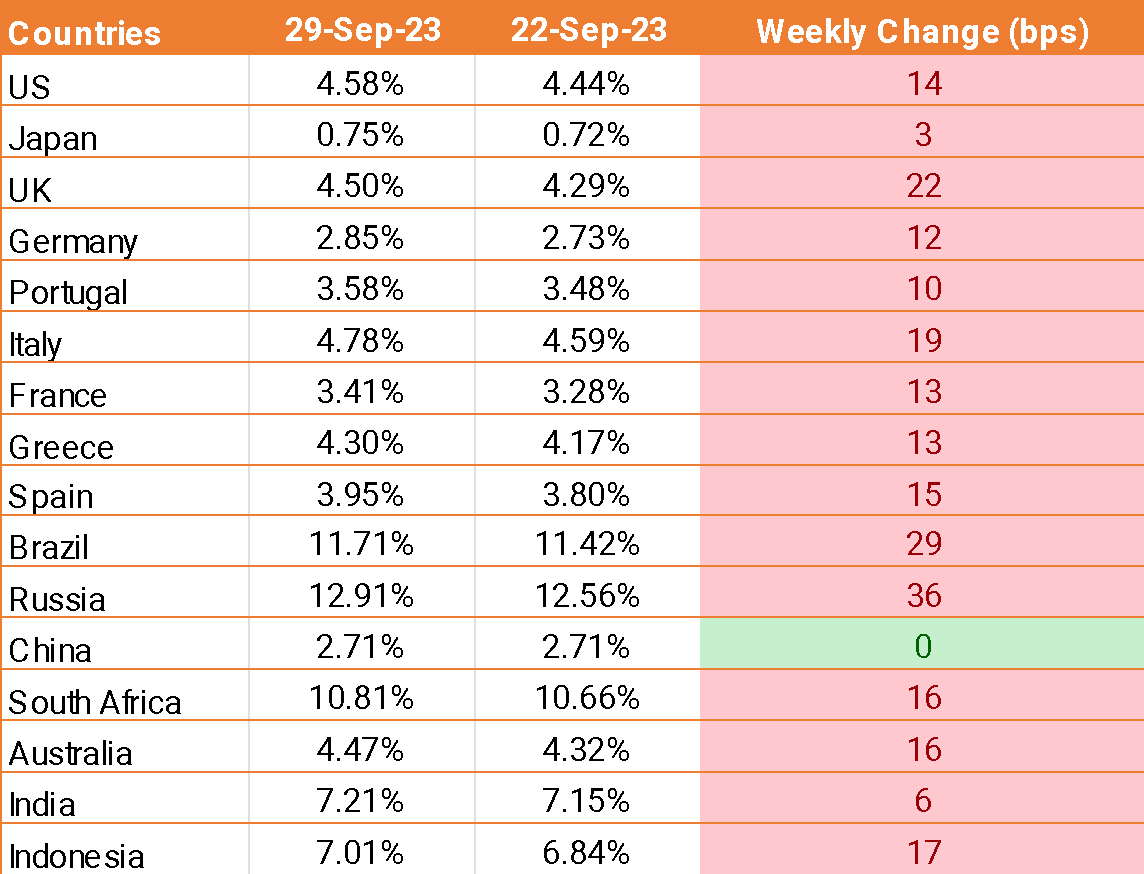

- The INR ended the week on a stronger note.

- This was attributed to easing U.S. Treasury yields and a decline in U.S. crude oil prices from their yearly highs on Friday.

We would love to hear back from you. Please Click here to share your valuable feedback