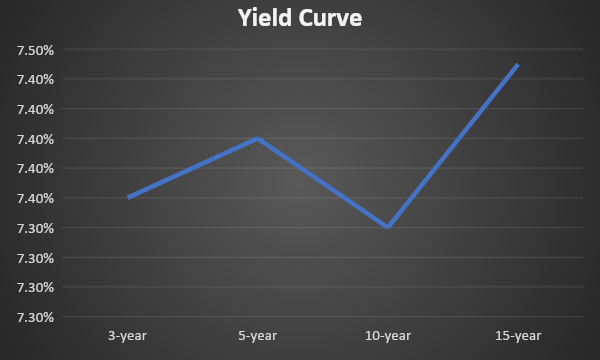

During the last Monetary Policy meeting, RBI Governor has said that OMO sales of g-sec will be considered based on evolving liquidity condition. Consequently g-sec yield soared that made the yield curve inverted. As systemic liquidity is in the deficit zone, (Rs -341 billion as of 5th Oct), OMO sale is expected to cause the liquidity deficit to fall further. Therefore, the yield curve is likely to remain flat to inverted in the coming days. RBI MPC has signalled that it will try to align the inflation target to 4% in the coming days.

As of 6th Oct, 3-, 5-, 10-year bond yield stood at 7.36%, 7.40% and 7.34% respectively.

Bank Credit and Deposit growth rate-As of 22nd Sep, deposit and credit growth rate stood at 13.2% and 20% respectively.

Government bonds, SDL and OIS yield movements

During the past week, there were several notable changes in bond yields:

The yield for the 10-year benchmark 7.18% 2033 bond yield rose by 12 bps to 7.34%. Similarly, the 7.26% 2033 bond yield increased by 14 bps to 7.39%. The 7.06% 2028 bond's yield rose by 17 basis points, reaching 7.40%. In the same line, the long-term paper, represented by the 7.25% 2063 bond, its yield rose by 12 bps to 7.54%.

The spread between the 10-year and 5-year bonds declined to -6 basis point from 2 basis point difference in the previous week. The spread between the 15-year benchmark and the 10-year benchmark rose to 11 bps from 8 basis points. Additionally, the spread between the 30-year benchmark and the 10-year benchmark increased to 21 basis points from the prior 16 basis points over the week.

In terms of the 10-year SDL auction, the average cutoff yield rose to 7.54% as compared to 7.47%, while the spread declined to 32 basis points from 33 basis points.

Lastly, in the Overnight Indexed Swap (OIS) rates, the 1-year OIS yield declined to 7.06% from 7.08%, while the 5-year OIS yield rose by 13 bps to 6.86%.

We would love to hear back from you. Please Click here to share your valuable feedback,