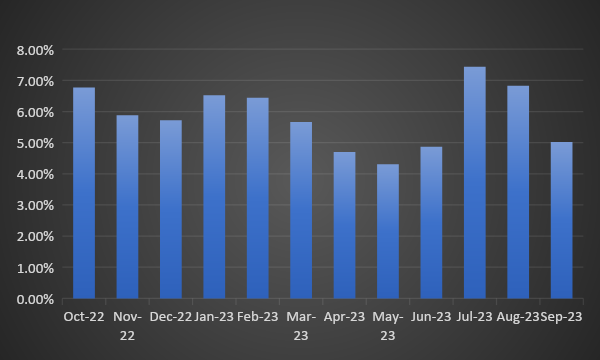

Domestic consumer inflation eased to 5.02% y-o-y in Sep from 6.83% in August. Core inflation stood at 4.5% during the month.

In the wake of falling inflation, RBI’s stance on monetary policy is very crucial in the next MPC meeting. However, a repo rate cut is unlikely in the next policy meeting. The recent geopolitical crisis in the middle east may impact crude prices which is very important in the future path of inflation.

IIP-India’s industrial production grew by 10.3% on yearly basis in August as compared to 6% in previous month.

Liquidity-System liquidity stood at a deficit of Rs 289 billion as of 12th October.

US inflation-US consumer price inflation rose by 3.7% in Sept 23 on a yearly basis.

Government bonds, SDL and OIS yield movements

During the past week, there were several notable changes in bond yields:

The yield for the 10-year benchmark 7.18% 2033 bond yield lost by 3 bps to 7.31%. Similarly, the 7.26% 2033 bond yield decreased by 3 bps to 7.36%. The 7.06% 2028 bond's yield declined by 7 basis points, reaching 7.33%. In the same line, the long-term paper, represented by the 7.25% 2063 bond, declined by 4 bps to 7.50%.

The spread between the 10-year and 5-year bonds rose to 2 basis point from -6 basis point difference in the previous week. The spread between the 15-year benchmark and the 10-year benchmark rose to 12 bps from 11 basis points. Additionally, the spread between the 30-year benchmark and the 10-year benchmark decreased to 19 basis points from the prior 21 basis points over the week.

In terms of the 10-year SDL auction, the average cutoff yield rose to 7.71% as compared to 7.54%, while the rose declined to 40 basis points from 32 basis points.

Lastly, in the Overnight Indexed Swap (OIS) rates, the 1-year OIS yield declined to 6.94% from 7.06%, while the 5-year OIS yield declined by 19 bps to 6.67%.

We would love to hear back from you. Please Click here to share your valuable feedback,