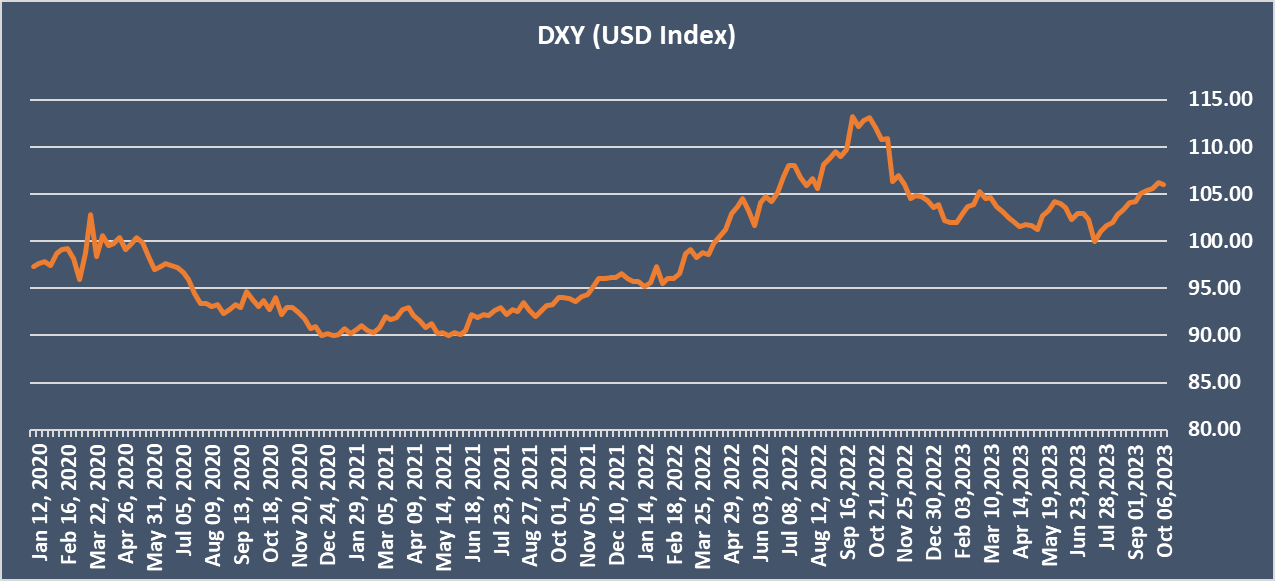

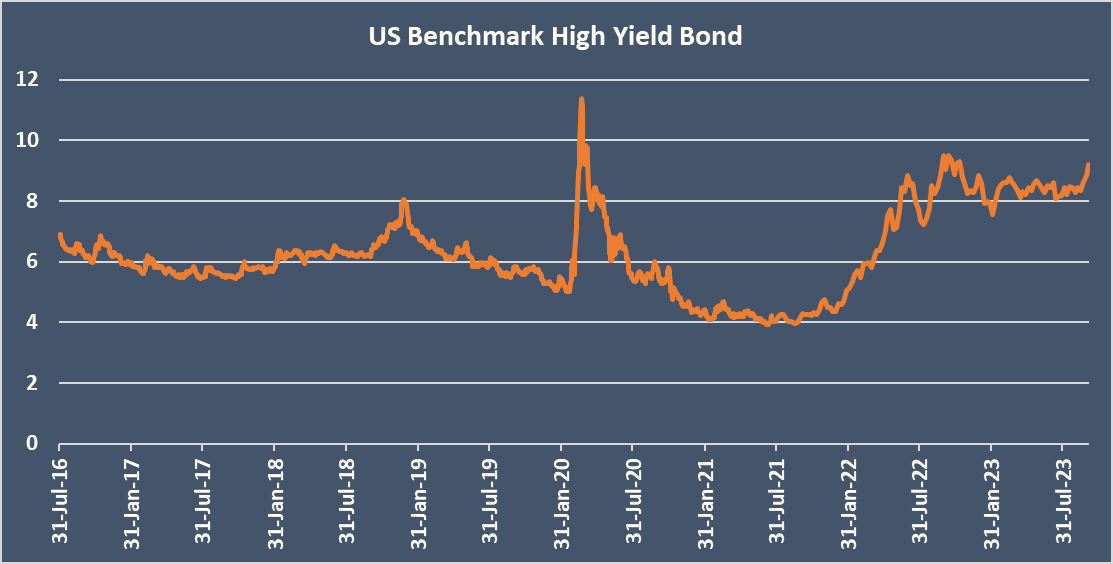

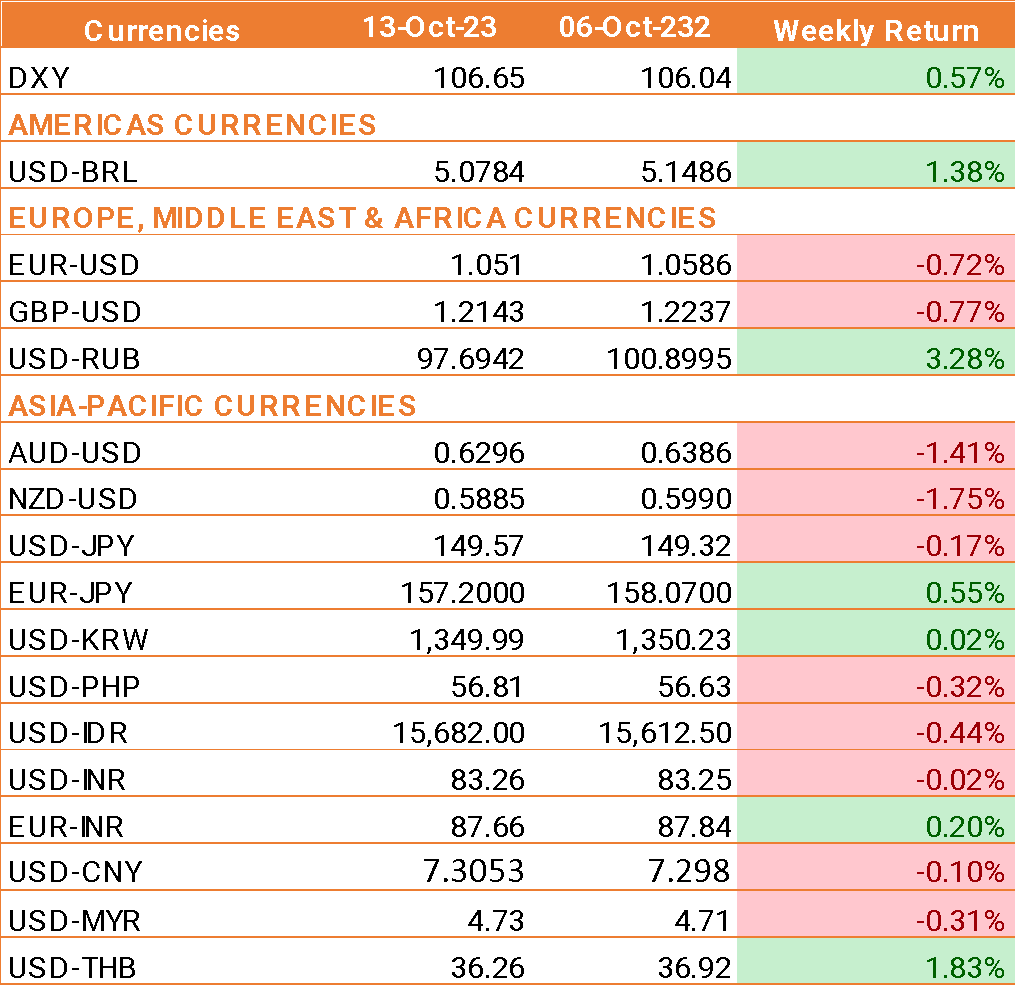

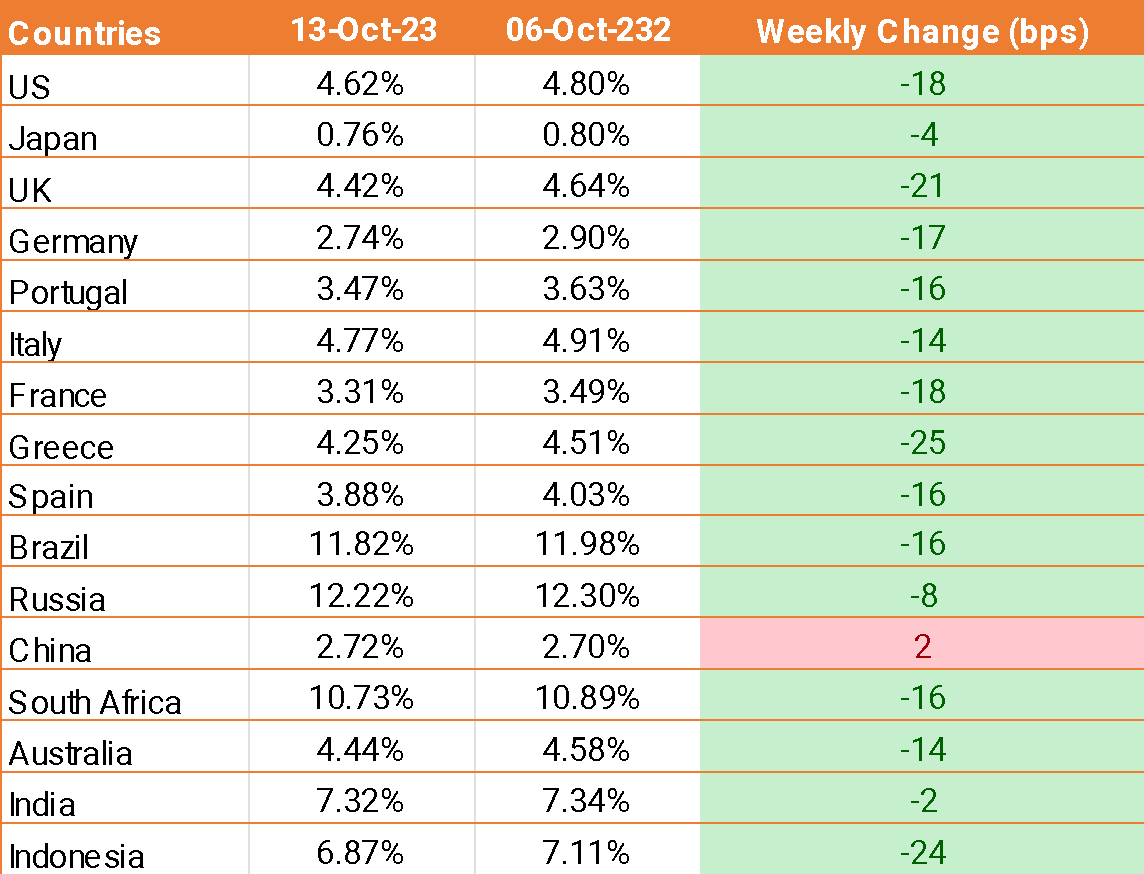

The USD ended the week higher, buoyed by rising yields and persistent investor concerns over inflation. The latest US inflation data did little to alleviate these fears and is not expected to influence the Federal Reserve's 'higher for longer' policy.

- U.S. Consumer Price Index (CPI) was at 0.4% month-on-month in September, ahead of the 0.3% expectations, boosted by energy costs. Meanwhile, on an annual basis, US inflation unexpectedly held steady at 3.7%, defying expectations of a fall to 3.6%.

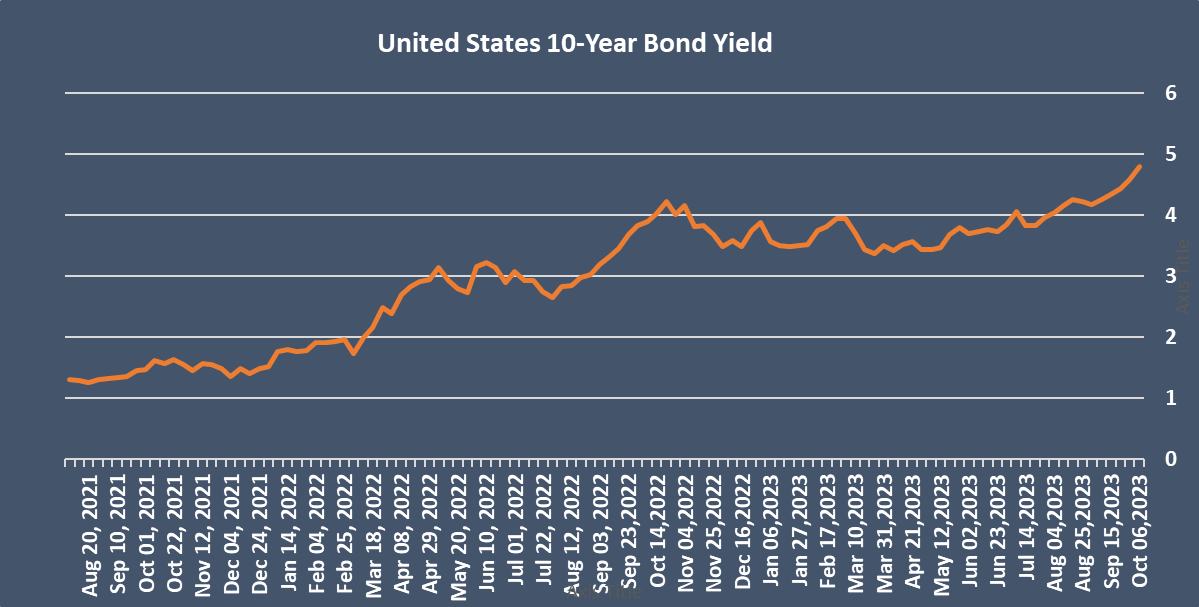

- Fed officials, including Vice Chair Philip Jefferson, said that the central bank will need to proceed carefully with any further increases in interest rates, nodding to the rise in U.S. Treasury yields, which tighten financial conditions.

- The International Monetary Fund raised its growth projections for the US by 0.3% compared to its July update of 2.1%.

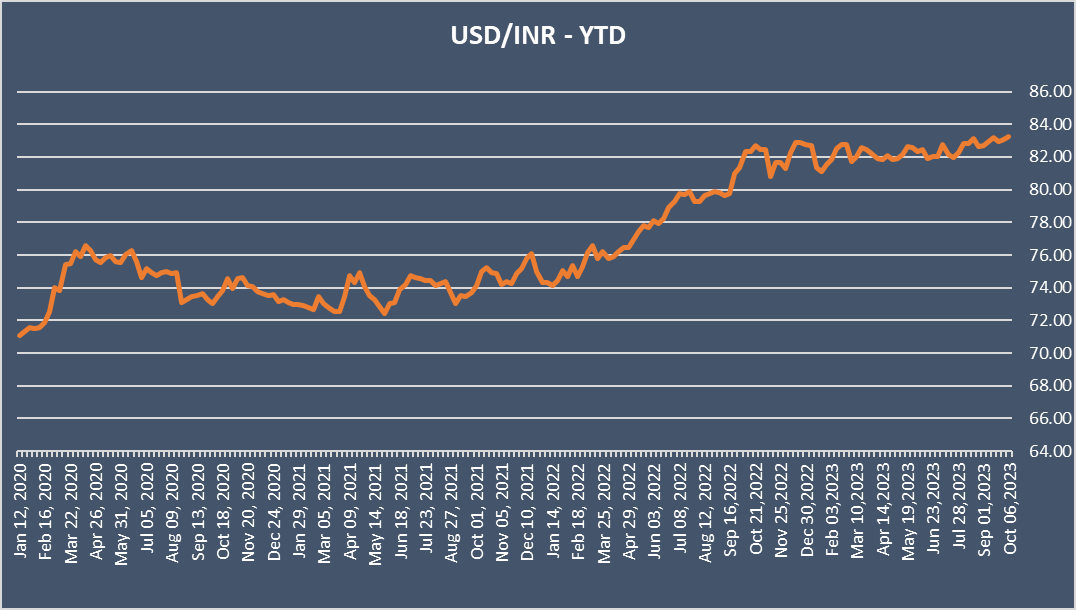

- INR ended the week lower but remains supported by RBI intervention, which involves selling USD to keep the INR off a record low.

- The Indian trade deficit came in at USD 19.37 billion in September, slightly below the trade deficit expectations of USD 23.25 billion.

- India’s CPI inflation was 5.02% in September, down from 6.83% in the previous month. This was below expectations of 5.5%. However, it remained above the 4% target.

We would love to hear back from you. Please Click here to share your valuable feedback