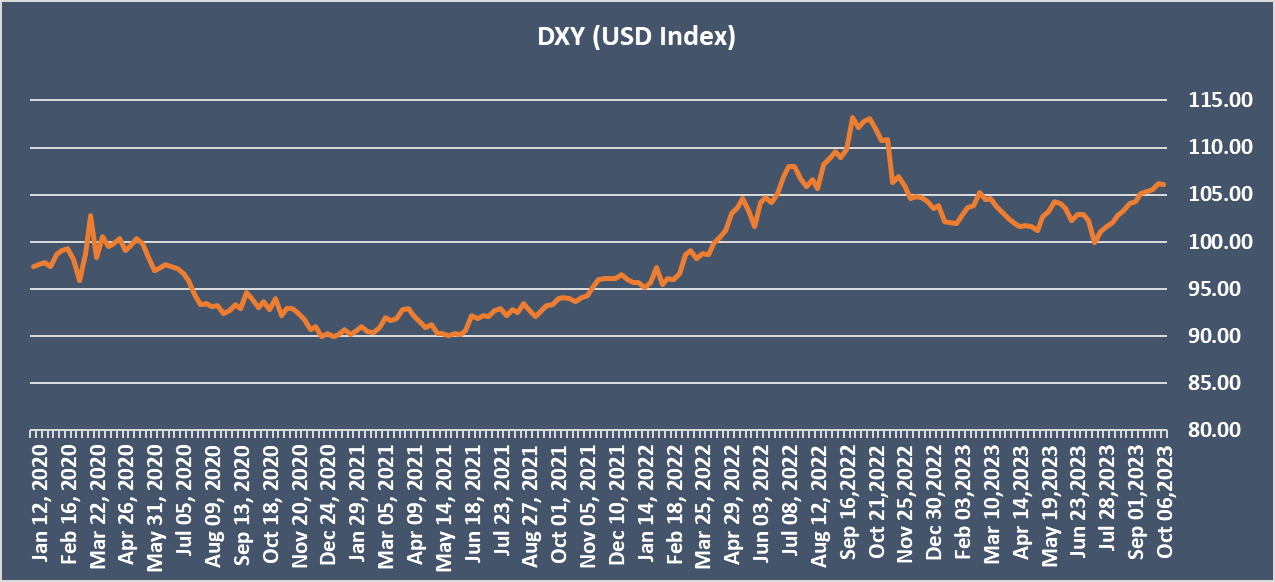

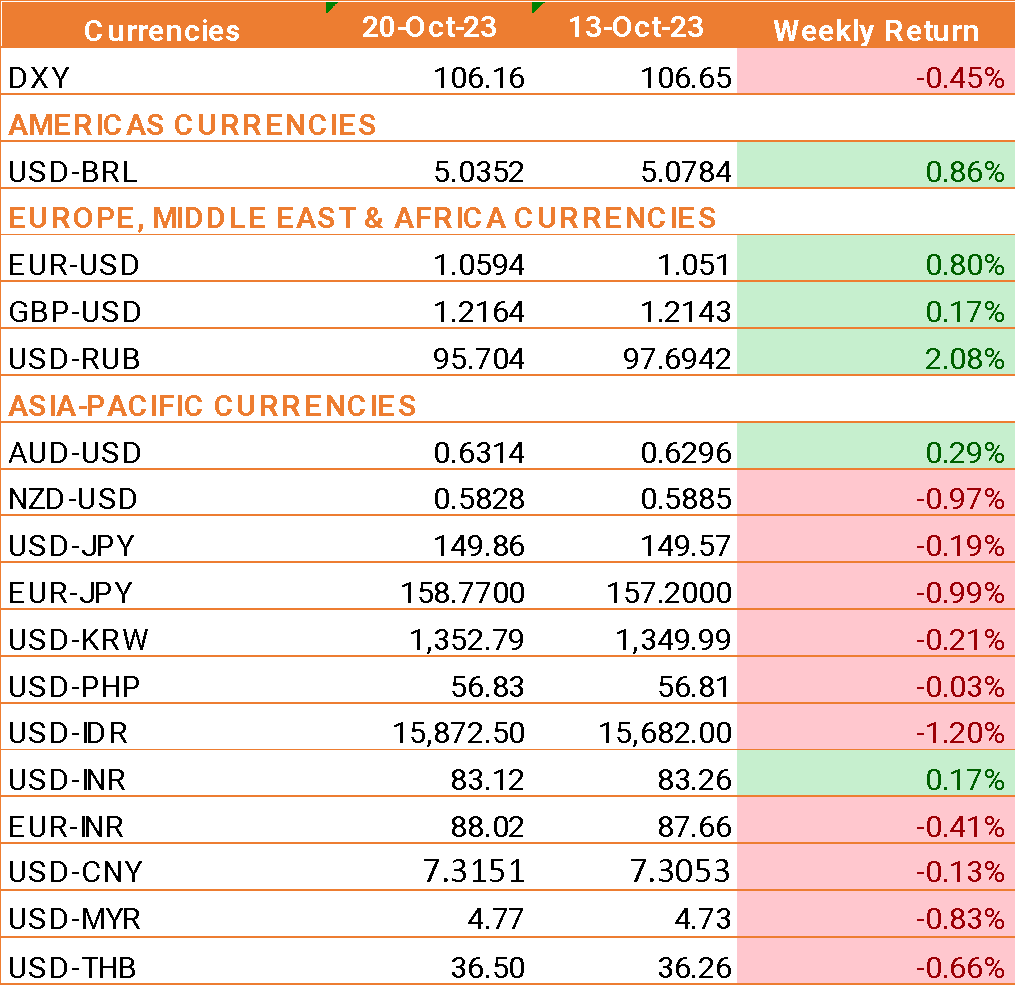

- The USD ended the week lower following Federal Reserve Chair Powell's indication of maintaining interest rates steady at the forthcoming Federal Open Market Committee (FOMC) meeting and his cautious stance towards additional policy firming.

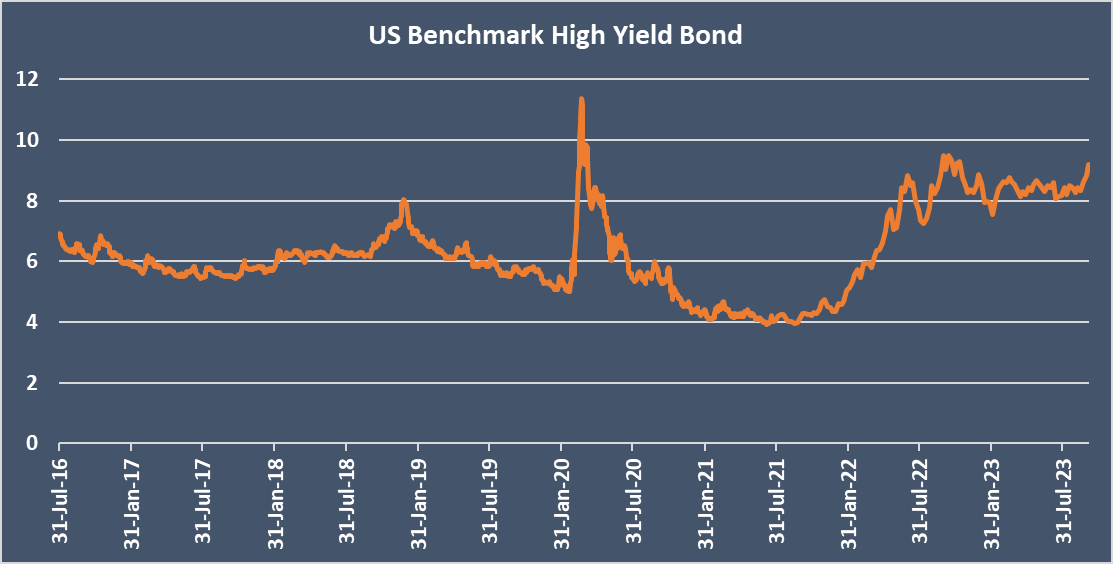

- The Federal Reserve Chair said that the US economy strengthened, and a tight labour market could mean that higher interest rates are needed to control inflation.

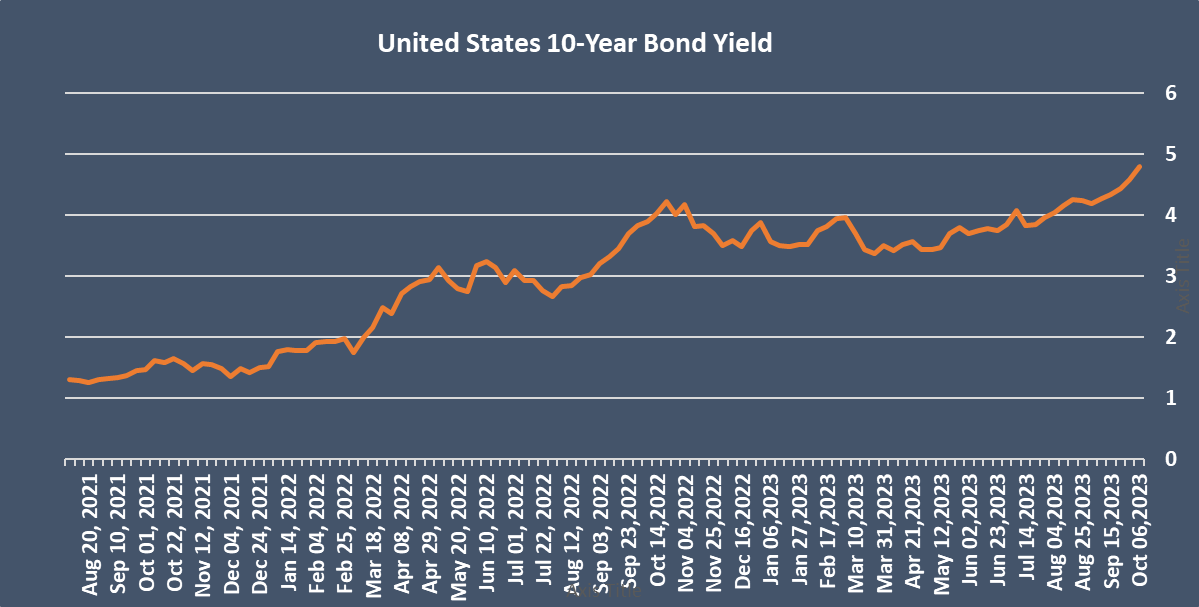

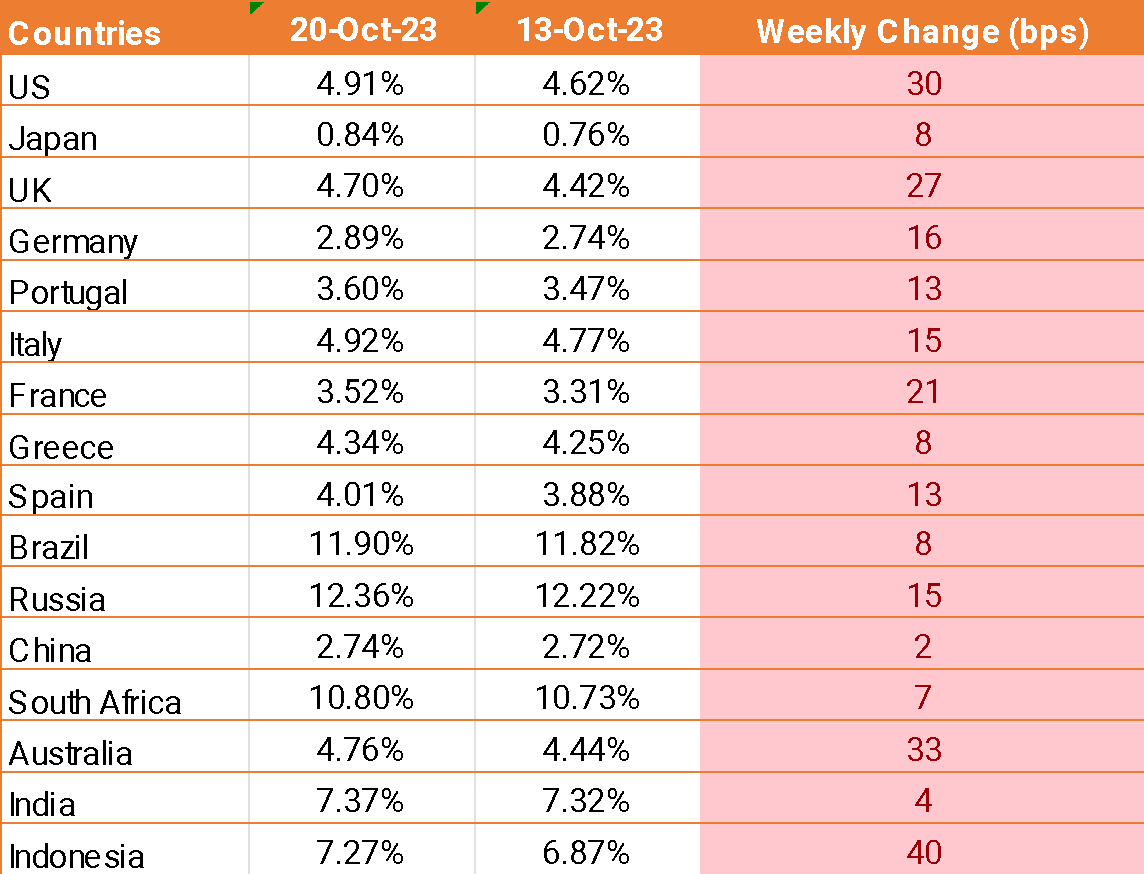

- The prospect of the Federal Reserve keeping interest rates higher for a longer period has led to US Treasury yields rising, which are currently trading close to the 5% level, which was last seen in 2007.

- In acknowledgment of elevated Treasury yields, Federal Reserve Chair also said that the bond market is doing some of the central banks' work, helping tighten financial conditions.

- US jobless claims fell to the lowest level since January at 198,000, down from 212,000, highlighting the tight labour market.

- U.S. retail sales also came in stronger than expected, underscoring the strength of the US consumer despite the Federal Reserve raising interest rates aggressively.

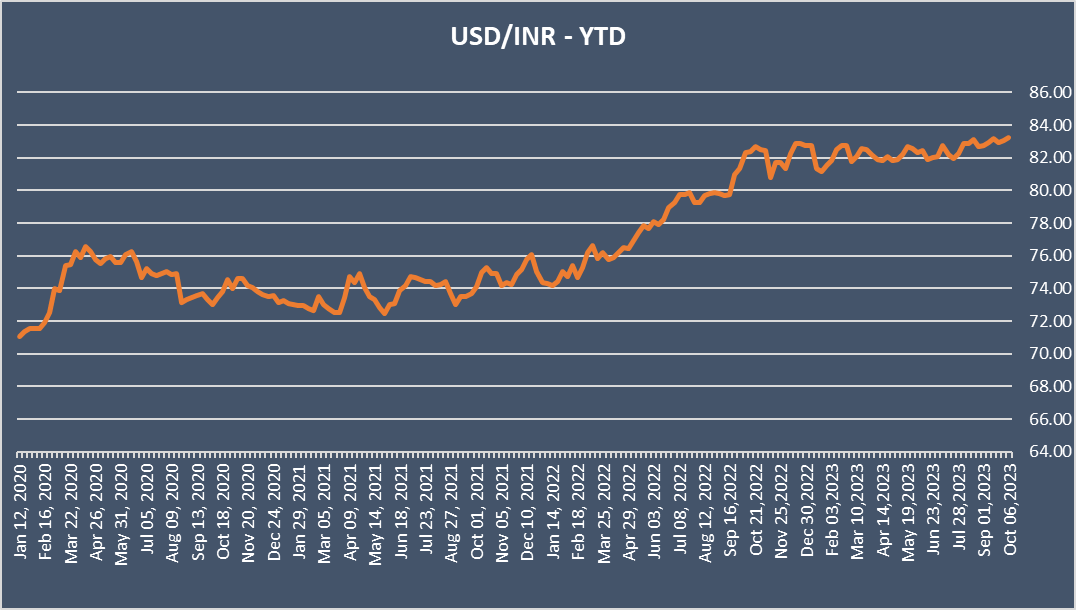

- INR ended the week higher amid broad USD weakness, and market reports also suggest that the INR had a helping hand from central bank intervention.

We would love to hear back from you. Please Click here to share your valuable feedback