System liquidity continued to remain in the deficit zone. Next month, in the wake of Rs 1430 billion of g-sec bonds maturity, RBI may conduct OMO sales which will make liquidity decline further.

System liquidity stood at Rs 178 billion of deficit level as of 19th Oct 2023. Liquidity absorption through Reverse Repo and SDF stood at Rs 574 billion as of 19th Oct 2023.

Total Forex reserves stood at USD 586 billion as of 13th Oct 2023. RBI was net seller of USD during Aug 23. Net selling of dollars was USD 3.86 billion during Aug 23 as compared to Net buying of US dollar was USD 3.47 billion during July 23. RBI publishes fx data with a one-month lag.

RBI net outstanding forward purchases stood at USD 10.07 billion as of Aug 23 as compared to USD 19.47 billion as of July 23.

The ICDR as of 6th Sep 2023 was 106%, credit grew by Rs 24839 billion, year on year, while deposits grew by Rs 23437 billion. Banks have to maintain a CRR of 4.5% at present and SLR of 18.00%, and ideal ICDR for liquidity neutrality for banks is around 75%.

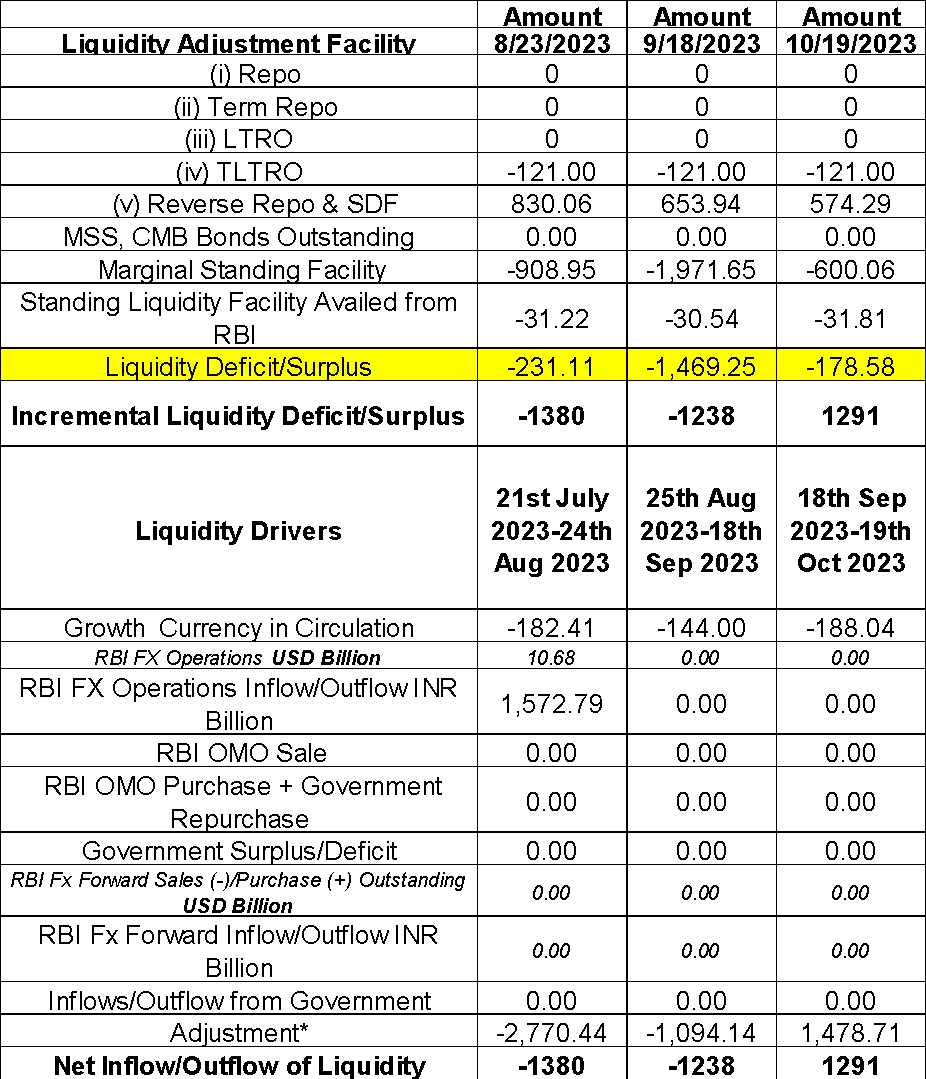

Liquidity Cheat Sheet

The Liquidity Cheat Sheet is for assessing system liquidity and the drivers of system liquidity.

System liquidity is defined as bids for Repo, Reverse Repo and Term Repo/Reverse Repo LAF (Liquidity Adjustment Facility), Long Term Repo Operations (LTROs)/Targeted Long-Term Repos Operations (TLTROs) auctions held by the RBI. Drawdowns from MSF and Export Credit Refinance Facility are the other constituents of system liquidity.

The need for liquidity is largely driven by the requirement to maintain CRR (Cash Reserve Ratio) balances with the RBI. Deficit system liquidity suggests that banks require to borrow from RBI to maintain CRR balances while surplus liquidity suggests that banks have excess funds over and above maintaining CRR balances.

The drivers of system liquidity include Currency in Circulation (outflows), RBI fx purchase (inflows)/ sales (outflows), RBI OMO sales (outflows)/purchase (inflows) and government surplus (outflows)/ deficit (inflows).

Currency in Circulation is money going out of the banking system and being held as cash by the public. For example, if you draw cash from an ATM, money goes out as cash. Currency in Circulation is determined by the need to hold cash for transactions and cash held as black money. Inflation affects the need to hold cash as the value of goods and services increases due to inflation.

RBI purchasing USD adds INR liquidity while USD sales lower INR liquidity as the central bank pays or receives INR for buying/selling USD.

RBI selling bonds through OMO takes out liquidity as markets pay RBI for buying bonds while bond purchases through OMO infuses liquidity as RBI pays the market for buying bonds. Maturity of RBI forward sale/purchase contracts also affect system liquidity.

Government surplus is money kept with the RBI while government deficit is money borrowed from the RBI. Government surplus is liquidity negative as money goes out of the banking system into government accounts with RBI. Government deficit is liquidity positive as RBI lends money to government through WMA (Ways and Means Advances) facility. Government spends money by drawing down on WMA and that adds to banking system liquidity.

Others include IPO inflows that add to bank deposits, spectrum and other license auctions that add to government cash balances and MSS (Market Stabilization Scheme) that takes out liquidity from the system as market pays for purchasing MSS bonds.

Advance tax payments goes out of banking system into government account with the RBI every quarter i.e. 15th of June, September, December and March.

Government bonds that mature and come up for redemption adds to banking system liquidity as money goes from the government to holders of the bonds.

Government pays interest of around Rs 4000 billion every year and that adds to system liquidity.

Liquidity Operations (In INR Billions)