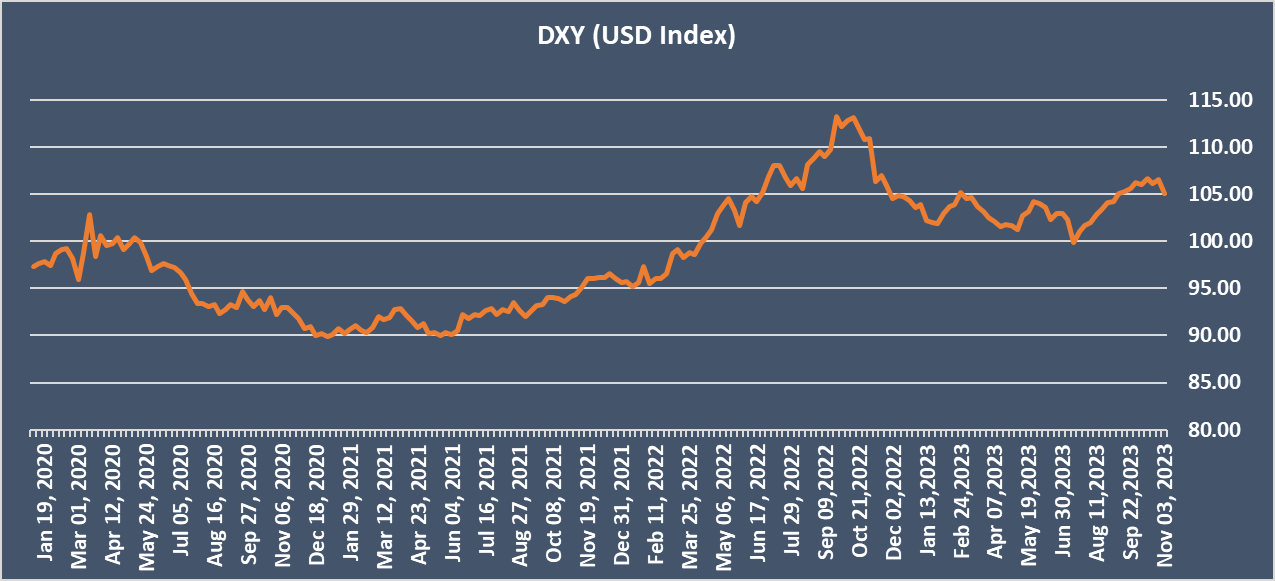

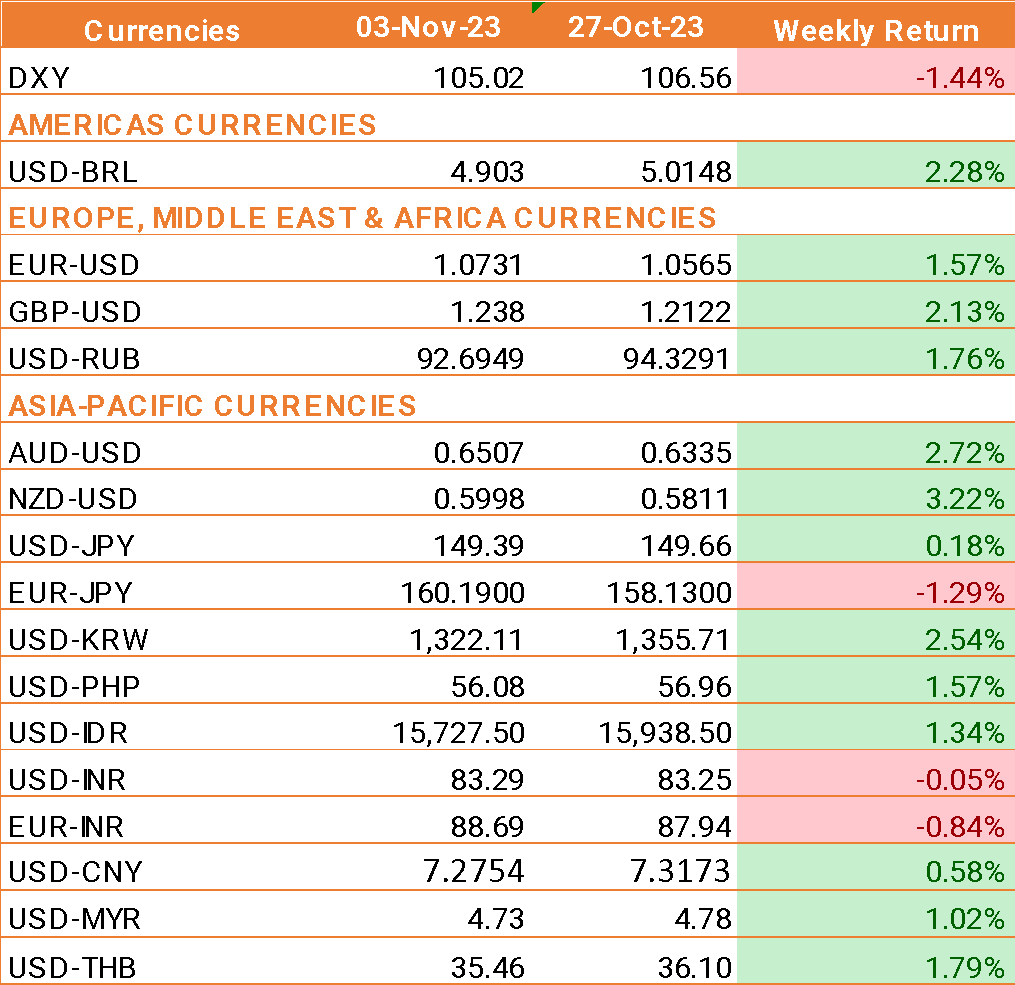

- The USD ended the week lower amid market expectations that the Federal Reserve has ended its rate-hiking cycle.

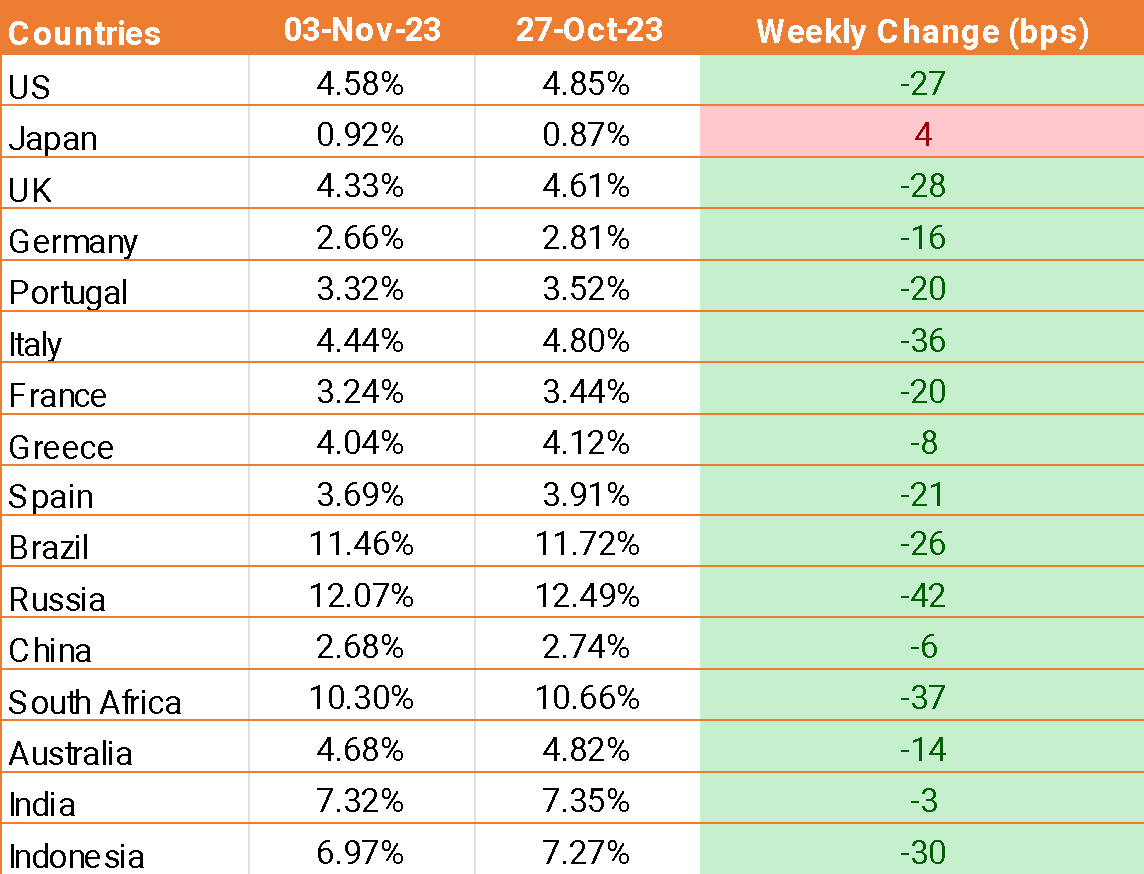

- The Federal Reserve left interest rates on hold at a 22-year high for a second straight month and hinted that they have reached the end of the interest rate hiking cycle.

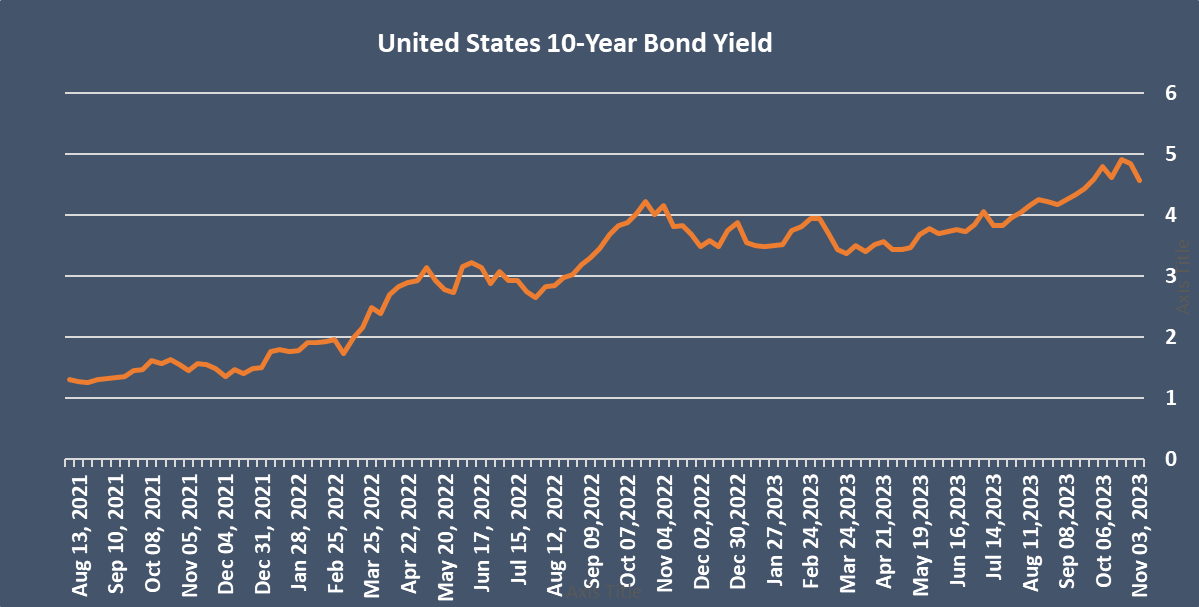

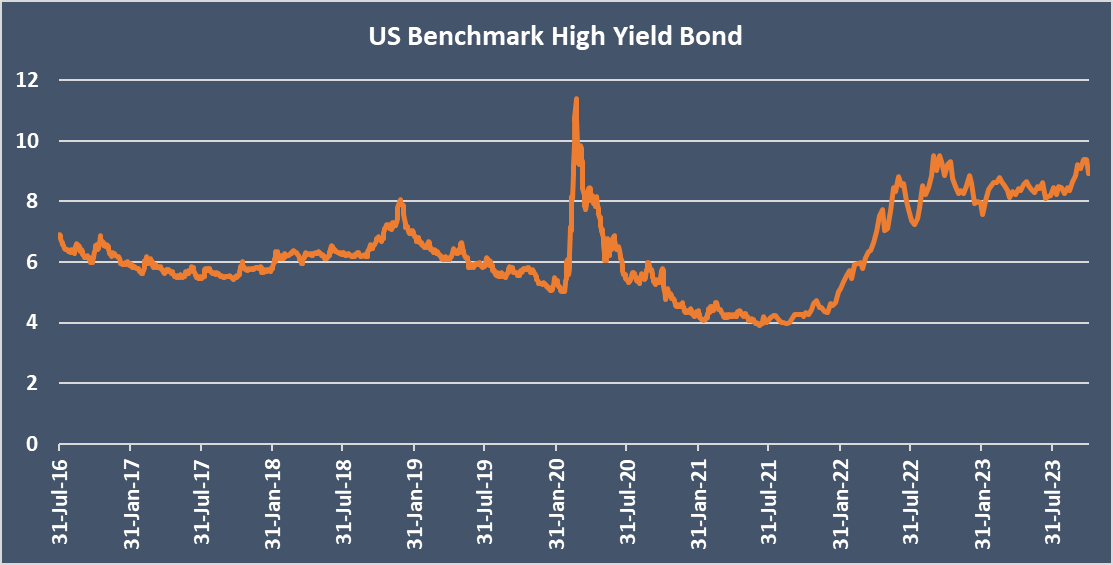

- Federal Reserve Chair Jerome Powell acknowledged that high yields have tightened financial conditions, removing some of the need to raise interest rates further.

- The U.S. labor market experienced a slowdown in October, with job growth significantly underperforming, according to the Labor Department's report. A total of 150,000 jobs were added, marking the smallest gain since June and falling short of the expected 180,000.

- The unemployment rate rose to a two-year high of 3.9%, reflecting a cooling labor market. Average hourly earnings rose by 4.1% from a year ago, and labor force participation fell slightly to 62.7%.

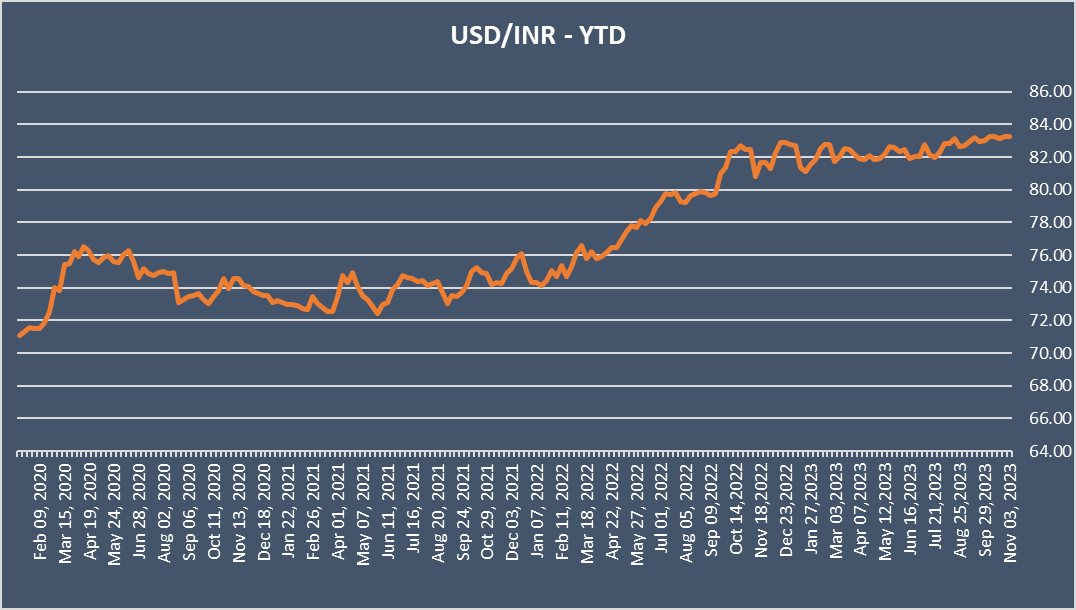

- The INR fell against the USD last week despite the fall in the USD as oil prices pushed higher.

- India's foreign exchange reserves saw a significant increase, despite a notable foreign investor pullout, ending the week of October 27 with a total of USD 586.11 billion, a surge of USD 2.579 billion according to the Reserve Bank of India (RBI).

We would love to hear back from you. Please Click here to share your valuable feedback