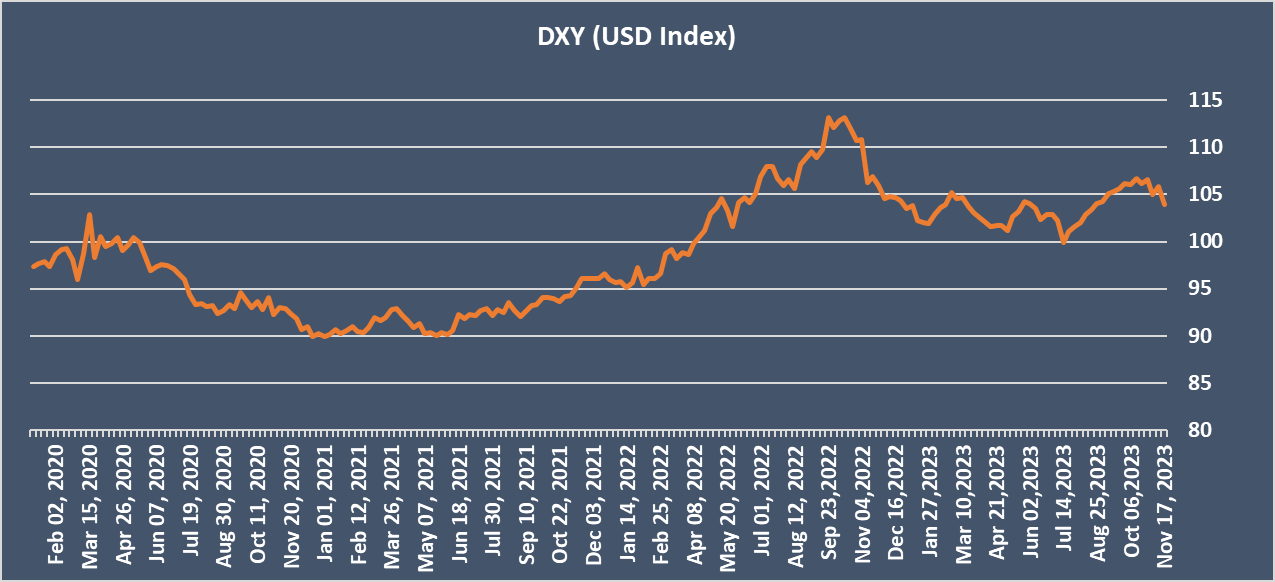

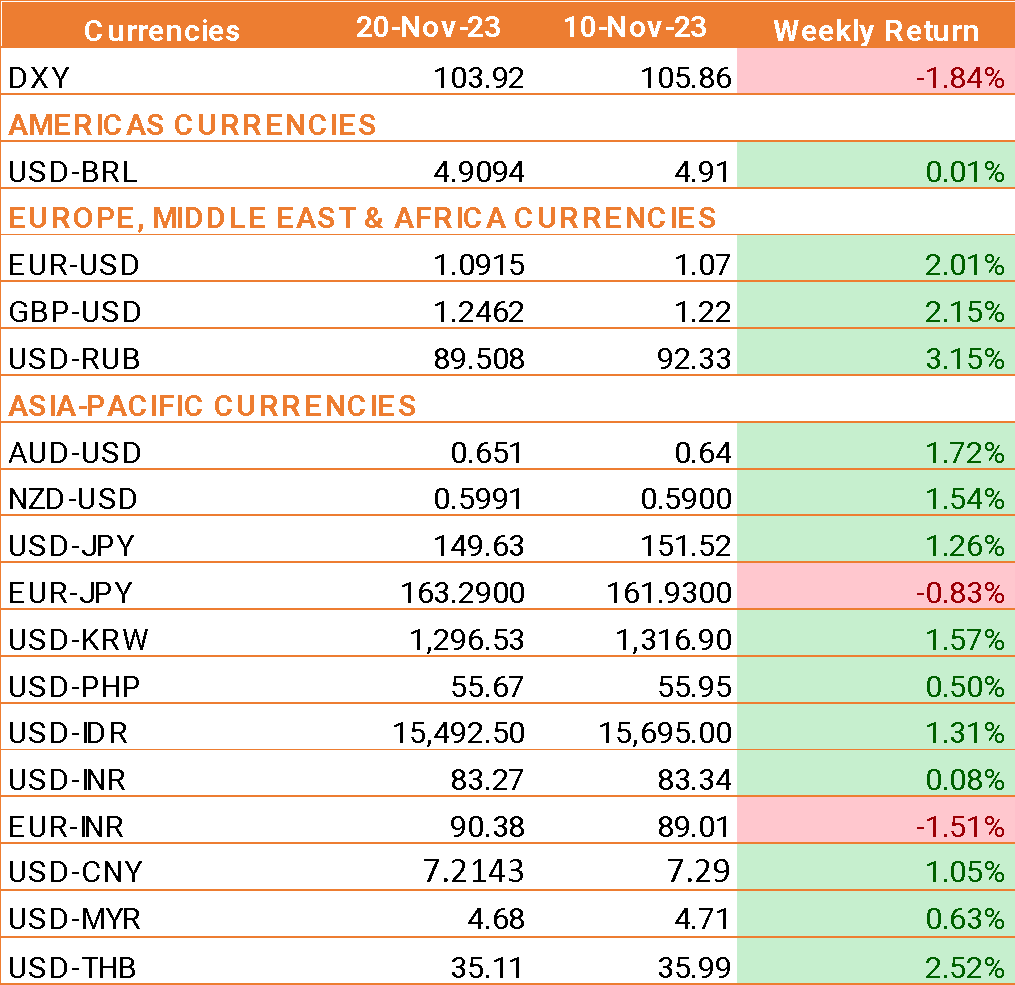

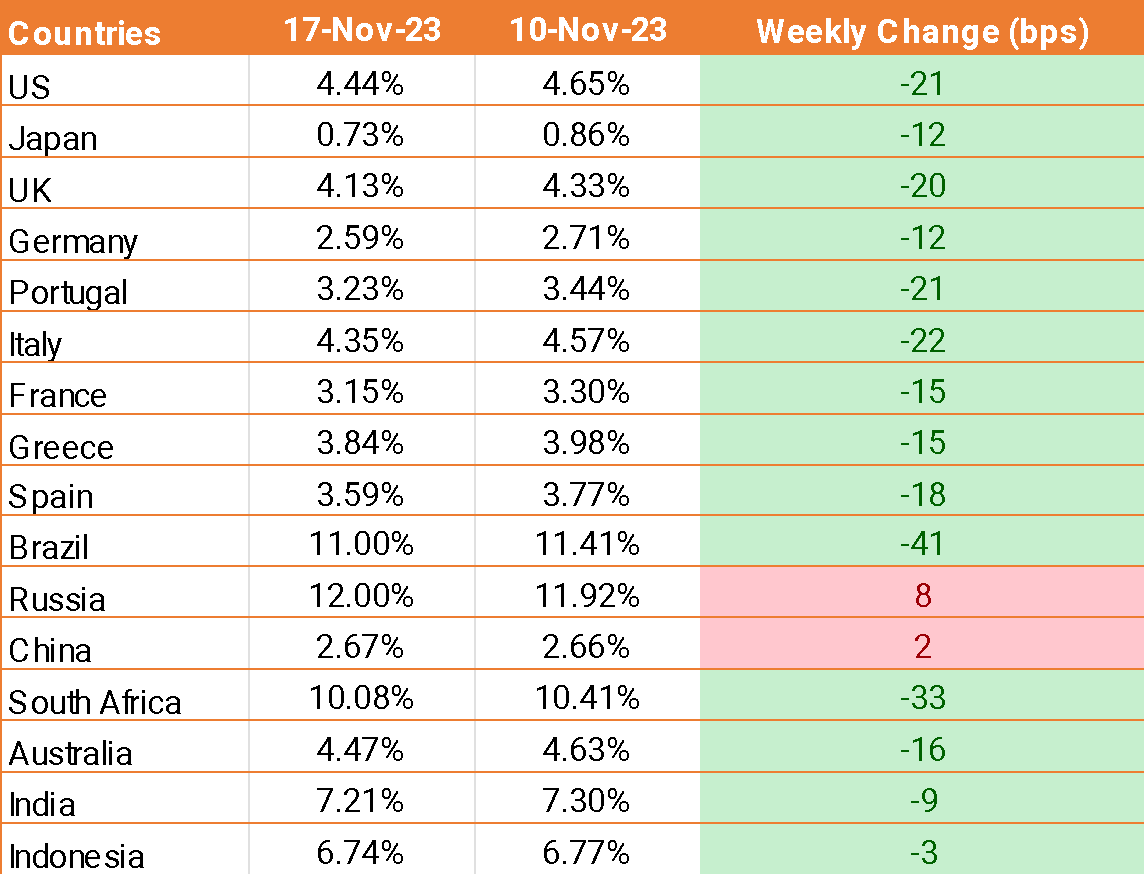

- The USD ended the week lower after a series of weaker-than-expected data fueled investors' expectations that the Federal Reserve will not raise interest rates further.

- US inflation, as measured by the consumer price index, rose 3.2% year on year in October, down from 3.7% in September and below expectations of 3.3%.

- Core inflation, which discounts more volatile items such as food and fuel, rose 4% year on year, down from 4.1% and below expectations.

- The producer price index fell by more than expected, dropping 0.5% month on month in October, below the expectation of a 0.1% increase. This was also down from the 0.4% inflation seen in September.

- Jobless claims rose by 231,000, up from 218,000 in the previous week and well ahead of the 220,000 that were expected.

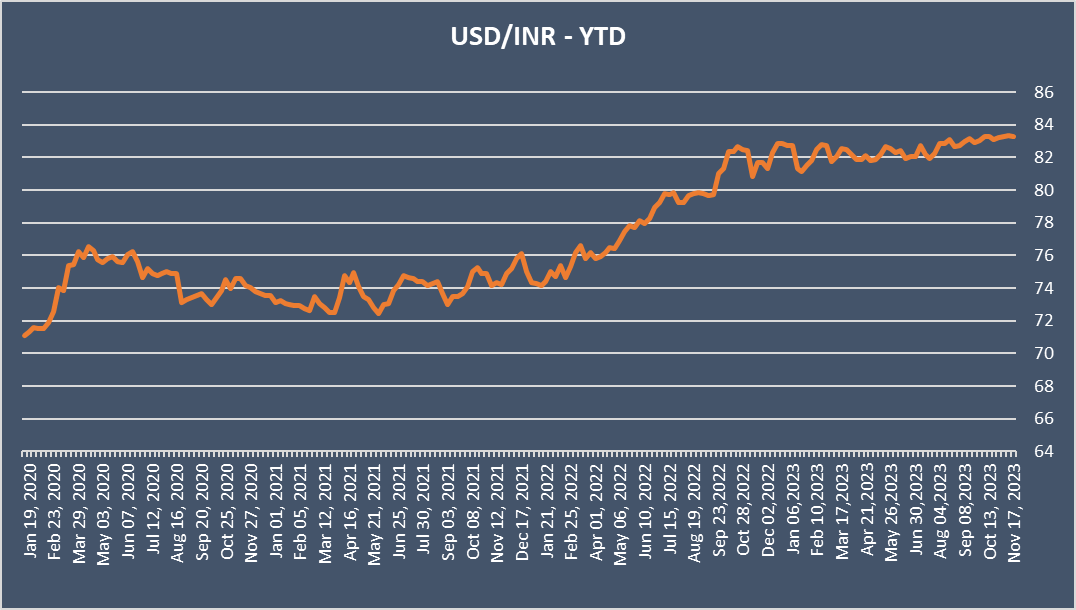

- INR ended the week higher against the USD largely on two accounts. Firstly, the broad fall in USD, and secondly, the sharp decline in crude oil prices.

- WTI has fallen 4.5% this week, extending losses of 4.15% from the previous week. Falling oil prices are good news for India, which imports around 80% of its oil needs.

- Indian retail inflation cooled in October to a four-month low of 4.87%, moving closer to the central bank's 4% target level. However, food inflation, which makes up over half of the inflation basket, remained unchanged at 6.2%.

We would love to hear back from you. Please Click here to share your valuable feedback