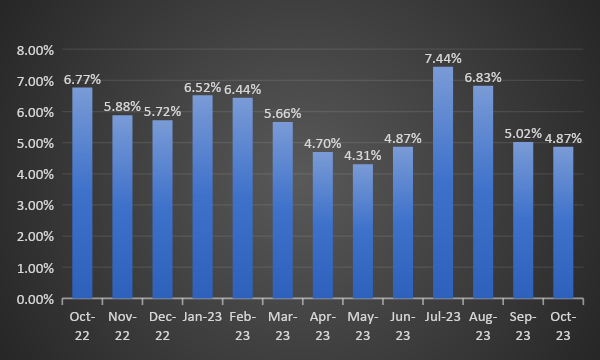

India’s consumer inflation eased to 4.87% in October from 5.02% in the previous month which is close to average inflation target set by the central bank i.e. 4 %. During the month, food inflation rose by 6.61% as compared to 6.56% in September. Going ahead, inflation is likely to stand below 5% with downward movement as RBI has projected inflation at 5.6% during Q3 and 5.2% during Q4 of the current fiscal year.

In the forthcoming monetary policy meeting, the central bank is likely to continue the status quo on policy repo rate due to the falling inflation trend. However, it is yet to see the monetary policy stance. As announced earlier by the central bank, OMO sale of g-sec has not been conducted yet. As of 16th Nov, system liquidity stood at Rs 424 billion of deficit.

Industrial Production- Domestic IIP rose by 5.8% on yearly basis during Sep 23 as compared to 10.3% in previous month.

Government bonds, SDL and OIS yield movements

During the past week, there were several notable changes in bond yields:

The yield for the 10-year benchmark 7.18% 2033 bond yield declined by 9 bps to 7.22%. Similarly, the 7.26% 2033 bond yield lost 10 bps to 7.26%. The 7.06% 2028 bond's yield came down by 9 basis points to 7.21%. In the same line, the long-term paper, represented by the 7.25% 2063 bond, its yield decreased by 7 bps to 7.41%. 50-yr paper, 7.46% 2073 yield stood at 7.41%.

The spread between the 10-year and 5-year bonds stood flat at 1 basis point as compared to the previous week. The spread between the 15-year benchmark and the 10-year benchmark stood flat at 11 bps. Additionally, the spread between the 30-year benchmark and the 10-year benchmark rose to 19 bps from 17 basis points as compared to the previous the week.

In terms of the 10-year SDL auction, the average cutoff yield declined to 7.70% as compared to 7.73%, while the decreased to 32 basis points from 38 basis points.

Lastly, in the Overnight Indexed Swap (OIS) rates, the 1-year OIS yield fell by 5 bps to 6.84%, while the 5-year OIS yield decreased by 26 bps to 6.44%.

We would love to hear back from you. Please Click here to share your valuable feedback,