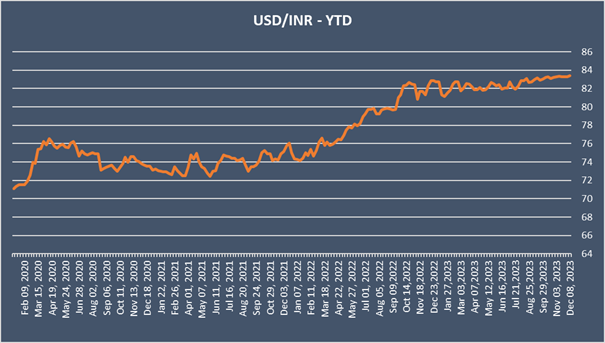

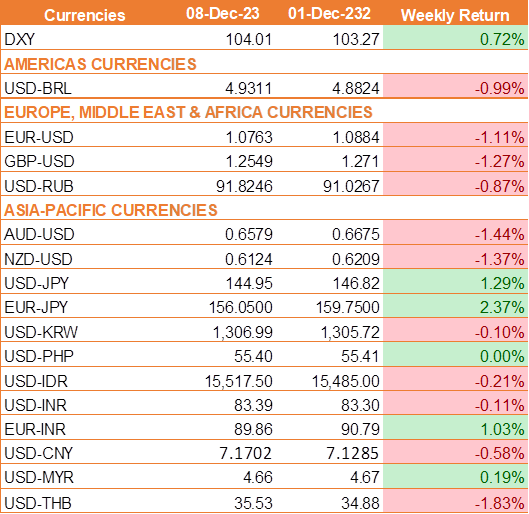

INR ended lower marginally as RBI maintain status quo.

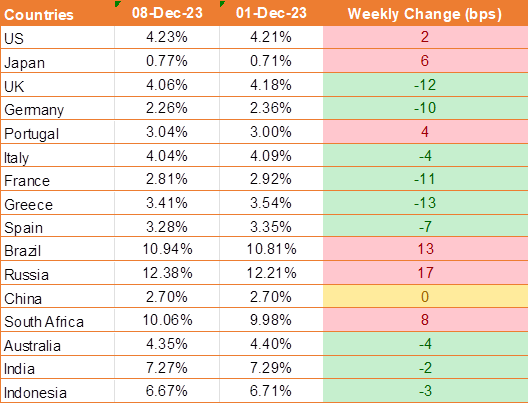

� INR ended the week marginally lower as the RBI, in its latest MPC meeting, unanimously decided to leave the repo rate unchanged at 6.50%.

� The growth projection for FY24 has been revised upward to 7% from the earlier estimate of 6.5%.

� The average CPI forecast for FY24 remains unchanged at 5.4%.

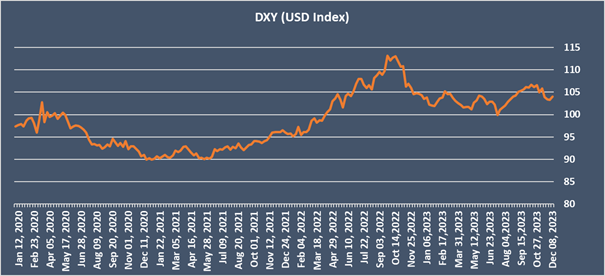

� The USD ended the week higher as the US non-farm payroll beat market expectations.

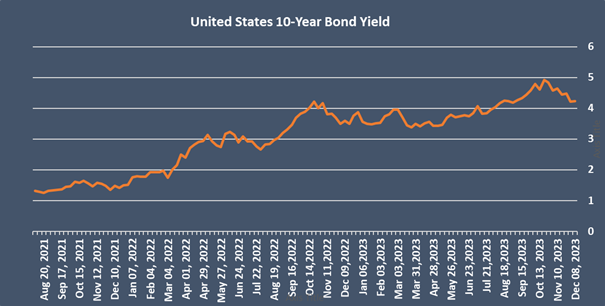

� U.S. nonfarm payrolls rose by a seasonally adjusted 199,000 for the month, slightly surpassing the expected 190,000 and exceeding the unrevised October gain of 150,000.

� The unemployment rate declined to 3.7%, compared to the forecasted 3.9%, as the labour force participation rate edged higher.

� Average hourly earnings, a key inflation indicator, increased by 0.4% for the month and 4% from a year ago, in line with expectations.

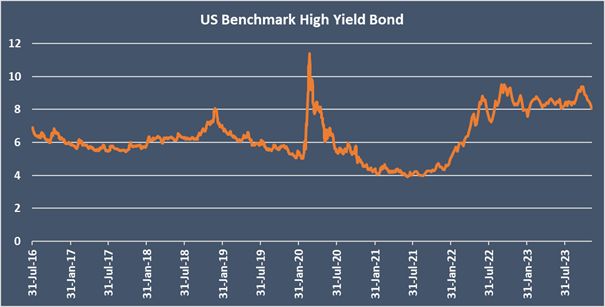

� The Euro traded lower last week as ECB Executive Board member Isabel Schnabel suggested that the central bank could consider pausing its rate hikes due to falling inflation rates. This dovish tone has led to market speculation about a substantial ECB rate cut.

We would love to hear back from you. Please Click here to share your valuable feedback