In the calendar year 2023, the G-sec prices demonstrated an overall bullish trend on average. This movement was notably influenced by the central bank's decision to halt the policy repo rate hike and maintain a status quo. Particularly, from April to June of that year, the G-sec yields experienced a significant decline, leading to the appreciation of gilt securities. Subsequently, however, the G-sec yields began to trend upwards. This upward movement was driven by factors such as limited system liquidity and an increase in inflation.

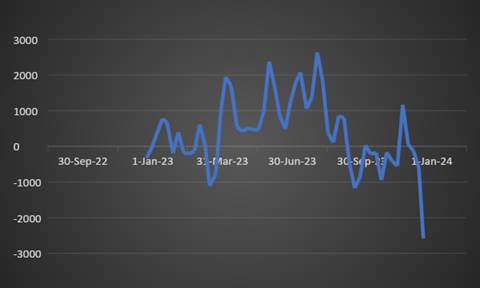

System Liquidity-During 2023, system liquidity experienced zigzag movement driven by various factors such as status quo of policy rates, incremental CRR by the central bank. System liquidity declined significantly to Rs 2584 billion of deficit as of 21st Dec.

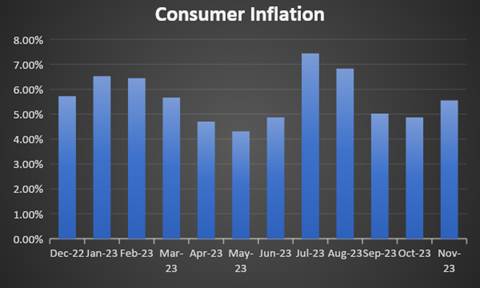

Consumer Inflation-During Jan to May 2023, consumer inflation declined. However, from June to August, it rose, driven by higher food and vegetable prices. It softened after that to 5.55% in November.

�

Government bonds, SDL and OIS yield movements

During the past week, there were several notable changes in bond yields:

The yield for the 10-year benchmark 7.18% 2033 bond yield rose by 3 bps to 7.19%. Similarly, the 7.26% 2033 bond yield increased by 1 bp to 7.21%. The 7.06% 2028 bond's yield rose by 3 basis points to 7.10%. In the same line, the long-term paper, represented by the 7.25% 2063 bond, its yield increased by 4 bps to 7.42%. 50-year paper, 7.46% 2073 yield stood flat at 7.37%.

The spread between the 10-year and 5-year bonds stood flat at 9 basis points as compared to the previous week. The spread between the 15-year benchmark and the 10-year benchmark stood steady at 11 bps. Additionally, the spread between the 30-year benchmark and the 10-year benchmark remained unchanged to 22 bps as compared to the previous week.

Lastly, in the Overnight Indexed Swap (OIS) rates, the 1-year OIS yield remained steady 6.65%, while the 5-year OIS yield increased marginally by 1 bp to 6.21%.

We would love to hear back from you. Please Click here to share your valuable feedback,