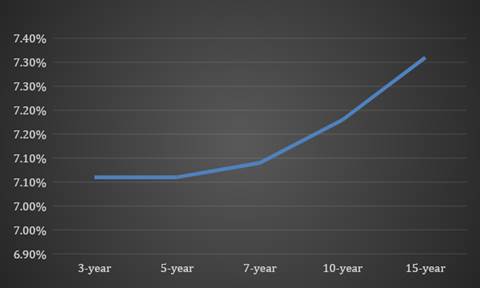

Domestic yield curve has sustained its steepening trend towards longer maturity which can be seen from the below graph.

Although consumer inflation has increased to 5.7% in Dec as compared to the previous month, it is likely to touch the long term average rate of 4% during the current calendar year. Thus, the probability of a rate cut by the central bank will be on cards. Globally,

System liquidity has remained in a deficit zone. As of 11th Jan, it stood at Rs 1629 billion of deficit.

US inflation stood at 3.4% in December as compared to 3.1% in the previous month.

Government bonds, SDL and OIS yield movements

During the past week, there were several notable changes in bond yields:

The yield for the 10-year benchmark 7.18% 2033 bond yield declined by 5 bps to 7.18%. The 7.06% 2028 bond's yield came down by 4 basis points to 7.07%. 7.18% 2037 bond yield lost 6 bps to 7.29%. In the same line, the long-term paper, represented by the 7.25% 2063 bond, its yield decreased by 8 bps to 7.39%.

The spread between the 10-year and 5-year bonds declined to 11 bps from 12 basis points as compared to the previous week. The spread between the 15-year benchmark and the 10-year benchmark decreased to 11 bps from 16 bps. Additionally, the spread between the 30-year benchmark and the 10-year benchmark remained unchanged at 22 bps as compared to the previous week.

Lastly, in the Overnight Indexed Swap (OIS) rates, the 1-year OIS yield came down by 4 bps to 6.63%, while the 5-year OIS yield decreased by 7 bps to 6.20%.

We would love to hear back from you. Please Click here to share your valuable feedback.