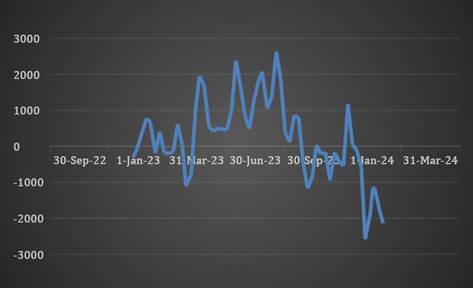

System liquidity has been in the deficit zone since Sep 2023. As of 18th Jan 24, liquidity stood at Rs 2141 billion of deficit. Factors such as withdrawal of accommodative monetary policy� by RBI to keep average inflation at 4% and bank�s credit growth has been higher as compared deposit growth have caused the liquidity to become negative. As of 29th Dec, incremental deposit growth rate stood at 13.2% while credit growth rate stood at 19.9%. Incremental credit to deposit growth rate stood at 113%.

�

In the wake of the current economic scenario, system liquidity is likely to remain in the deficit zone in coming days as policy rate cut is unlikely in first half of 2024 with continuation of withdrawal of accommodative monetary policy.

Government bonds, SDL and OIS yield movements

During the past week, there were several notable changes in bond yields:

The yield for the 10-year benchmark 7.18% 2033 bond yield stood flat at 7.18%. The 7.06% 2028 bond's yield came down by 1 basis point to 7.06%. 7.18% 2037 bond yield lost 2 bps to 7.27%. In the same line, the long-term paper, represented by the 7.25% 2063 bond, its yield decreased by 1 bp to 7.38%.

The spread between the 10-year and 5-year bonds rose to 12 bps from 11 basis points as compared to the previous week. The spread between the 15-year benchmark and the 10-year benchmark decreased to 9 bps from 11 bps. Additionally, the spread between the 30-year benchmark and the 10-year benchmark declined to 20 bps from 22 bps as compared to the previous week.

Lastly, in the Overnight Indexed Swap (OIS) rates, the 1-year OIS yield rose by 1 bp to 6.64%, while the 5-year OIS yield increased by 4 bps to 6.24%.

We would love to hear back from you. Please Click here to share your valuable feedback.