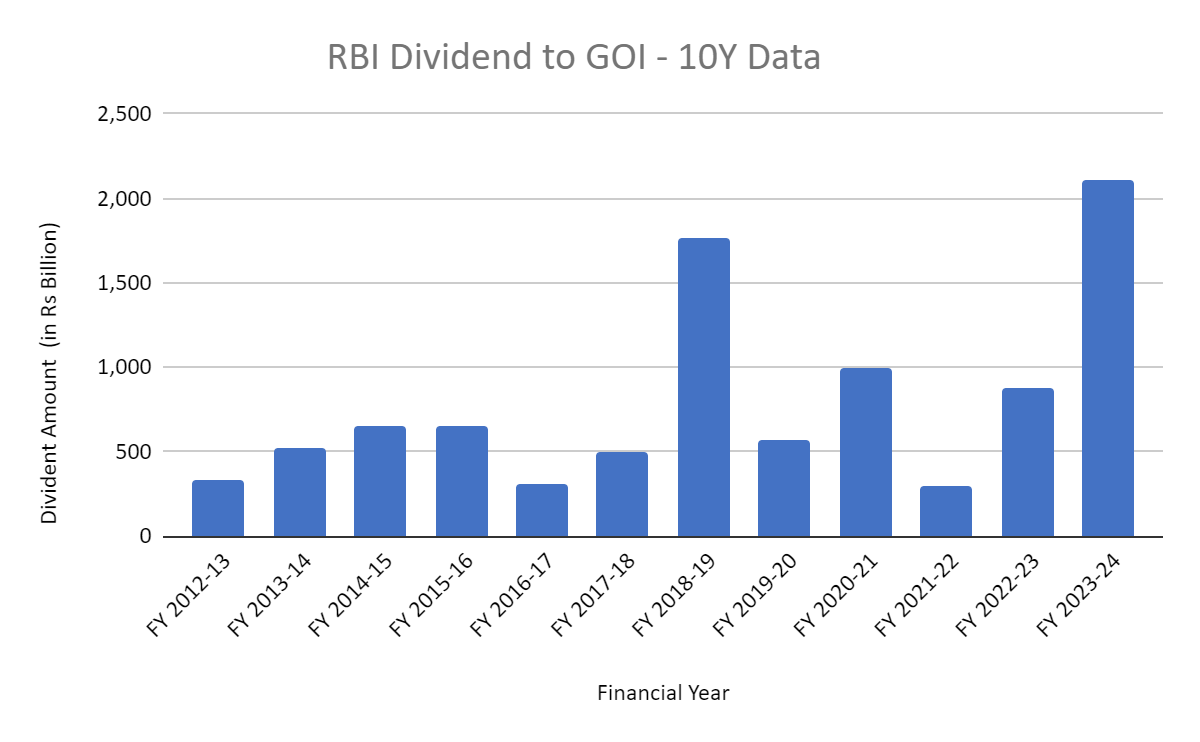

The RBI's approval of a record-high dividend of Rs. 2.11 trillion to the Government of India for FY24 significantly influenced the fixed income market this week. The 10-year 2034 G-sec yields fell by 5 basis points on a weekly basis, touching levels of 6.99% during the week. This development fueled speculations of a potential reduction in the government's borrowing for this fiscal year compared to the last.

Weekly Market Highlights:

- 10 year 2034 Gsec yields fell by 5bps on weekly basis. Touched levels of 6.99% during the week.

- Weekly T-bill auction saw a significant drop in cut-off rates after the RBI approved a record-high dividend to the Government of India.

- RBI approves dividend of Rs. 2.11 trillion to GOI for Fy24.

- INRBonds retail index declined by 4 bps on a weekly basis, in-line with Gsec movement.

- Weekly Gsec auction cut-off for 2027, 2039 and 2073 stood at 7.02%, 7.043% and 7.15% respectively.

- Domestic market liquidity deficit stood at Rs. 2373 billion.

- 360 One Prime Ltd public debt IPO is open for bidding.

- US Fed policy-meeting minutes show, policymakers are anticipating it would take longer to get confidence that inflation would move gradually towards the 2% target. Expects rates to remain higher.

- UST 10 year yields traded on a flat note and closed at 4.46%.

Market Data | |||

Particulars | 24/5/2024 | 17/5/2024 | Change |

10 Yr Benchmark Gsec (%) | 7.00% | 7.05% | -5 bps |

Banking Liquidity (in Rs Billion) | -2373 | -939 | -152.72% |

5 Yr OIS (%) | 6.40% | 6.41% | -1 bps |

1 Yr OIS (%) | 6.81% | 6.81% | 0 bps |

INRBonds Retail High Yield Index | 9.70% | 9.59% | 12 bps |

Nifty | 22,957 | 22,482 | 2.11% |

10 Yr SDL | 7.35% | 7.43% | -8 bps |

91 Day T-Bill (%) | 6.85% | 6.99% | -13 bps |

182 Day T-Bill (%) | 7.01% | 7.08% | -7.07 bps |

10 Yr US Treasury Yield (%) | 4.46% | 4.42% | 4 bps |

US Junk Bond Yield (%) | 7.72% | 7.57% | 15 bps |

Brent Crude Oil (In USD per Barrel) | 82.09 | 84 | -2.27% |

Primary & Secondary Corporate Bonds Data | |||

Primary Public Debt Issuance | Maturity | Yield | IP Frequency |

8.86% 360 One Prime Ltd | 18 Months | 9.22% | Monthly |

9.16% 360 One Prime Ltd | 18 Months | 9.23% | Annual |

8.98% 360 One Prime Ltd | 24 Months | 9.36% | Monthly |

9.35% 360 One Prime Ltd | 24 Months | 9.35% | Annual |

9.16% 360 One Prime Ltd | 36 Months | 9.55% | Monthly |

9.55% 360 One Prime Ltd | 36 Months | 9.55% | Annual |

9.21% 360 One Prime Ltd | 60 Months | 9.60% | Monthly |

9.6% 360 One Prime Ltd | 60 Months | 9.60% | Annual |

9.44% 360 One Prime Ltd | 120 Months | 9.86% | Monthly |

9.85% 360 One Prime Ltd | 120 Months | 9.84% | Annual |

Top 5 Secondary Retail Trades | Maturity | Yield | - |

7.46% Mahindra Mahindra Financial Services Limited | 24/6/2024 | 7.95 | |

10% IIFL SAMASTA FINANCE LIMITED | 26/11/2026 | 9.99 | |

9.81% SPANDANA SPHOORTY FIN LTD | 2/4/2026 | 11.36 | |