Weekly Market Highlights:

- The 10 year 2034 G-sec yield closed at 6.76% this week vs 6.79% last week.

- Strong FPI inflows are expected following the Fed’s substantial 50 bps rate cut, shifting market’s attention to the RBI’s MPC meeting next month.

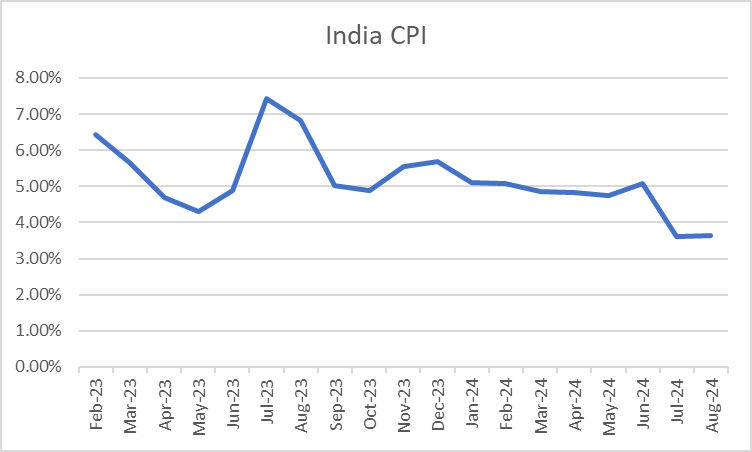

- RBI to not immediately cut rates in response to Fed’s rate cut and tighten liquidity as the base effect on inflation is expected to wear off.

- 3M and 6M T-bill auction data yields were stable at 6.65% and 6.72% respectively.

- The INR Bonds high yield Index stood at 9.92% up 13 bps fortnightly.

- The US Fed’s 50 basis point rate cut may trigger a rally in Indian G-Secs, boosting liquidity and lowering borrowing costs.

- The 10Y UST was up to 3.74% as Fed Chief Powell noted that while the economy remains strong, 50bps will not be the ongoing pace of easing.

- Fed’s dot plot positive for G-Secs as it indicates a slightly more dovish stance, indicating another 50 bps cut by the end of CY24 contrary to previous expectations of a single rate cut this year. It also indicated an additional 100 bps reduction in CY25.

- The Dollar Index declined as the USD weakened against the Euro, driven by positive inflation data from the Eurozone, which strengthens the ECB’s ability to continue its gradual rate cut cycle.

- India CPI at 3.65% as of August.

Market Data | |||

Particulars | 20/9/2024 | 13/9/2024 | Change |

10 Yr Benchmark Gsec (%) | 6.76% | 6.79% | -3 bps |

Banking Liquidity (in Rs Billion) | 24.82 | 196.1 | -87.34% |

5 Yr OIS (%) | 6.01% | 5.94% | 7 bps |

1 Yr OIS (%) | 6.39% | 6.37% | 2 bps |

INRBonds Retail High Yield Index | 9.92% | 9.79% | 13 bps |

Nifty | 25,791 | 25,357 | 1.71% |

10 Yr SDL | 7.05% | 7.17% | -12 bps |

91 Day T-Bill (%) | 6.65% | 6.65% | 0 bps |

182 Day T-Bill (%) | 6.72% | 6.72% | 0.23 bps |

10 Yr US Treasury Yield (%) | 3.74% | 3.65% | 9.01 bps |

US Junk Bond Yield (%) | 6.66% | 6.96% | -30 bps |

Brent Crude Oil (In USD per Barrel) | 73.93 | 71.49 | 3.41% |

Primary & Secondary Corporate Bonds Data | |||

Top 5 Secondary Retail Trades | Maturity | Yield | - |

9.95% IndoStar Capital Finance Ltd | 28/11/2026 | 10.85% | |

8.85% HDFC Credila Financial Services Ltd | 6/7/2029 | 9.18% | |

9.75% IKF Finance Ltd | 11/8/2025 | 10.39% | |

10.25% Aye Finance Ltd | 20/3/2026 | 11.68% | |

9.9% Oxyzo Financial Services Ltd | 15/2/2027 | 10.22% | |

Currency Market Data | |||

Particulars | 20/9/2024 | 13/9/2024 | Change |

USD/INR | 83.474 | 83.88 | -0.48% |

DXY | 100.74 | 101.11 | -0.37% |

USD/ Brazil Real | 5.38 | 5.44 | -1.10% |

EUR/ USD | 1.1162 | 1.1086 | 0.69% |

USD/CNY | 7.0505 | 7.093 | -0.60% |

USD/JPY | 143.91 | 140.82 | 2.19% |

USD/ Russian Ruble | 92.3505 | 89.996 | 2.62% |