Government borrowing analysis

The RBI's H2FY24 government borrowing calendar targets Rs. 6.61 trillion, in line with the budget. Of this, Rs. 20,000 crore is allocated for sovereign green bonds. In H1FY24, the government borrowed over Rs. 7 trillion, with nearly 40% through longer-tenure bonds. The second half will feature 21 auctions, with Rs. 390 billion to be auctioned, including Rs. 220 billion in 10-year bonds and Rs. 100 billion in 50-year securities. Bonds with tenures over 10 years will account for 76.6% of borrowing In H2FY24.

India's current account deficit widened slightly to USD 9.7 billion (1.1% of GDP) in Q1FY25, up from USD 8.9 billion (1.0% of GDP) in Q1FY24 and against a USD 4.6 billion surplus (0.5% of GDP) in Q4FY24, according to RBI. In the financial account, net FDI rose to USD 6.3 billion in Q1FY25, while external commercial borrowings also fell to USD 1.8 billion from USD 5.6 billion.

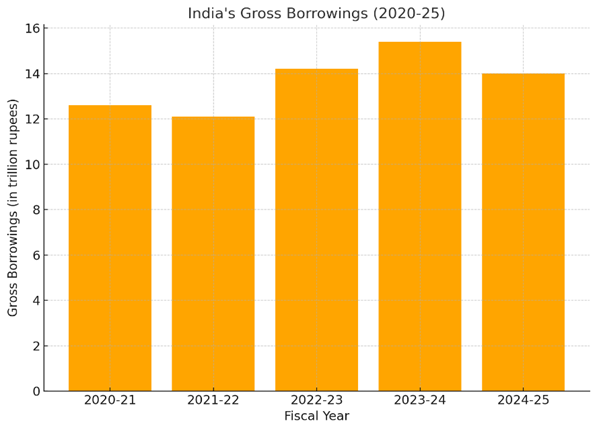

The gross borrowing for FY25 is Rs 14.01 trillion, lower than last year’s estimate of Rs 15.43 trillion, which was the highest ever. The government also aims to reduce the fiscal deficit to 4.9% of GDP, down from 5.1% in the interim budget.

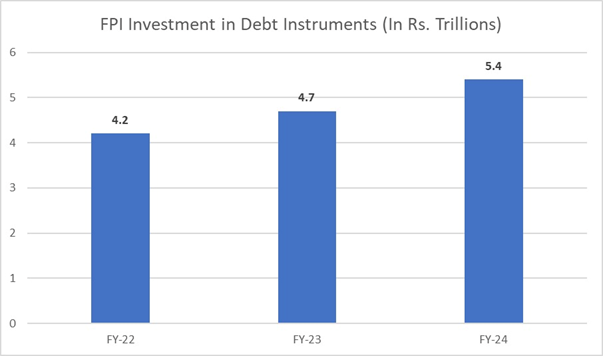

With record high forex reserve of USD 692 billion and anticipation of strong FPI inflows, G-Secs are poised to rally in the medium term. With slowdown in China and unrest in the middle-east Indian G-Secs stand out as an attractive bet for foreign investors.