Weekly Market Highlights:

- The 10 year 2034 G-sec yield closed at 6.81% this week vs 6.72% last week.

- The highly anticipated RBI MPC meeting is set to commence on 7th October, with 3 new members. The RBI’s policy stance will play a crucial role in driving G-Secs.

- The Government has announced a buyback of securities of 2025-26 maturities aggregating to Rs. 25,000 Cr.

- 3M and 6M T-bill auction data yields were stable at 6.47% and 6.72% respectively.

- The INR Bonds high yield Index stood at 9.907% down 2 bps fortnightly.

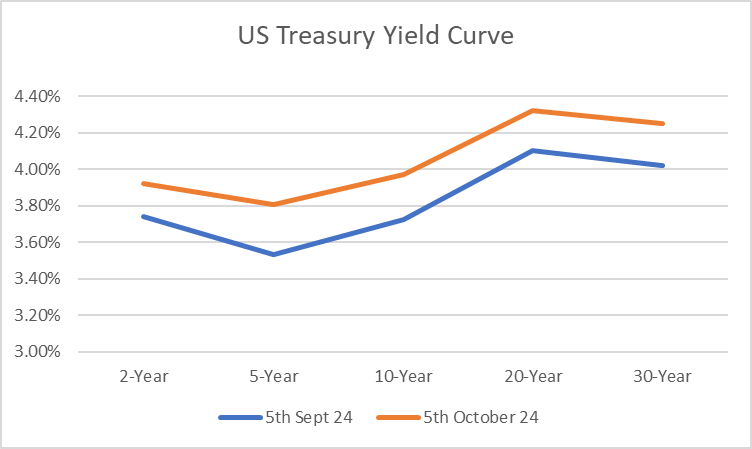

- The 10Y UST surged 22 bps to 3.97%, as US Nonfarm payroll data for September came in at 254,000 exceeding expectations of 150,000.

- The US unemployment rate fell 0.1% with a strong household employment gain of 430,000.

- Oil prices are surging as tensions escalate in the Middle East. Brent Crude has risen by 8.5% over the past week, with markets factoring in potential supply disruptions from the region, which is responsible for about one-third of the world's oil supply.

Market Data | |||

Particulars | 5/10/2024 | 27/9/2024 | Change |

10 Yr Benchmark Gsec (%) | 6.81% | 6.72% | 9 bps |

Banking Liquidity (in Rs Billion) | 288.36 | 44.34 | 550.34% |

5 Yr OIS (%) | 6.14% | 6.03% | 11 bps |

1 Yr OIS (%) | 6.45% | 6.40% | 5 bps |

INRBonds Retail High Yield Index | 9.91% | 9.91% | 0 bps |

Nifty | 25,015 | 26,179 | -4.45% |

10 Yr SDL | 7.10% | 7.10% | 0 bps |

91 Day T-Bill (%) | 6.47% | 6.65% | -17 bps |

182 Day T-Bill (%) | 6.56% | 6.72% | -15.93 bps |

10 Yr US Treasury Yield (%) | 3.97% | 3.75% | 22 bps |

US Junk Bond Yield (%) | 6.74% | 6.76% | -2 bps |

Brent Crude Oil (In USD per Barrel) | 78.09 | 71.98 | 8.49% |

Primary & Secondary Corporate Bonds Data | |||

Top 5 Secondary Retail Trades | Maturity | Yield | - |

12.25% Midland Microfin Limited | 19/3/2026 | 12.67% | |

10.11% Spandana Sphoorty Financial Limited | 18/12/2025 | 11.72% | |

10.50% Satin Creditcare Network Limited | 4/1/2027 | 11.69% | |

10.30% Indostar Capital Finance Limited | 25/9/2027 | 10.85% | |

11.65% Berar Finance Limited | 23/4/2026 | 11.50% | |

Currency Market Data | |||

Particulars | 5/10/2024 | 27/9/2024 | Change |

USD/INR | 84.03 | 82.723 | 1.58% |

DXY | 102.52 | 100.42 | 2.09% |

USD/ Brazil Real | 5.32 | 5.3 | 0.38% |

EUR/ USD | 1.0976 | 1.1163 | -1.68% |

USD/CNY | 7.0176 | 7.011 | 0.09% |

USD/JPY | 148.71 | 142.19 | 4.59% |

USD/ Russian Ruble | 95.007 | 94.3107 | 0.74% |

Public Issuance - UGRO Capital | |||

Series | I | II | III |

Coupon Frequency | Monthly | Monthly | Monthly |

Face Value | 1000 | 1000 | 1000 |

Tenor | 18 Months | 24 Months | 30 Months |

Coupon | 10.15% | 10.25% | 10.4%% |

Effective Yield | 10.64% | 10.75% | 10.91% |

Base Issue | Rs. 100 Cr. | ||

Green Shoe Option | Rs. 100 Cr. | ||

Total Issue Size | Rs. 100 Cr. | ||

Credit Rating | India Ratings A+/Stable | ||

Issue Open | 10/10/2024 | ||

Issue Close | 23/10/2024 | ||

Type of Issue | Secured Redeemable NCD | ||

Buyback of G-Secs | |||

Amount | Rs. 25,000 Cr. | ||

Security | Date of Maturity | ||

7.72% GS 2025 | 25/05/2025 | ||

5.22% GS 2025 | 15/06/2025 | ||

8.20% GS 2025 | 24/09/2025 | ||

5.15% GS 2025 | 09/11/2025 | ||

7.59% GS 2026 | 11/01/2026 | ||