Weekly Market Highlights:

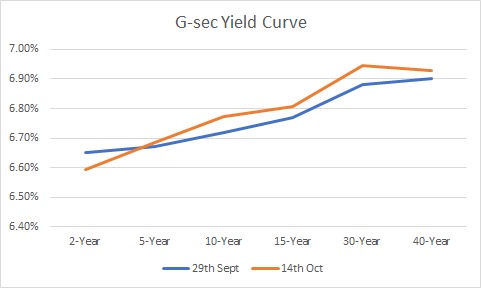

- The 10 year 2034 G-sec yield closed at 6.72% this week vs 6.81% last week.

- The RBI's shift from a "withdrawal of accommodation" to a "neutral" stance indicates that the Central Bank believes it has tightened monetary policy enough to curb inflationary pressures. However, economic growth seems to be slowing, driven by weakening domestic demand and global geopolitical uncertainties.

- This shift in stance could signal the RBI's initial move toward a rate-cut strategy, as evidenced by the contraction in the 5-year and 1-year OIS spreads by 7 bps and 10 bps, respectively, following the policy meeting. The MPC's decision was positively received by the markets, with the Nifty and Sensex rising by 80 bps and the 10-year G-Sec yield declining by 7 bps.

- 3M and 6M T-bill auction data yields were stable at 6.43% and 6.54% respectively.

- The INR Bonds high yield Index stood at 9.907% down 2 bps fortnightly.

- The 10Y UST was up 13bps to 4.10% as US CPI rose 0.2% vs estimates of 0.1% on a monthly basis. However jobless claims for the week exceeded estimates.

- Gold resumed its uptrend and is nearing 52 week high levels after positive US CPI data.

Market Data | |||

Particulars | 11/10/2024 | 5/10/2024 | Change |

10 Yr Benchmark Gsec (%) | 6.72% | 6.81% | -8 bps |

Banking Liquidity (in Rs Billion) | 180.2 | 288.36 | -37.51% |

5 Yr OIS (%) | 6.16% | 6.14% | 3 bps |

1 Yr OIS (%) | 6.43% | 6.45% | -3 bps |

INRBonds Retail High Yield Index | 9.91% | 9.91% | 0 bps |

Nifty | 25,023 | 25,015 | 0.03% |

10 Yr SDL | 7.01% | 7.10% | -9 bps |

91 Day T-Bill (%) | 6.43% | 6.47% | -4 bps |

182 Day T-Bill (%) | 6.54% | 6.56% | -2.3 bps |

10 Yr US Treasury Yield (%) | 4.10% | 3.97% | 13 bps |

US Junk Bond Yield (%) | 6.95% | 6.74% | 21 bps |

Brent Crude Oil (In USD per Barrel) | 78.15 | 78.09 | 0.08% |

Primary & Secondary Corporate Bonds Data | |||

Top 5 Secondary Retail Trades | Maturity | Yield | - |

9.57% IIFL Samasta Finance Limited | 21/6/2027 | 10.47% | |

10.50% Spandana Sphoorty Financial Limited | 14/4/2027 | 11.65% | |

9.50% Hinduja Leyland Finance Limited | 29/11/2029 | 9.85% | |

11.50% Keertana Finserv Private Limited | 20/2/2026 | 14.05% | |

10.30% IKF Finance Limited | 30/7/2027 | 10.73% | |

Currency Market Data | |||

Particulars | 11/10/2024 | 5/10/2024 | Change |

USD/INR | 84.074 | 84.03 | 0.05% |

DXY | 103.02 | 102.52 | 0.49% |

USD/ Brazil Real | 5.48 | 5.32 | 3.01% |

EUR/ USD | 1.0976 | 1.0976 | 0.00% |

USD/CNY | 7.0746 | 7.0176 | 0.81% |

USD/JPY | 149.31 | 148.71 | 0.40% |

USD/ Russian Ruble | 96.2885 | 95.007 | 1.35% |

Public Issuance - UGRO Capital | |||

Series | I | II | III |

Coupon Frequency | Monthly | Monthly | Monthly |

Face Value | 1000 | 1000 | 1000 |

Tenor | 18 Months | 24 Months | 30 Months |

Coupon | 10.15% | 10.25% | 10.4%% |

Effective Yield | 10.64% | 10.75% | 10.91% |

Base Issue | Rs. 100 Cr. | ||

Green Shoe Option | Rs. 100 Cr. | ||

Total Issue Size | Rs. 100 Cr. | ||

Credit Rating | India Ratings A+/Stable | ||

Issue Open | 10/10/2024 | ||

Issue Close | 23/10/2024 | ||

Type of Issue | Secured Redeemable NCD | ||

Public Issuance - Muthoot Fincorp Ltd | |||||||||||||

Series | I | II | III | IV | V | VI | VII | VIII | IX | X | XI | XII | XIII |

Coupon Frequency | Monthly | Annual | Cumulative | ||||||||||

Face Value | 1000 | 1000 | 1000 | 1000 | 1000 | 1000 | 1000 | 1000 | 1000 | 1000 | 1000 | 1000 | 1000 |

Tenor | 24 | 36 | 60 | 72 | 24 | 36 | 60 | 72 | 24 | 36 | 60 | 72 | 92 |

Coupon | 9.00% | 9.25% | 9.45% | 9.65% | 9.40% | 9.65% | 9.90% | 10.10% | NA | NA | NA | NA | NA |

Effective Yield | 9.38% | 9.65% | 9.87% | 10.09% | 9.40% | 9.65% | 9.89% | 10.10% | 9.40% | 9.65% | 9.90% | 10.10% | 9.50% |

Base Issue | Rs. 75 Cr. | ||||||||||||

Green Shoe Option | Rs. 17.5 Cr. | ||||||||||||

Total Issue Size | Rs. 25 Cr. | ||||||||||||

Credit Rating | AA- | ||||||||||||

Issue Open | 11/10/2024 | ||||||||||||

Issue Close | 23/10/2024 | ||||||||||||

Type of Issue | Secured Redeemable NCD | ||||||||||||