Weekly Market Highlights:

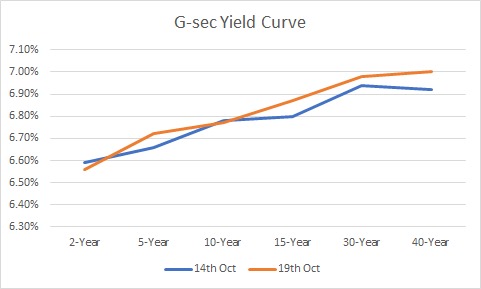

- The 10-year 2034 G-sec yield closed at 6.77% this week vs 6.72% last week.

- 3M and 6M T-bill auction data yields were stable at 6.45% and 6.55% respectively.

- India's CPI reached a 9-month high of 5.49% as the base effect faded. Near-term inflation risks remain unfavorable for a rate cut.

- India’s forex reserves dropped by USD 10.7 bn to USD 690 bn after reaching record highs. India’s gold reserves also fell amid gold hitting 52w high levels of USD 2720 per ounce.

- The INR Bonds high yield Index stood at 9.86% down 5 bps fortnightly.

- The ECB has reduced its interest rates for the third time this year, cutting the key deposit rate by 25 basis points to 3.25%. Markets anticipate 3 more rate cuts by March 2025. Meanwhile, the Euro fell against the dollar as the ECB presented a bleak Eurozone outlook.

- China's central bank injected 14-day liquidity into the banking system for the first time in months on Monday, lowering the interest rate by 25 bps, indicating its intention to further ease monetary conditions.

- The 10Y UST closed 2 bps lower at 4.08% as the US budget deficit widened. FED’s Schmid speech to drive the UST next week.

Market Data | |||

Particulars | 18/10/2024 | 11/10/2024 | Change |

10 Yr Benchmark Gsec (%) | 6.77% | 6.72% | 5 bps |

Banking Liquidity (in Rs Billion) | 175.2 | 180.2 | -2.77% |

5 Yr OIS (%) | 6.23% | 6.16% | 6 bps |

1 Yr OIS (%) | 6.53% | 6.43% | 10 bps |

INRBonds Retail High Yield Index | 9.86% | 9.91% | -5 bps |

Nifty | 24,854 | 25,023 | -0.68% |

10 Yr SDL | 7.07% | 7.01% | 6 bps |

91 Day T-Bill (%) | 6.45% | 6.43% | 2 bps |

182 Day T-Bill (%) | 6.55% | 6.54% | 0.93 bps |

10 Yr US Treasury Yield (%) | 4.08% | 4.10% | -2 bps |

US Junk Bond Yield (%) | 6.81% | 6.95% | -14 bps |

Brent Crude Oil (In USD per Barrel) | 73.16 | 78.15 | -6.39% |

Primary & Secondary Corporate Bonds Data | |||

Top 5 Secondary Retail Trades | Maturity | Yield | - |

11.95% Namra Finance Limited | 25/5/2026 | 11.90% | |

9.90% Incred Financial Services Limited | 21/8/2026 | 10.45% | |

10.30% Indostar Capital Finance Limited | 25/9/2027 | 10.71% | |

9.50% Hinduja Leyland Finance Limited | 29/11/2029 | 9.82% | |

10.90% Earlysalary Services Private Limited | 27/3/2026 | 12.00% | |

Currency Market Data | |||

Particulars | 18/10/2024 | 11/10/2024 | Change |

USD/INR | 84.065 | 84.074 | -0.01% |

DXY | 103.49 | 103.02 | 0.46% |

USD/ Brazil Real | 5.55 | 5.48 | 1.28% |

EUR/ USD | 1.0866 | 1.0976 | -1.00% |

USD/CNY | 7.105 | 7.0746 | 0.43% |

USD/JPY | 149.52 | 149.31 | 0.14% |

USD/ Russian Ruble | 96.7 | 96.2885 | 0.43% |

Public Issuance - Muthoot Fincorp Ltd | |||||||||||||

Series | I | II | III | IV | V | VI | VII | VIII | IX | X | XI | XII | XIII |

Coupon Frequency | Monthly | Annual | Cumulative | ||||||||||

Face Value | 1000 | 1000 | 1000 | 1000 | 1000 | 1000 | 1000 | 1000 | 1000 | 1000 | 1000 | 1000 | 1000 |

Tenor | 24 | 36 | 60 | 72 | 24 | 36 | 60 | 72 | 24 | 36 | 60 | 72 | 92 |

Coupon | 9.00% | 9.25% | 9.45% | 9.65% | 9.40% | 9.65% | 9.90% | 10.10% | NA | NA | NA | NA | NA |

Effective Yield | 9.38% | 9.65% | 9.87% | 10.09% | 9.40% | 9.65% | 9.89% | 10.10% | 9.40% | 9.65% | 9.90% | 10.10% | 9.50% |

Base Issue | Rs. 75 Cr. | ||||||||||||

Green Shoe Option | Rs. 17.5 Cr. | ||||||||||||

Total Issue Size | Rs. 25 Cr. | ||||||||||||

Credit Rating | AA- | ||||||||||||

Issue Open | 11/10/2024 | ||||||||||||

Issue Close | 23/10/2024 | ||||||||||||

Type of Issue | Secured Redeemable NCD | ||||||||||||