Weekly Market Highlights:

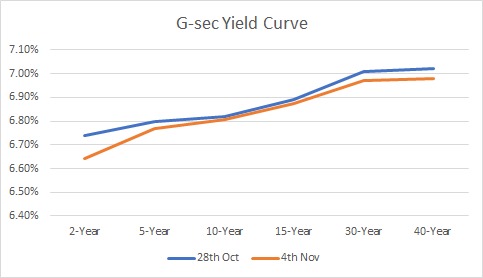

- The 10-year 2034 G-sec yield remained stable at 6.81% over the week.

- 3M and 6M T-bill auction data yields were stable at 6.51% and 6.64% respectively.

- India’s Forex Reserves dropped to Rs. 685 bn on 25th October as foreign currency assets decreased by Rs. 4.5 bn.

- The INR Bonds High Yield Index rose to 10.2%, up 34 basis points over the past two weeks, primarily due to the impact on issuances like Navi Finserv following RBI sanctions on NBFC-MFIs.

- FPIs turned net sellers for the first time in 6 months in the Indian bond market amid signs of economic slowdown as they sold Rs. 28 billion this october.

- The 10Y UST yield surged to 4.38% this week as markets anticipate a 25 bps Fed rate cut, while uncertainty lingers with the U.S. elections approaching on Tuesday.

- Oil prices are on the rise as OPEC agreed to extend its output cut by another month until the end of December.

Market Data | |||

Particulars | 1/11/2024 | 25/10/2024 | Change |

10 Yr Benchmark Gsec (%) | 6.81% | 6.80% | 1 bps |

Banking Liquidity (in Rs Billion) | 153.6 | 67.2 | 128.57% |

5 Yr OIS (%) | 6.30% | 6.28% | 2 bps |

1 Yr OIS (%) | 6.57% | 6.57% | 0 bps |

INRBonds Retail High Yield Index | 10.20% | 9.86% | 34 bps |

Nifty | 24,048 | 24,181 | -0.55% |

10 Yr SDL | 7.12% | 7.13% | -1 bps |

91 Day T-Bill (%) | 6.51% | 6.48% | 3 bps |

182 Day T-Bill (%) | 6.64% | 6.60% | 4.3 bps |

10 Yr US Treasury Yield (%) | 4.38% | 4.24% | 14 bps |

US Junk Bond Yield (%) | 6.96% | 6.96% | 0 bps |

Brent Crude Oil (In USD per Barrel) | 73.13 | 75.97 | -3.74% |

Primary & Secondary Corporate Bonds Data | |||

Top 5 Secondary Retail Trades | Maturity | Yield | - |

7.38% Bajaj Finance Limited | 8/8/2025 | 7.80% | |

10.40% Navi Finserv Limited | 13/8/2026 | 12.25% | |

8.4% HDB Financial Services Limited | 22/12/1933 | 8.30% | |

13.50% Tapir Constructions Limited | 18/1/2027 | 14.23% | |

10.5% Samman Capital Limited | 25/9/2029 | 10.10% | |

Currency Market Data | |||

Particulars | 1/11/2024 | 25/10/2024 | Change |

USD/INR | 84.073 | 84.095 | -0.03% |

DXY | 103.69 | 104.26 | -0.55% |

USD/ Brazil Real | 5.72 | 5.57 | 2.69% |

EUR/ USD | 1.0899 | 1.0793 | 0.98% |

USD/CNY | 7.0913 | 7.1199 | -0.40% |

USD/JPY | 151.75 | 152.3 | -0.36% |

USD/ Russian Ruble | 97.72 | 97.25 | 0.48% |