Weekly Market Highlights:

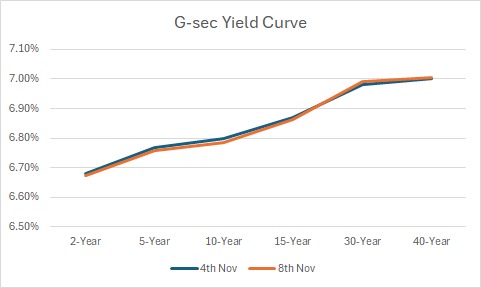

- The 10-year 2034 G-sec yield remained stable at 6.81% over the week.

- 3M and 6M T-bill auction data yields were stable at 6.44% and 6.63% respectively.

- The Rupee dropped to a record low of 84.37 this week due to outflows from FPI and FII. This decline signals a shift in FPI/FII sentiment after China introduced a stimulus package aimed at reducing its debt, enhancing its appeal among emerging markets.

- The BoE on Thursday cut interest rates for the second time since covid, reducing the rate from 5% to 4.75%.

- The U.S. FED has reduced its key interest rate by 0.25% amid uncertainties following the election.The Fed Chair expressed concerns about the nation's fiscal debt but remained confident in the strength of the U.S. economy.

- Post the election result and FED’s rate cut the 10Y UST dipped to 4.30% after reaching a high of 4.45%.

- Oil futures dropped by 1.23% on Friday as fears eased over the impact of Hurricane Rafael in the U.S. Gulf.

Market Data | |||

Particulars | 8/11/2024 | 1/11/2024 | Change |

10 Yr Benchmark Gsec (%) | 6.81% | 6.81% | 1 bps |

Banking Liquidity (in Rs Billion) | 244.73 | 153.6 | -59.33% |

5 Yr OIS (%) | 6.23% | 6.30% | -7 bps |

1 Yr OIS (%) | 6.51% | 6.57% | -5 bps |

INRBonds Retail High Yield Index | 10.20% | 10.20% | 0 bps |

Nifty | 24,148 | 24,048 | 0.42% |

10 Yr SDL | 7.12% | -712 bps | |

91 Day T-Bill (%) | 6.44% | 6.51% | -7 bps |

182 Day T-Bill (%) | 6.83% | 6.64% | 19 bps |

10 Yr US Treasury Yield (%) | 4.30% | 4.38% | -8.01 bps |

US Junk Bond Yield (%) | 6.96% | 6.96% | 0 bps |

Brent Crude Oil (In USD per Barrel) | 73.9 | 73.13 | 1.05% |

Primary & Secondary Corporate Bonds Data | |||

Top 5 Secondary Retail Trades | Maturity | Yield | - |

9.57% MAS Financial Services Limited | 21/6/2027 | 9.95% | |

10.75% AU Small Finance Bank Limited | 15/12/2028 | 9.60% | |

11.80% Namdev Finvest Private Limited | 5/7/2027 | 12.50% | |

11.10% ESAF Small Finance Bank Limited | 20/4/1931 | 11.56% | |

10.50% Spandana Sphoorty Financial Limited | 14/4/2027 | 10.76% | |

Currency Market Data | |||

Particulars | 8/11/2024 | 25/10/2024 | Change |

USD/INR | 84.395 | 84.095 | 0.36% |

DXY | 105 | 104.26 | 0.71% |

USD/ Brazil Real | 5.58 | 5.57 | 0.18% |

EUR/ USD | 1.072 | 1.0793 | -0.68% |

USD/CNY | 7.1785 | 7.1199 | 0.82% |

USD/JPY | 152.63 | 152.3 | 0.22% |

USD/ Russian Ruble | 97.5955 | 97.25 | 0.36% |