Weekly Market Highlights:

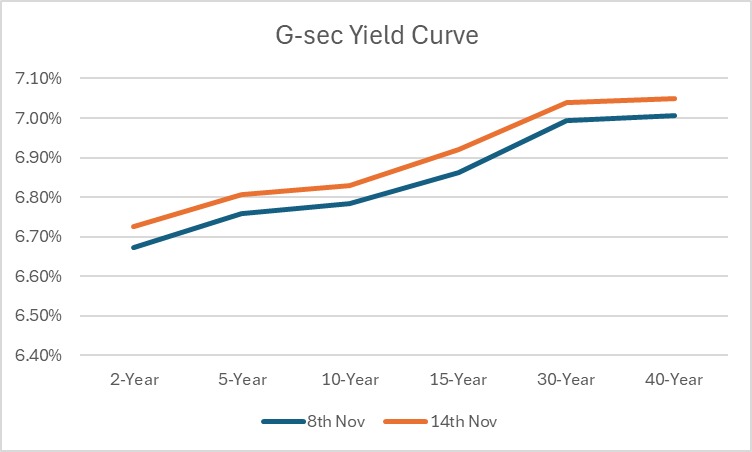

- The 10-year 2034 G-sec yield edged up 2bps closing at 6.83% for the week.

- 3M and 6M T-bill auction data yields were stable at 6.44% and 6.62% respectively.

- The INR Bonds High Yield Retail Index stood at 9.92%, down 28 bps fortnightly.

- India's retail inflation climbed to 6.21% in October from 5.49% in September, driven by rising food prices and exceeding the RBI's upper tolerance limit.

- India’s IIP grew 3.1% in September driven by a low base effect, rebounding from a 0.1% contraction in August and exceeding the expected 2.5% growth. Manufacturing rose 3.9%, electricity 0.5%, and mining 0.2%.

- Global brokerage firm, CLSA has increased India’s allocation to 20% overweight while reducing exposure to China, citing India’s stable economy and sidelined foreign flows poised to return. This shift comes despite India’s foreign investor outflows, as CLSA highlights China’s economic challenges and potential trade tensions under "Trump 2.0," with exports key to China’s growth.

- FPIs bought Rs. 99 bn in the primary market while selling Rs. 323 bn in the cash market, resulting in a net November sell-off of Rs. 224 bn. They also sold Rs. 472 bn in the debt market during this period. This can be attributed to the earnings downgrade and the US election outcome.

- The US core CPI rose 0.3% for the third straight month and 3.3% year-over-year, highlighting ongoing challenges for the Federal Reserve in meeting its target. Job data to drive markets next week.

Market Data | |||

Particulars | 15/11/2024 | 8/11/2024 | Change |

10 Yr Benchmark Gsec (%) | 6.83% | 6.81% | 2 bps |

Banking Liquidity (in Rs Billion) | 212.26 | 244.73 | 13.27% |

5 Yr OIS (%) | 6.23% | -623 bps | |

1 Yr OIS (%) | 6.51% | -651 bps | |

INRBonds Retail High Yield Index | 10.20% | -1020 bps | |

Nifty | 23,533 | 24,148 | -2.55% |

10 Yr SDL | 7.13% | 7.11% | 2 bps |

91 Day T-Bill (%) | 6.44% | 6.44% | 0 bps |

182 Day T-Bill (%) | 6.62% | 6.63% | -1.01 bps |

10 Yr US Treasury Yield (%) | 4.44% | 4.30% | 14.01 bps |

US Junk Bond Yield (%) | 6.97% | 6.96% | 1 bps |

Brent Crude Oil (In USD per Barrel) | 71.04 | 73.9 | -3.87% |

Primary & Secondary Corporate Bonds Data | |||

Top 5 Secondary Retail Trades | Maturity | Yield | - |

10.75% MAS Financial Services Limited | 10/10/2028 | 11.15% | |

9.65% Auxilo Finserv Private Limited | 19/7/2027 | 10.75% | |

10.90% Earlysalary Services Private Limited | 27/3/2026 | 13.10% | |

9.90% Vivriti Capital Limited | 22/8/2025 | 10.95% | |

8.65% IIFL Finance Limited | 28/6/2028 | 11.32% | |

Currency Market Data | |||

Particulars | 15/11/2024 | 8/11/2024 | Change |

USD/INR | 84.424 | 84.395 | 0.03% |

DXY | 106.69 | 105 | 1.61% |

USD/ Brazil Real | 5.64 | 5.58 | 1.08% |

EUR/ USD | 1.0541 | 1.072 | -1.67% |

USD/CNY | 7.2309 | 7.1785 | 0.73% |

USD/JPY | 154.34 | 152.63 | 1.12% |

USD/ Russian Ruble | 99.9955 | 97.5955 | 2.46% |