Weekly Market Highlights:

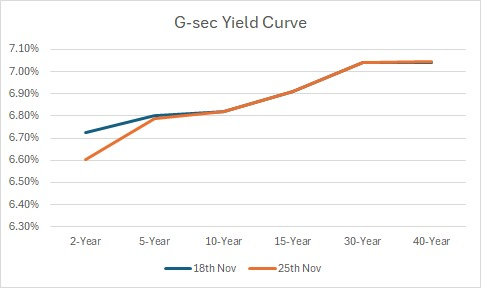

- The 10-year 2034 G-sec yield remained stable at 6.82% for the week.

- 3M and 6M T-bill auction data yields were stable at 6.46% and 6.65% respectively.

- The INR Bonds High Yield Retail Index stood at 9.92%, down 28 bps fortnightly.

- GDP growth and PMI data to be key factors for the RBI MPC meeting on 6th December.

- FPIs remain net sellers with an outflow of Rs. 27 Lakh Cr so far in November owing to favorable conditions in China, inflated valuations and earnings downgrade in the domestic market.

- WTI crude oil futures traded near USD 71.2 per barrel, supported by geopolitical tensions involving Russia and Iran and rising demand from China and India. Prices also surged last week after Ukraine’s U.S.-backed attack on Russia and Iran's nuclear expansion plans heightened supply concerns.

- US PMI rose to 55.3 in November signaling expansion in the private sector. FOMC meeting minutes to drive UST this week. Currently the 10Y UST is at 4.43%.

- UK inflation rose by 2.3% in October, higher than BoE’s expectations of 2.2%. The UK10Y was down 1.6 bps to 4.4%.

- Japan's inflation came in at 2.3% v/s a forecast of 2.2%. This will be key amid BoJ’s meeting in December. The JP10Y edged up 1 bps to 1.071%.

Market Data | |||

Particulars | 22/11/2024 | 15/11/2024 | Change |

10 Yr Benchmark Gsec (%) | 6.82% | 6.83% | -1 bps |

Banking Liquidity (in Rs Billion) | 19.04 | 212.26 | 91.03% |

5 Yr OIS (%) | 6.26% | 6.33% | -7 bps |

1 Yr OIS (%) | 6.56% | 6.57% | -1 bps |

INRBonds Retail High Yield Index | 9.92% | 10.14% | -22 bps |

Nifty | 24,882 | 23,533 | 5.73% |

10 Yr SDL | 7.11% | 7.13% | -2 bps |

91 Day T-Bill (%) | 6.46% | 6.44% | 2 bps |

182 Day T-Bill (%) | 6.65% | 6.62% | 3.01 bps |

10 Yr US Treasury Yield (%) | 4.43% | 4.44% | -1.01 bps |

US Junk Bond Yield (%) | 6.95% | 6.97% | -2 bps |

Brent Crude Oil (In USD per Barrel) | 74.32 | 71.04 | 4.62% |

Primary & Secondary Corporate Bonds Data | |||

Top 5 Secondary Retail Trades | Maturity | Yield | - |

8.40% HDFC Credila Financial Services Limited | 30/6/2032 | 9.25% | |

9.90% Vivriti Capital Limited | 22/8/2025 | 10.95% | |

9.60% Creditaccess Grameen Limited | 23/11/2025 | 10.37% | |

9.75% Muthoottu Mini Financiers Limited | 13/9/2026 | 12.00% | |

10.25% Aye Finance Private Limited | 20/3/2026 | 11.80% | |

Currency Market Data | |||

Particulars | 22/11/2024 | 15/11/2024 | Change |

USD/INR | 84.333 | 84.424 | -0.11% |

DXY | 106.95 | 106.69 | 0.24% |

USD/ Brazil Real | 5.66 | 5.64 | 0.35% |

EUR/ USD | 1.048 | 1.0541 | -0.58% |

USD/CNY | 7.2443 | 7.2309 | 0.19% |

USD/JPY | 154.05 | 154.34 | -0.19% |

USD/ Russian Ruble | 103.7071 | 99.9955 | 3.71% |