Weekly Market Highlights:

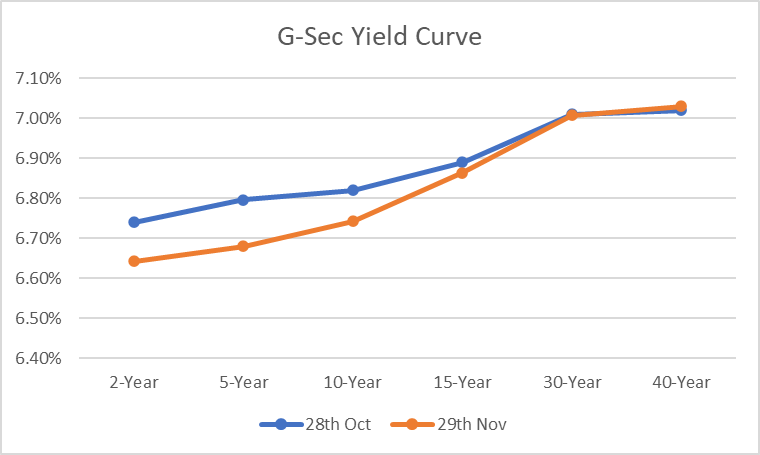

- The 10-year 2034 G-sec yield edged down 8bps to 6.74% for the week.

- 3M and 6M T-bill auction data yields were stable at 6.49% and 6.66% respectively.

- The INR Bonds High Yield Retail Index stood at 9.73%, down 19 bps fortnightly.

- India's GDP grew 5.4% in Q2FY25, falling short of the RBI's 7% forecast, raising economic concerns. This puts pressure on the RBI to cut rates in its December policy meeting.

- India's fiscal deficit reached Rs. 7.5 T, 46.5% of the FY25 target, during April-October. The Union government aims to reduce the fiscal deficit to 4.9% of GDP by March 2025, down from 5.6% last year.

- Banking system liquidity turned negative after two months, driven by a Q3FY25 BoP deficit, a widening trade gap, and increased FPI outflows since October. Currently the banking liquidity is at a deficit of Rs. 9.5 billion.

- G-Sec yields to be driven by RBI MPC meeting outcome on 6th December. The 10Y G-Sec yield has fallen by 8 bps over the week as market discounts the probability of a RBI rate cut next week.

- The US economy grew at 2.8% in Q3, driven by strong consumer spending and exports, down from 3% in Q2, marking over 2% growth in eight of the last nine quarters. The 10Y UST currently at 4.17%, will be driven by job data next week.

Market Data | |||

Particulars | 29/11/2024 | 22/11/2024 | Change |

10 Yr Benchmark Gsec (%) | 6.74% | 6.82% | -8 bps |

Banking Liquidity (in Rs Billion) | -9.49 | 19.04 | 149.84% |

5 Yr OIS (%) | 6.07% | 6.26% | -19 bps |

1 Yr OIS (%) | 6.38% | 6.56% | -18 bps |

INRBonds Retail High Yield Index | 9.73% | 9.92% | -19 bps |

Nifty | 24,131 | 24,882 | -3.02% |

10 Yr SDL | 7.18% | 7.11% | 7 bps |

91 Day T-Bill (%) | 6.49% | 6.46% | 3 bps |

182 Day T-Bill (%) | 6.66% | 6.65% | 1.01 bps |

10 Yr US Treasury Yield (%) | 4.17% | 4.43% | -26 bps |

US Junk Bond Yield (%) | 6.88% | 6.95% | -7 bps |

Brent Crude Oil (In USD per Barrel) | 72.94 | 74.32 | -1.86% |

Primary & Secondary Corporate Bonds Data | |||

Top 5 Secondary Retail Trades | Maturity | Yield | - |

8.35% MAS Financial Services Limited | 18/4/2026 | 9.03% | |

6.75% Piramal Capital & Housing Finance Limited | 26/9/1931 | 10.66% | |

10.20% Clix Capital Services Private Limited | 18/3/2027 | 10.98% | |

11.40% Keertana Finserv Private Limited | 22/4/2027 | 12.75% | |

9.90% Adani Enterprises Limited | 12/9/2029 | 9.87% | |

Currency Market Data | |||

Particulars | 29/11/2024 | 22/11/2024 | Change |

USD/INR | 84.559 | 84.333 | 0.27% |

DXY | 105.74 | 106.95 | -1.13% |

USD/ Brazil Real | 5.86 | 5.66 | 3.53% |

EUR/ USD | 1.0575 | 1.048 | 0.91% |

USD/CNY | 7.242 | 7.2443 | -0.03% |

USD/JPY | 149.75 | 154.05 | -2.79% |

USD/ Russian Ruble | 106.496 | 103.7071 | 2.69% |