Weekly Market Highlights:

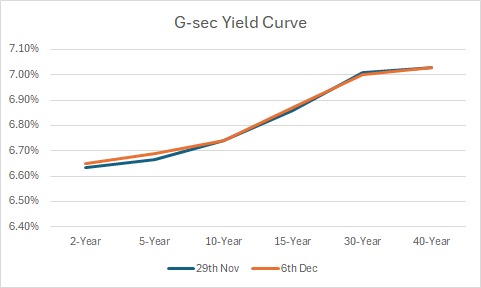

- The 10-year 2034 G-sec yield edged down 2bps to 6.72% for the week.

- 3M and 6M T-bill auction data yields were at 6.43% and 6.54% respectively.

- The INR Bonds High Yield Retail Index stood at 9.73%, down 19 bps fortnightly.

- The RBI seemed to be concerned about liquidity as the RBI cut CRR by 50 bps and increased the FCNR(B) deposit rates to ARR + 400 bps from ARR + 200 bps to attract capital amid a falling forex reserve.

- RBI also moderated its GDP growth projection down to 6.6% and inflation projections to 4.8% for FY25. The 10Y G-Sec yield rose to 6.71% from 6.68% after the RBI cut the CRR by 50 bps.

- India's services sector saw a slight dip in November, with the PMI easing to 58.4 from October's 58.5. Meanwhile, the HSBC Final India Manufacturing PMI by S&P Global highlighted growth in hiring and sales.

- The 10Y G-Sec yield rose to 6.71% (+3 bps) after the RBI cut the CRR by 50 bps. The 1Y OIS climbed to 6.40% (+8 bps), and the 5Y OIS to 6.05% (+5 bps), reflecting market adjustments.

- Despite tariff and inflation concerns, the U.S. added 227,000 jobs in November, rebounding sharply from October’s revised 36,000. The rise reflects recovery from strikes and weather disruptions. Unemployment inched up to 4.2% from 4.1%.

- The 10Y UST was down 2 bps to 4.15% this week. The UST to be driven by much awaited inflation data next week and upcoming FOMC rate cut expectations.

Market Data | |||

Particulars | 6/12/2024 | 29/11/2024 | Change |

10 Yr Benchmark Gsec (%) | 6.72% | 6.74% | -2 bps |

Banking Liquidity (in Rs Billion) | 42.4 | -9.49 | 546.79% |

5 Yr OIS (%) | 6.05% | 6.07% | -2 bps |

1 Yr OIS (%) | 6.40% | 6.38% | 2 bps |

INRBonds Retail High Yield Index | 9.73% | 9.73% | 0 bps |

Nifty | 24,678 | 24,131 | 2.27% |

10 Yr SDL | 7.09% | 7.18% | -9 bps |

91 Day T-Bill (%) | 6.43% | 6.49% | -6 bps |

182 Day T-Bill (%) | 6.54% | 6.66% | -12.01 bps |

10 Yr US Treasury Yield (%) | 4.15% | 4.17% | -2 bps |

US Junk Bond Yield (%) | 6.78% | 6.88% | -10 bps |

Brent Crude Oil (In USD per Barrel) | 71.06 | 72.94 | -2.58% |

Primary & Secondary Corporate Bonds Data | |||

Top 5 Secondary Retail Trades | Maturity | Yield | - |

10.90% Earlysalary Services Private Limited | 6/5/2026 | 13.10% | |

10.85% IKF Home Finance Limited | 31/8/2026 | 10.80% | |

9.45% Oxyzo Financial Services Limited | 11/11/2026 | 10.50% | |

9.35% Tata Capital Limited | 7/1/2025 | 9.10% | |

9.35% Capsave Finance Private Limited | 6/9/2025 | 9.10% | |

Currency Market Data | |||

Particulars | 6/12/2024 | 29/11/2024 | Change |

USD/INR | 84.668 | 84.559 | 0.13% |

DXY | 106.6 | 105.74 | 0.81% |

USD/ Brazil Real | 5.83 | 5.86 | -0.51% |

EUR/ USD | 1.057 | 1.0575 | -0.05% |

USD/CNY | 7.27 | 7.242 | 0.39% |

USD/JPY | 150.03 | 149.75 | 0.19% |

USD/ Russian Ruble | 100.5455 | 106.496 | -5.59% |