Weekly Market Highlights:

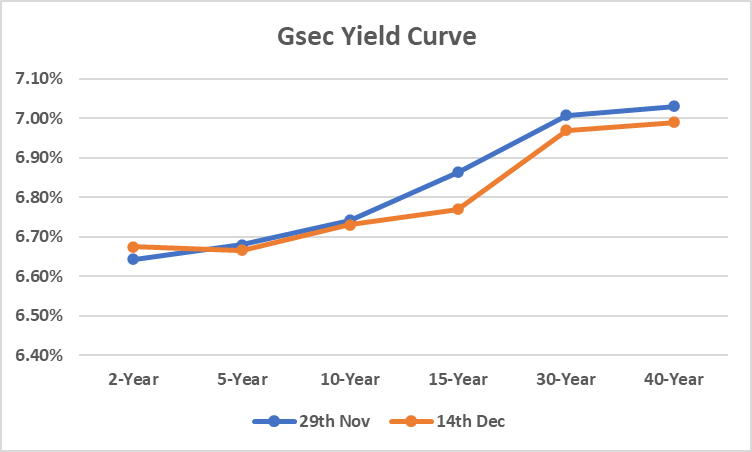

- The 10-year 2034 G-sec yield edged up 2bps to 6.74% for the week.

- 3M and 6M T-bill auction data yields were at 6.45% and 6.61% respectively compared to 6.43% and 6.54% last week.

- The INR Bonds High Yield Retail Index stood at 9.77%, up 4 bps fortnightly.

- India CPI eased to 5.48% in November 2024 v/s expectations of 5.53% on account of easing food prices. The November CPI prompted the RBI to revise its inflation forecast for FY25 from 4.5% to 4.8%.

- Sanjay Malhotra, a Princeton-educated economist and seasoned bureaucrat, has been appointed as the 26th Governor of the RBI. Economists expect Malhotra to adopt a pragmatic, growth-oriented approach with potential rate cuts in early 2025, while maintaining policy stability to address India’s economic slowdown and inflation challenges.

- India's Index of Industrial Production (IIP) rose by 3.5% in October 2024, an improvement from 3.1% in September 2024, driven by robust growth in key sectors such as basic metals, electrical equipment, and refined petroleum products.

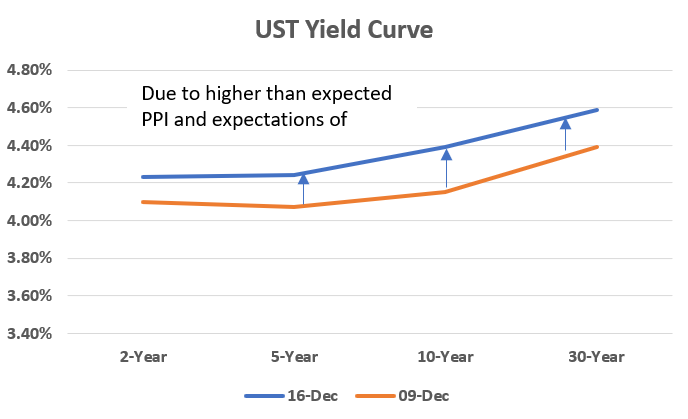

- The US CPI rose 0.3% in November, the largest increase since April, after four months of 0.2% gains. Annually, CPI climbed 2.7% in line with expectations, up from 2.6% in October. Despite the seven-month high in inflation, the FED is still expected to cut interest rates next week amid signs of a cooling labor market.

- The 10Y UST yield was up 25 bps this week to 4.4% amid higher than expected PPI data and as investors await FED’s final meeting this year.

- ECB cut rates by a quarter point to 3%, 4th time this year amid signs of weakening growth and a possibility of US tariffs.

Market Data | |||

Particulars | 13/12/2024 | 6/12/2024 | Change |

10 Yr Benchmark Gsec (%) | 6.74% | 6.72% | 2 bps |

Banking Liquidity (in Rs Billion) | 64.31 | 42.4 | -51.67% |

5 Yr OIS (%) | 6.04% | 6.05% | -1 bps |

1 Yr OIS (%) | 6.41% | 6.40% | 1 bps |

INRBonds Retail High Yield Index | 9.73% | -973 bps | |

Nifty | 24,768 | 24,678 | 0.37% |

10 Yr SDL | 7.10% | 7.09% | 1 bps |

91 Day T-Bill (%) | 6.45% | 6.43% | 2 bps |

182 Day T-Bill (%) | 6.61% | 6.54% | 7.01 bps |

10 Yr US Treasury Yield (%) | 4.40% | 4.15% | 25 bps |

US Junk Bond Yield (%) | 6.87% | 6.78% | 9 bps |

Brent Crude Oil (In USD per Barrel) | 74.43 | 71.06 | 4.74% |

Primary & Secondary Corporate Bonds Data | |||

Top 5 Secondary Retail Trades | Maturity | Yield | - |

9.75% Navi Finserv Limited | 18/6/2025 | 9.61% | |

9.50% Incred Financial Services Limited | 18/9/2026 | 10.30% | |

8.40% Credila Financial Services Limited | 30/7/1932 | 9.15% | |

8.75% Shriram Finance Limited | 4/5/2026 | 9.05% | |

11.25% Indel Money Limited | 6/4/2026 | 13.90% | |

Currency Market Data | |||

Particulars | 13/12/2024 | 6/12/2024 | Change |

USD/INR | 84.782 | 84.668 | 0.13% |

DXY | 107 | 106.6 | 0.38% |

USD/ Brazil Real | 5.89 | 5.83 | 1.03% |

EUR/ USD | 1.0502 | 1.057 | -0.64% |

USD/CNY | 7.2756 | 7.27 | 0.08% |

USD/JPY | 153.64 | 150.03 | 2.41% |

USD/ Russian Ruble | 104.4955 | 100.5455 | 3.93% |